QUOTE(Catalyst86 @ Apr 14 2019, 10:52 PM)

I did some searching both in the BP thread and CC exchange rate thread but found different answers. Does BP charge 0% fees for forex exchange (similar with MasterCard rate)? I use VI for overseas transactions for 5x TP and BP for 0x or 1x TP.

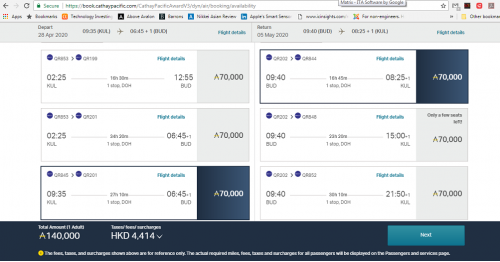

I'm a bit conflicted on this issue. For example, I'm planning to go overseas near the end of the year and estimate spending would be around 60k. So assuming BP 0% charges, I would need to pay additional RM1350 if I use the VI instead of BP (VI forex fees 2.25%). However I would get additional ~68,000 miles (306,750TP). So meaning to say I would gain those miles at around 2 cents per mile.

I think 2 cents is good value.

Interesting discussions. Yes, first off is make full use of BP as much as possible. You still get points to your VI when you top up BP (and since you're only travelling year end, you should search some of the previous posts, and change your VI to MUVI for more TPs). Also, each of your family member can apply for their own BP cards, which can be topped up either by your transferring BP to BP, or getting sup cards so you have more options to top up.

From my calculations, 1 Enrich Mile for economy redemptions is worth about 4 cents (more for business class), so I guess it's still worth while.

Also, I know this thread is related to M2P, but just putting it out there. AMB WMC is also a good card for overseas spend. It used to be a superb card and I used to use it all the time overseas, but recently it has been devalued. In the T&Cs they state that they cap forex markup at 1% (as opposed to BP at 0% and VI at 2.25%). Plus, you used to be able to earn RM1 overseas spend = 1 Airmile, but as of Jan 2019, it has been devalued to RM1.40 overseas spend = 1 Airmile.

QUOTE(lilsunflower @ Apr 15 2019, 01:21 AM)

Just sharing my own strategy below, but ultimately the choice of cards depends on timing, circumstances and nature of your expenses.

I go on one family to Europe every year but most of my expenses are actually pre-paid. Bulk of expenditure will be for flights, accommodation and other tickets (e.g. tourist attractions, trains etc), which I will book as early as possible and also time it so that I can maximise the combination of MUVI (top up BP with MUVI on match days and hope for 5x, as well as other CB cards) and BP. For example, my husband and I have BP cards, so if we book flights and accommodation over 2 months, we effectively have RM40k of BP quota to play with.

If I'm lucky, I can enjoy the MUVI 5xTP (if MU wins!) coupled with the lowest forex rates through using BP on my prepaid expenses.

While we are on holiday, RM10k x 2 is usually enough to pay for food and other non prepaid expenses, as we do not shop for big ticket items. If your RM60k is for shopping, then you have to find another card for RM40k. For me, my back-up plan (in theory) would be to ask my parents or siblings to top up their BP (with their MUVI and other CB supp cards) and P2P transfer the cash to my BP if our RM10k x 2 quotas are exhausted. But based on my spending pattern (i.e. no shopping spree while on holiday), this would be highly unlikely to happen in practice.

I usually spend some time thinking about how to play with my card inventory depending on timing and other expenses, so I don't really have a fixed strategy. But just sharing my usual way of thinking. I know some people may laugh and think this is just counting pennies and wasting time.... but I am from a middle income family and every bit of saving really matters to me.

Good strategy, spreading out spending (though, over those few months, forex fluctuations could be more than the 2% forex spread. haha

).

Also, if you want to maximise it even further, you could apply for M2P sup cards for your family members. Or even get them to apply as principal and sup to you. There's no rule saying that one can't hold 2 (or more) of the same cards from the same bank.

This post has been edited by isaacchew: Apr 15 2019, 02:22 AM

Apr 14 2019, 02:55 AM

Apr 14 2019, 02:55 AM

Quote

Quote

0.0317sec

0.0317sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled