QUOTE(statikinetic @ Jul 5 2022, 11:48 AM)

Okay... so it recovers.... how high can it go? Can pass 9?If no... not much meat leh

STOCK MARKET DISCUSSION V150

|

|

Jul 5 2022, 11:52 AM Jul 5 2022, 11:52 AM

Show posts by this member only | IPv6 | Post

#60581

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jul 5 2022, 12:05 PM Jul 5 2022, 12:05 PM

Show posts by this member only | IPv6 | Post

#60582

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(Boon3 @ Jul 5 2022, 11:52 AM) It's a bounce which I don't buy. I remember mentioning to someone maybe last year (Not sure if it was here) when Tenaga breached the 10 support that I wouldn't buy even if it hit 8. The person said something along the lines if it being crazy and people would rush to buy long before it reached that level. But I have my valuations.I don't like sitting on equities with a big retailer presence. Retailers are volatility. I dislike volatility generally. Did say I might wade into the swamp if it passes a certain level. That time is not yet here. |

|

|

Jul 5 2022, 12:08 PM Jul 5 2022, 12:08 PM

Show posts by this member only | IPv6 | Post

#60583

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jul 5 2022, 12:05 PM) It's a bounce which I don't buy. I remember mentioning to someone maybe last year (Not sure if it was here) when Tenaga breached the 10 support that I wouldn't buy even if it hit 8. The person said something along the lines if it being crazy and people would rush to buy long before it reached that level. But I have my valuations. Hehehe.... okay. I don't like sitting on equities with a big retailer presence. Retailers are volatility. I dislike volatility generally. Did say I might wade into the swamp if it passes a certain level. That time is not yet here. |

|

|

Jul 5 2022, 09:52 PM Jul 5 2022, 09:52 PM

Show posts by this member only | IPv6 | Post

#60584

|

Junior Member

626 posts Joined: Jul 2020 From: Land of Honah Lee |

QUOTE(statikinetic @ Jul 5 2022, 11:48 AM) reminds me of TG too What are you eyeing at the moment? Come share share |

|

|

Jul 5 2022, 11:13 PM Jul 5 2022, 11:13 PM

Show posts by this member only | IPv6 | Post

#60585

|

Junior Member

998 posts Joined: May 2014 |

some of the banking/ REITs stocks such as MBB are quite defensive in nature. no moving down so much compare to other industries stocks Davidtcf liked this post

|

|

|

Jul 6 2022, 11:17 AM Jul 6 2022, 11:17 AM

Show posts by this member only | IPv6 | Post

#60586

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(howyoulikethat @ Jul 5 2022, 09:52 PM) reminds me of TG too I'm not really eyeing anything in particular at the moment as I had setup to be on the defensive this year. Had hedged against the MYR to start the year and went for commodity based equities for 2022.What are you eyeing at the moment? Come share share I'm just watching the current prices against my valuations and if one or two fall below the level, will consider doing a trade on it. Though it must be said, trades are how generally I lose money but I find it hard to learn this lessons throughout the years. Sometimes I think of it as my entertainment money. Bank stocks generally correlates with the economy so might be safe for some, but not much meat for me. So right now it's doing basic homework on some stocks to pass the time. Currently pulling apart Senheng's QR & numbers. |

|

|

|

|

|

Jul 6 2022, 01:56 PM Jul 6 2022, 01:56 PM

|

Junior Member

626 posts Joined: Jul 2020 From: Land of Honah Lee |

QUOTE(statikinetic @ Jul 6 2022, 11:17 AM) I'm not really eyeing anything in particular at the moment as I had setup to be on the defensive this year. Had hedged against the MYR to start the year and went for commodity based equities for 2022. Hopefully your commodities are still in safe territories. FCPO plunged today, taking blue chip plantations down with it. Oil is starting to fall too. Even steel.I'm just watching the current prices against my valuations and if one or two fall below the level, will consider doing a trade on it. Though it must be said, trades are how generally I lose money but I find it hard to learn this lessons throughout the years. Sometimes I think of it as my entertainment money. Bank stocks generally correlates with the economy so might be safe for some, but not much meat for me. So right now it's doing basic homework on some stocks to pass the time. Currently pulling apart Senheng's QR & numbers. For me Msia banks despite Msia's slow growth , are still more predictable & defensive. Buying on expextations there's visible earnings improvement in nxt quarter doesnt suit me. Learned the hard way frm TG & Bplant. I prefer companies with decent growth & I would be able to hold long or short. Looks like the funds are competing who's gonna lose less this year. Tech heavy funds shud bear the brunt. Hibiscus seems to be wilting in accordance to falling oil price. Overall trx volume is getting less as fatigue & fear kicks in. No idea why HLB still rates highly on Kobay & Hiaptek, which to me, has been very overvalued previously. I don't touch any tech, until nesting Mac 2020 lows. Keeping cash until prices are appealing. Funny how Alibaba &other China stocks arent falling as much now. |

|

|

Jul 7 2022, 09:15 AM Jul 7 2022, 09:15 AM

Show posts by this member only | IPv6 | Post

#60588

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(howyoulikethat @ Jul 6 2022, 01:56 PM) Hopefully your commodities are still in safe territories. FCPO plunged today, taking blue chip plantations down with it. Oil is starting to fall too. Even steel. I was never comfortable with Palm Oil, so never got involved in it. That lets me watch the current FCPO plunge on the sidelines.For me Msia banks despite Msia's slow growth , are still more predictable & defensive. Buying on expextations there's visible earnings improvement in nxt quarter doesnt suit me. Learned the hard way frm TG & Bplant. I prefer companies with decent growth & I would be able to hold long or short. Looks like the funds are competing who's gonna lose less this year. Tech heavy funds shud bear the brunt. Hibiscus seems to be wilting in accordance to falling oil price. Overall trx volume is getting less as fatigue & fear kicks in. No idea why HLB still rates highly on Kobay & Hiaptek, which to me, has been very overvalued previously. I don't touch any tech, until nesting Mac 2020 lows. Keeping cash until prices are appealing. Funny how Alibaba &other China stocks arent falling as much now. China has stabilized somewhat. I don't think they would further risk their economic engine for even more regulatory controls. Could be wrong there and if I am, money on the table gonna burn. Let's see if the KLCI heads towards the 1400 support. howyoulikethat liked this post

|

|

|

Jul 7 2022, 12:59 PM Jul 7 2022, 12:59 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(statikinetic @ Jul 7 2022, 09:15 AM) I was never comfortable with Palm Oil, so never got involved in it. That lets me watch the current FCPO plunge on the sidelines. Recent nickel price movements at LME shows; commodity price is often moved by whale or irrational.China has stabilized somewhat. I don't think they would further risk their economic engine for even more regulatory controls. Could be wrong there and if I am, money on the table gonna burn. Let's see if the KLCI heads towards the 1400 support. |

|

|

Jul 9 2022, 12:24 PM Jul 9 2022, 12:24 PM

Show posts by this member only | IPv6 | Post

#60590

|

Senior Member

2,940 posts Joined: Jan 2010 |

Everyone is a genius in a bull market.

Much less noise in the public space nowadays. Transferring some funds in preparation to pick up some local equities next week. Hopefully as the market tracks towards 1400. If the market spikes, I'll be left with some spare cash on hand. |

|

|

Jul 9 2022, 01:06 PM Jul 9 2022, 01:06 PM

|

Senior Member

3,500 posts Joined: Dec 2007 |

QUOTE(statikinetic @ Jul 9 2022, 12:24 PM) Everyone is a genius in a bull market. Bursa without retailer usually flat line, better invest in industrial dividend counters or stable growing giant to spot for the next QL, Inari, Harta respectively.Much less noise in the public space nowadays. Transferring some funds in preparation to pick up some local equities next week. Hopefully as the market tracks towards 1400. If the market spikes, I'll be left with some spare cash on hand. But still i think prepare money to do bargain hunting on growth and next gen tech in US market is more exciting and rewarding |

|

|

Jul 9 2022, 01:18 PM Jul 9 2022, 01:18 PM

Show posts by this member only | IPv6 | Post

#60592

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(ChAOoz @ Jul 9 2022, 01:06 PM) Bursa without retailer usually flat line, better invest in industrial dividend counters or stable growing giant to spot for the next QL, Inari, Harta respectively. The latter part is what I am hoping for.But still i think prepare money to do bargain hunting on growth and next gen tech in US market is more exciting and rewarding This is a small portion I'm readjusting in the portfolio (About 10%). Time is up for some non-performers after the H1 deadline, time to cut and redeploy elsewhere. |

|

|

Jul 9 2022, 02:33 PM Jul 9 2022, 02:33 PM

Show posts by this member only | IPv6 | Post

#60593

|

Junior Member

192 posts Joined: Feb 2022 |

QUOTE(ChAOoz @ Jul 9 2022, 01:06 PM) Bursa without retailer usually flat line, better invest in industrial dividend counters or stable growing giant to spot for the next QL, Inari, Harta respectively. Agree. Malaysia stocks can wait for good bargain only buy inBut still i think prepare money to do bargain hunting on growth and next gen tech in US market is more exciting and rewarding Right now I am slowing accumulating alternative energy or next gen energy producing shares or ETF that focus on solar, battery, semicon, hydrogen and others. Too bad Malaysia had none of these |

|

|

|

|

|

Jul 11 2022, 07:20 PM Jul 11 2022, 07:20 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ Jul 9 2022, 01:06 PM) Bursa without retailer usually flat line, better invest in industrial dividend counters or stable growing giant to spot for the next QL, Inari, Harta respectively. When one reflects back to recent good days, isn't it so important to know when to sell?But still i think prepare money to do bargain hunting on growth and next gen tech in US market is more exciting and rewarding Stocks ain't too different than casinos, no? When one is winning big, getting up and leave With a huge chunk of chips is so important.... esp for Harta.  which clearly you can see that the stock hasn't stop declining from its short lived glory days..... and in that sense, if you look at one of your past loved tech...  Yeah... the carnage was there... and once again... learning to sell the stock is really useful... but look at the downtrend.... not too bad eh? and yeah.... banking stocks...  it did well since March.... but since then.... This post has been edited by Boon3: Jul 11 2022, 07:44 PM |

|

|

Jul 11 2022, 09:00 PM Jul 11 2022, 09:00 PM

|

Senior Member

3,500 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Jul 11 2022, 07:20 PM) When one reflects back to recent good days, isn't it so important to know when to sell? Yeah two components to it. When to buy and when to sell.Stocks ain't too different than casinos, no? When one is winning big, getting up and leave With a huge chunk of chips is so important.... esp for Harta.  which clearly you can see that the stock hasn't stop declining from its short lived glory days..... and in that sense, if you look at one of your past loved tech...  Yeah... the carnage was there... and once again... learning to sell the stock is really useful... but look at the downtrend.... not too bad eh? and yeah.... banking stocks...  it did well since March.... but since then.... Well sometime greed get the best of me. For bursa im pretty defensive so no issues, the pain is in my other bets. This post has been edited by ChAOoz: Jul 11 2022, 09:00 PM |

|

|

Jul 13 2022, 10:01 AM Jul 13 2022, 10:01 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jul 11 2022, 07:20 PM) Stocks ain't too different than casinos, no? Casino for trader like you.. or those heavy in options QUOTE(Boon3 @ Jul 11 2022, 07:20 PM) When one is winning big, getting up and leave With a huge chunk of chips is so important.... esp for Harta. This is why I avoid glove stocks.. after Covid cool down, losing steam liao. But strange don't see Pfizer or Moderna stocks shooting up so much also after vaccines came in? QUOTE(Boon3 @ Jul 11 2022, 07:20 PM) and yeah.... banking stocks... this one I like.. banks + reits is what I invest for MY market. This post has been edited by Davidtcf: Jul 13 2022, 10:02 AM |

|

|

Jul 13 2022, 11:19 AM Jul 13 2022, 11:19 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Jun 18 2022, 10:18 AM) the question that needed to answer is "why despite the monopolistic business, why has the stock failed the past 5 years?" .... and the Edge (again) picks up the receivables and cash flow issue...quick check on Tenaga earnings would be useful. 2015 -- 6.118 Billion 2016 -- 7.368 Billion 2017 -- 6.904 Billion 2018 -- changed calendar year ... 2019 -- 4.529 Billion 2020 -- 3.593 Billion 2021 -- 3.662 Billion Which clearly shows that Tenaga earnings had declined rapidly since 2018. Which coincided with Tenaga in 2018 was high as 16++ Today? 8.30 What gives? Firstly look at Tenaga monopolistic business. As a utility company, government (and politics), Tenaga's pricing is capped. Okay, there's more usage in energy. Last fiscal, despite covid, Tenaga's revenue managed to increase 20% but the increase is negated by the increase in operating costs etc etc, which meant Tenaga's net profit were flattish at 3.662 billion. Same thing for the 1st quarter of the current fiscal year. Revenue increased by 35% but operating cost increased by 43%. Yup. This is what we are seeing where the company pricing is fixed but not the cost. (rising fuel costs is a massive no no for Tenaga) And despite, the increase in usage, it's not all smooth sailing. Receivables had increased from 10 billion to 14 billion. A worrying factor which possibly indicates that collection is NOT EASY. If slow paying consumers, is understandable but what if the main increase comes from business shutting down? That will be tough job collecting. And then despite being a monopoly business, Tenaga's cash flow has been poor. I remember Tenaga's cash balances used to be closed to 10 billion. Yup plenty of cash. But its most recent Q1, Tenaga's cash was only roughly 4.7 billion. Yes, that's all the past. That's what basically ailing Tenaga. What's next? Electricity prices are still fixed. Yeah, yeah, there are talks that Tenaga might be allowed to increase its tariffs. Which means any purchase of Tenaga's shares is NOTHING but speculation that it will be allowed to increase its tariffs. But will it? Big money question. Any decision to increase tariff rates will most likely to piss off the rakyat, more so when inflation is spiraling out of control. (some) politicians will surely argue that why allow Tenaga raise rates? Tenaga is cash rich and is still making very good yearly profit of 3 billion plus. Yup, let Tenaga's profits be sacrificed for the Keluarga Malaysia sake. And without the increase in electricity tariffs, unfortunately Tenaga's cost is going to be a burden .... (which means the past mediocre earnings would most likely to continue and could even see a possible decline in future earnings) we have the rising fuel costs issue (which I don't see going down soon) .... and not to forget Tenaga has more than 10 billion in foreign debts (mostly USD too! and yeah.... not forgetting the legacy IPP issue ( https://m.malaysiakini.com/news/387795 ) so consider the following issue too now.... market has been terrible... the smarter ones are rubbing their hands in glee for those generational opportunity to win couple of baggers. how many would want to put it into Tenaga, who's looking like a terribly handicapped stock? simply put, in betting terms, is Tenaga looking like a one in a lifetime opportunity now, where one will put their house down to bet on the stock? and then dividends... best put this way... For fy 2019, Tenaga dished out 100sen in dividends (yeah that's when ppl screamed out loud for dividend stocks) (and yeah it included a special dividend) but last fiscal year, tenaga dished out only 40sen. 40 sen compared to 100 sen. Which is why those who invested in Tenaga since 2018, is losing money! Biggest thing to note... dividends is never fixed. Dividends can increase but dividends can indeed shrink drastically too. https://www.theedgemarkets.com/article/tena...ghter-cash-flow THERE is growing concern about Tenaga Nasional Bhd’s (Tenaga) likely strained cash flow, as the electricity tariff is not rising fast enough to cope with escalating fuel costs. The utility group will have to borrow more to sustain its operations, as it needs to fork out a bigger sum in advance in view of the big jump in fuel prices. To make matters worse, compensation for the fuel cost increment comes only after six months, if not longer. In the quarter ended March 31 (1QFY2022), Tenaga recognised revenue of RM3.51 billion that was an under-recovery of the ICPT (imbalance cost pass-through). The group can only claw back its under-recovery fuel costs every six months. In the past, the lag between fuel cost spent and payment for cost increment through the ICPT mechanism had not been an issue owing to stable fuel prices. Already, Tenaga has increased its borrowings, drawing down a total of RM5.13 billion from bank borrowings in 1QFY2022, which was almost quadruple the amount in the financial year ended Dec 31, 2021 (FY2021). Tenaga is also issuing medium-term debt paper. Last Thursday (June 30), it issued RM4 billion worth of sukuk wakalah, part of its Islamic medium-term notes programme launched in June 2020. Two weeks ago, Prime Minister Datuk Seri Ismail Sabri Yaakob announced that the electricity tariff in Peninsular Malaysia would be kept at current levels for the rest of the year via a subsidy bill of an additional RM5.8 billion. This announcement caught analysts and investors by surprise, considering that electricity tariffs are already skyrocketing in many countries. They had believed that Tenaga would be immune to high fuel prices owing to the fuel cost pass-through mechanism. The news sent Tenaga’s share price plunging to a seven-year low of RM7.89 on June 28. Year to date, the group has seen RM6.5 billion in total market capitalisation wiped out. The counter is now trading at a trailing 12-month (TTM) price-earnings ratio (PER) of 12.74 times and TTM dividend yield of 5%. In January, the government raised the electricity tariff for non-domestic users by imposing a surcharge of 3.7 sen per kilowatt hour (kWh) on top of the base rate of 39.45 sen/kWh for the February-to-June period, while domestic households continue to enjoy a two-sen rebate on the base rate. In 1QFY2022, high fuel costs lifted Tenaga’s operating expenses by 47% to RM13.43 billion, from RM9.15 billion a year ago. In the first half of the year, international coal prices had spiked from US$157.50 a tonne to as high as US$440 a tonne. Coal accounts for about 56% of Tenaga’s fuel mix. The average coal price agreed upon by the government and Tenaga for the Regulatory Period 3 (RP3) is not known. Under the incentive-based regulation (IBR) mechanism, the electricity base rate is set for every three years, with the current RP3 running from February 2022 to December 2024. Industry players are saying that the average thermal coal agreed upon for RP3 is US$79 a tonne. “This means TNB Fuel [Services Sdn Bhd], which is the sole coal buyer for all the power plants in the peninsula, has been paying four to five times more for coal than the average price that was agreed on with the government in setting up the tariff for RP3 in the first half of the year,” says an observer. Now that the government has decided not to impose a higher surcharge in the second half of the year to make up for the shortfall in the first half, Tenaga should find its cash flow affected. This has been translated into higher current receivables for the group up to 1QFY2022. Tenaga’s current receivables surged to RM14.07 billion, from RM10.55 billion in the preceding quarter, up 33.4% in three months. Its receivables were only RM6.9 billion as at Dec 31, 2020. The higher current receivables could result in a meaningful increase in working capital requirement and, therefore, affect Tenaga’s cash flow in the near term, says Hafriz Hezry, an analyst with MIDF Research who covers the power sector. Analysts have cut their target prices for Tenaga after the government’s decision not to raise tariffs. MIDF Research revised its target price on the stock to RM8.45, from RM9.55, but maintained a “neutral” call on it. Maybank Investment Bank has a target price of RM8.70, down from RM9.30 previously, with a “hold” call. RHB Research downgraded the power sector to “neutral” from “overweight”. Its power sector analyst Sean Lim says Tenaga’s receivables coming from the ICPT could continue to grow if fuel prices stay high in the second half of the year. “Our concern is on the impact of operating cash flow, if the government is unable to pay on time. In the worst-case scenario, where the ICPT no longer holds, TNB’s defensive earnings could be at risk if it is vulnerable to volatile fuel prices without being able to fully pass on the costs to end-consumers,” he says in a June 30 report. HLIB Research is still positive, however, on Tenaga’s prospects. Its analyst Daniel Wong is maintaining his “buy” call and target price of RM13.40, as the continuation of the ICPT mechanism allays investors’ concern on regulatory risks, he says in a report dated June 27. The question is whether the ICPT mechanism can be construed as intact, as the government does not want the end-user to bear the brunt of high energy prices. It will be no surprise if the government is slow in disbursing the subsidy on electricity tariffs to Tenaga. In the 2020 annual report of Kumpulan Wang Industri Elektrik (KWIE), it stated that Tenaga had requested to reclaim a total of RM1.89 billion for the tariff discounts that the government had imposed under Pakej Rangsangan Ekonomi 2020, Pakej Rangsangan Ekonomi Prihatin Rakyat and Bantuan Prihatin Elektrik. Of this amount, RM1.05 billion had been refunded to the utility group from KWIE’s 2020 fund, while the balance was to have been refunded in 2021. This means the balance of about 45% of the amount claimed was not refunded in the same year. It is not clear whether the government has refunded Tenaga through KWIE or directly from its coffers. As at press time, Tenaga had not replied to queries from The Edge on the matter. Nevertheless, Tenaga’s credit rating seems to have remained intact. In a statement dated June 16, S&P Global Ratings raised its long-term issue rating on the company’s notes to reflect its expectations of a lower secured debt ratio and subordination risk. However, the upgrade came before the news on the zero tariff hike for 2H2022. The global credit rating agency then stated that Tenaga’s cash flow should remain largely predictable, with limited exposure to demand risk. “The company should be able to continue passing through actual uncontrollable costs via an ICPT mechanism. The regulated ICPT mechanism allows Tenaga to pass through actual uncontrollable fuel and generation costs, albeit with a six-month lag. “Fuel costs have significantly increased since late 2021. We estimate TNB’s financial leverage, as measured by an adjusted ratio of funds from operation (FFO) to debt, to remain at 16% to 18% in 2022 to 2023, compared with 18.6% in 2021,” the rating agency says. It adds that the stable outlook on Tenaga reflects its expectation that the group will maintain its adjusted FFO-to-debt ratio at above 15% over the next 12 to 18 months. The credit agency believes Tenaga will be able to pass on any under- or over-recovery of fuel costs through tariff adjustments. Nonetheless, S&P Global Ratings says in its statement that it could revise downward its assessment if Tenaga’s adjusted FFO-to-debt ratio falls below 15% with no prospects for improvement. It says this could happen if, among others, the group’s earnings before interest, taxes, depreciation and amortisation margin falls below 30%, owing to higher fuel costs without tariff relief, or because of adverse regulatory decisions when its businesses undergo regulatory resets. Will the decision not to increase tariffs result in a downgrade of TNB’s credit ratings? The coal price trend will be a gauge. |

|

|

Jul 13 2022, 03:11 PM Jul 13 2022, 03:11 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

MPI has really taken a huge beating. almost 50% drop from peak. miss the guy who was super bullish about Malaysian tech stocks.

|

|

|

Jul 13 2022, 03:20 PM Jul 13 2022, 03:20 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ Jul 11 2022, 09:00 PM) Yeah two components to it. When to buy and when to sell. Stocks are stocks. Doesn't matter Bursa or Yankee market. It is still the same.Well sometime greed get the best of me. For bursa im pretty defensive so no issues, the pain is in my other bets. Look at Musk and Tesla. We all knew very well, before the delivery of cars breakthrough, Tesla was technically dead. I doubted it could survive another cash call. Many others too. Short sellers had damn valid reasons to short the stock to kingdom come. But then, miracle happened. LOL! Rest is history.... Which comes the stock ownership issue.... what the bosses do when they hit the jackpot... so very important.... We had Jack Ma talking absolutely bullocks.... We had TG boss getting way too deep into the stock market.... and we had Musk... talking like himself again. Twitter. LOL! (spot on description from you. these were signs to sell the stock. Harta? The best managed stock in a sunset sector? Hey, it's still a stock in a sunset industry. And the simplest of logic says it will fall. Not selling? Really? LOL!!! Wait... is it average down or is it average up? LOL! And yet all this will happen all over again and again...... like how folks will continue to follow the old fart blogger the next time he posts he's buying AAA666 stock...... why? it's a stock tip! LOL! |

|

|

Jul 13 2022, 03:28 PM Jul 13 2022, 03:28 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

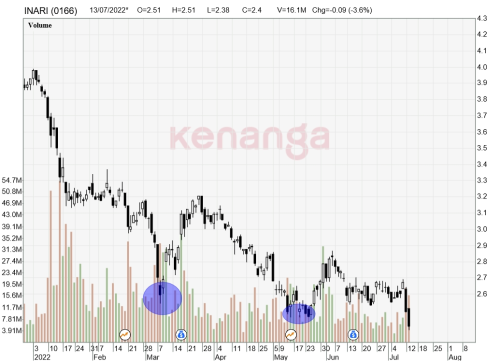

Reading the March tea leaves....

take Inari...  As can be seen... the March lows, was as expected... but after that.... yeah... after that... you can see that it is sort of firming up its bottom... watching how these bottoms develops, is really useful... for example Inari today...  and that's a fresh round of 'selling'.... yup... the bottom is giving way.... Then you have Harta.... LOL!  clearly... it is still rolling... rolling, rolling down the hill......................... |

| Change to: |  0.0650sec 0.0650sec

0.48 0.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 09:39 AM |