well, if one had done homework... and paid attention to say... Frontken

one can see that is actually doing okay... the bottom was firming up...

but then.... this happened...

and yea..... there ....

STOCK MARKET DISCUSSION V150

|

|

Jul 13 2022, 03:37 PM Jul 13 2022, 03:37 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jul 13 2022, 03:37 PM Jul 13 2022, 03:37 PM

|

Junior Member

164 posts Joined: Sep 2015 |

What happened to Scientex.... haihhh

|

|

|

Jul 13 2022, 03:45 PM Jul 13 2022, 03:45 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 13 2022, 04:40 PM Jul 13 2022, 04:40 PM

Show posts by this member only | IPv6 | Post

#60604

|

Junior Member

192 posts Joined: Feb 2022 |

|

|

|

Jul 13 2022, 04:52 PM Jul 13 2022, 04:52 PM

|

Junior Member

164 posts Joined: Sep 2015 |

Bought at 4.120 lol, klci no eyes to see, everday dropping

|

|

|

Jul 13 2022, 05:15 PM Jul 13 2022, 05:15 PM

Show posts by this member only | IPv6 | Post

#60606

|

Junior Member

227 posts Joined: May 2022 |

|

|

|

|

|

|

Jul 14 2022, 09:52 AM Jul 14 2022, 09:52 AM

|

Junior Member

198 posts Joined: Jan 2019 From: Praia Espiñeirido/Kuala Lumpur |

Which broker is good for newbie ?

If want trade worldwide not just malaysia...got any broker that does that ? and how fast is the process if transfer money to get the stocks ? |

|

|

Jul 14 2022, 11:48 AM Jul 14 2022, 11:48 AM

|

Junior Member

164 posts Joined: Sep 2015 |

|

|

|

Jul 14 2022, 05:27 PM Jul 14 2022, 05:27 PM

Show posts by this member only | IPv6 | Post

#60609

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 14 2022, 06:09 PM Jul 14 2022, 06:09 PM

|

Junior Member

164 posts Joined: Sep 2015 |

|

|

|

Jul 14 2022, 06:20 PM Jul 14 2022, 06:20 PM

Show posts by this member only | IPv6 | Post

#60611

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 14 2022, 06:35 PM Jul 14 2022, 06:35 PM

|

Senior Member

3,500 posts Joined: Dec 2007 |

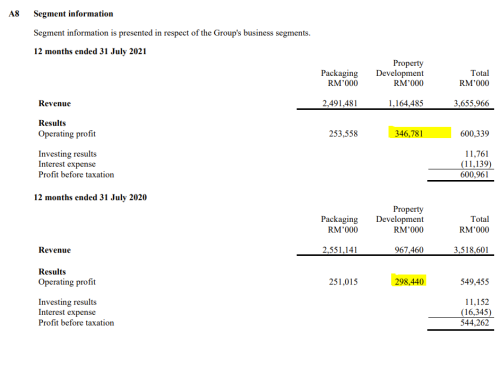

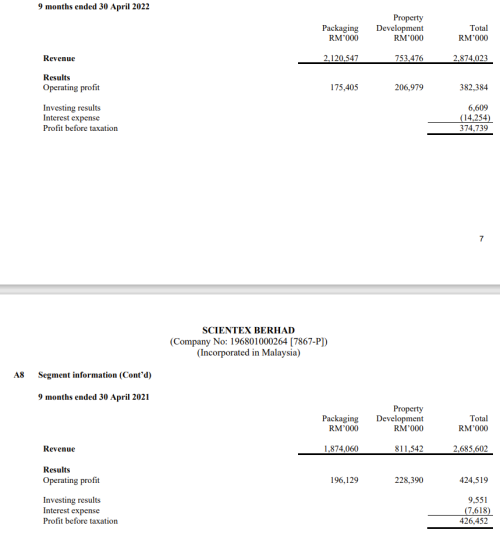

QUOTE(Sherman Kong @ Jul 13 2022, 03:37 PM) Got squeeze on both manufacturing and property end by material input cost. Rising construction material and rising resin/petrochemical prices for stretch film.Upside is that demand seemed robust, and overall both property and stretch film sales are quite defensive. Hopefully margin compression story end soon. I'm looking at it for a possible entry soon, waiting for an event trigger price breakdown like Malaysia official in recession news. |

|

|

Jul 14 2022, 07:00 PM Jul 14 2022, 07:00 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ Jul 14 2022, 06:35 PM) Got squeeze on both manufacturing and property end by material input cost. Rising construction material and rising resin/petrochemical prices for stretch film. Glory days could be passed.... Upside is that demand seemed robust, and overall both property and stretch film sales are quite defensive. Hopefully margin compression story end soon. I'm looking at it for a possible entry soon, waiting for an event trigger price breakdown like Malaysia official in recession news. Its property success is coming with a cost - bad reputation for poor workmanship... do confirm this. Glory days it was making 100million plus per quarter. If shit really starts to hit the fan (very much possible imo).. would it reverse back to 50+ million per quarter? If so... the downside risk could be below rm2.. |

|

|

|

|

|

Jul 14 2022, 11:03 PM Jul 14 2022, 11:03 PM

Show posts by this member only | IPv6 | Post

#60614

|

Junior Member

192 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Jul 14 2022, 07:00 PM) Glory days could be passed.... Your view is abit too over pessimistic perhaps?Its property success is coming with a cost - bad reputation for poor workmanship... do confirm this. Glory days it was making 100million plus per quarter. If shit really starts to hit the fan (very much possible imo).. would it reverse back to 50+ million per quarter? If so... the downside risk could be below rm2.. |

|

|

Jul 15 2022, 09:43 AM Jul 15 2022, 09:43 AM

|

Senior Member

3,500 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Jul 14 2022, 07:00 PM) Glory days could be passed.... Yeah i got heard about that. But then i search around for similar price range competitor and there is just not many.Its property success is coming with a cost - bad reputation for poor workmanship... do confirm this. Glory days it was making 100million plus per quarter. If shit really starts to hit the fan (very much possible imo).. would it reverse back to 50+ million per quarter? If so... the downside risk could be below rm2.. Currently most developers are focusing on high rise while some bigger one like sime darby or ecoworld is focusing on mid to high end and not the affordable range for landed. So that leave scientex dominantly in the landed affordable space But what you said there is a possibility of happening so just gotta becareful This post has been edited by ChAOoz: Jul 15 2022, 09:44 AM |

|

|

Jul 15 2022, 09:59 AM Jul 15 2022, 09:59 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ Jul 15 2022, 09:43 AM) Yeah i got heard about that. But then i search around for similar price range competitor and there is just not many. Well that's how I would have evaluated my downside risk. Currently most developers are focusing on high rise while some bigger one like sime darby or ecoworld is focusing on mid to high end and not the affordable range for landed. So that leave scientex dominantly in the landed affordable space But what you said there is a possibility of happening so just gotta becareful And I will still hold what I said that the market had been way too generous with the stock valuation for it. The bigger money contributor was from its property sector. That is its growth engine.... but the market wasn't valuing the company as a property stock. That was the biggest disconnect for me. And lastly... when growth stocks stop growing, its corrections tends to be massive.... and the worst thing one could do is start talking about value and using value as the reason to hold the stock. (haven't we seen in cases like Harta?) |

|

|

Jul 15 2022, 10:45 AM Jul 15 2022, 10:45 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Jul 15 2022, 09:59 AM) Well that's how I would have evaluated my downside risk. ChAOozAnd I will still hold what I said that the market had been way too generous with the stock valuation for it. The bigger money contributor was from its property sector. That is its growth engine.... but the market wasn't valuing the company as a property stock. That was the biggest disconnect for me. And lastly... when growth stocks stop growing, its corrections tends to be massive.... and the worst thing one could do is start talking about value and using value as the reason to hold the stock. (haven't we seen in cases like Harta?) this is from fy2021 Q4 ..  Packaging sector was flat.... And the property sector was driving the company's growth... * see how property earnings contributed more for Scientex's profits * this is from its latest quarterlies .... see the decline in both....  |

|

|

Jul 15 2022, 05:59 PM Jul 15 2022, 05:59 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

Better sell now if you holding any Malaysia cigarette stocks. Price gonna dive real soon:

https://www.nst.com.my/news/nation/2022/07/...day-says-khairy |

|

|

Jul 18 2022, 11:09 AM Jul 18 2022, 11:09 AM

Show posts by this member only | IPv6 | Post

#60619

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Can't find a right thread to post this, but this one comes close.

The Big Read: Malaysia The sultan, his family and a $15bn dispute over oil in Malaysia The heirs to the last ruler of Sulu have seized state-owned energy assets in a lawsuit that dates back to colonial Britain by Oliver Telling in Singapore and Leo Lewis in Tokyo (YESTERDAY) » Click to show Spoiler - click again to hide... « This post has been edited by TOS: Jul 18 2022, 11:13 AM |

|

|

Jul 19 2022, 05:12 PM Jul 19 2022, 05:12 PM

|

Junior Member

215 posts Joined: Jan 2022 |

QUOTE(TOS @ Jul 18 2022, 11:09 AM) Can't find a right thread to post this, but this one comes close. What will happen if Malaysia go against the international law which award the assets to the claimants? Will Malaysia become 'full Russia'? Get sanction by western countries? Then our foreign stock/cash will be frozen? Scary.... Time to divest foreign investment?The Big Read: Malaysia The sultan, his family and a $15bn dispute over oil in Malaysia The heirs to the last ruler of Sulu have seized state-owned energy assets in a lawsuit that dates back to colonial Britain by Oliver Telling in Singapore and Leo Lewis in Tokyo (YESTERDAY) The claimants’ lawyers warn that more state assets will be pursued unless a resolution is reached. “International law doesn’t let you pick and choose,” says Cohen. “Either Malaysia honours its international obligations, or it goes ‘full Russia’.” “The seizure process is a rolling programme that is designed to meet our clients’ financial demands,” he adds. “But we hope Malaysia will see the cost of being a legal pariah state and come to terms.” Additional reporting by Eleanor Olcott in Taipei [/spoiler] |

| Change to: |  0.0508sec 0.0508sec

0.51 0.51

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 01:37 AM |