QUOTE(minum susu @ Jan 4 2021, 09:25 AM)

safer to browse FD thread.STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Jan 4 2021, 09:46 AM Jan 4 2021, 09:46 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

|

|

|

|

|

|

Jan 4 2021, 09:47 AM Jan 4 2021, 09:47 AM

|

Senior Member

1,370 posts Joined: Feb 2018 |

QUOTE(Angelpoli @ Jan 4 2021, 09:44 AM) Honestly, buy when no one else is talking about it. Right now you have institutions who are slowly dumping their shares. On the other hand, you have retailers who are desperate to cut their losses and free their capital. Wait when both of the above groups are gone. HereToLearn liked this post

|

|

|

Jan 4 2021, 09:47 AM Jan 4 2021, 09:47 AM

|

Senior Member

3,500 posts Joined: Dec 2007 |

Also IDSS and PDT short sales is still ban. Too bad retailer don't get to participate in this short sell bonanza. By the time they can participate, market would have stabilized at a new price point. HereToLearn liked this post

|

|

|

Jan 4 2021, 09:48 AM Jan 4 2021, 09:48 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

meanwhile ringgit is breaking RM4.00 barrier

|

|

|

Jan 4 2021, 09:48 AM Jan 4 2021, 09:48 AM

|

Senior Member

2,940 posts Joined: Jan 2010 |

|

|

|

Jan 4 2021, 09:48 AM Jan 4 2021, 09:48 AM

|

Junior Member

587 posts Joined: May 2016 |

PBB, Genting and a few others looking like fair games to be shorted soon

|

|

|

|

|

|

Jan 4 2021, 09:49 AM Jan 4 2021, 09:49 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

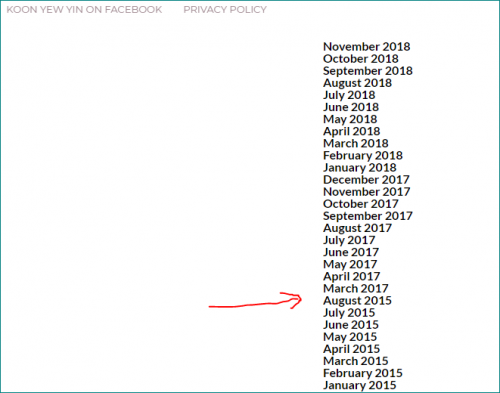

QUOTE(Boon3 @ Dec 31 2020, 03:10 PM) Then of course there is this old article on the old fart... At this rate .... he WILL have margin calls soon....https://www.thestar.com.my/business/busines...s-side-of-story Tycoon Koon tells his side of story about his stocks By TEE LIN SAY BUSINESS Monday, 16 May 2016 12:00 AM MYT ETALING JAYA: Savvy investor and philantropist Koon Yew Yin reasoned that his age, wealth and ability to pick the right stocks have contributed to his late disclosures in dealing with his shares becoming an issue. The 83-year old former civil engineer, who has a large following among retail investors, also alluded that he failed to disclose his buying and selling of shares on time to the company because of the cumbersome system of reporting share transactions on a daily basis. “The main problem is that I have too much money which is why I need to buy above 5%. I am too good at buying shares (which has got him a lot of followers). But when I say it like that, it sounds like a bad word,” says Koon when asked on his late disclosures in shares he buys and sells. Koon has been in the spotlight lately for untimely disclosures on companies such as VS Industry Bhd, Latitude Tree Holdings Bhd and Focus Lumber Bhd. According to the regulations, a substantial shareholder must notify the company within seven days of any changes in his or her shareholding. However, Koon’s disclosures were late by between two weeks to up to two months. This has caused a stir among his followers on social media who are of the view that Koon should have made timely disclosures for them to decide on their portfolio. Going forward, Koon indicated that he might restrict his buying of stocks to less than 5% so that it would need no disclosures. In his blog, Koon explained in detail the reasons for his delay in notifying the company. Koon said that he needed to fill up Form 29A & B which required details such as the number of shares and the date he bought or sold. Moreover, the buying or selling price frequently changes. To report the price he has to work out the average price that he traded on the whole day. He has margin accounts with six brokers and his total margin loan amount is RM150mil. “My average daily trading exceeds RM1mil and the number of shares I buy and sell every day is quite a lot,” said Koon in his blog. Koon has many trading accounts and simply gives instructions to his remisiers to buy or sell at a certain price. “A few times I made the mistake of instructing one remisier to sell in the morning the same share that I instructed another remisier to buy in the afternoon. In fact, the authorities had reprimanded my remisers who were involved in these transactions that might seem to mislead investors. Those were honest mistakes,” he said in his blog. As a result of the above difficulties, Koon said he had timed his disclosures on his dealings with shares until he had sold enough to own less than 5% of the total issued shares of the company. Following this, he just needed to fill up one form to state that he has ceased to be a substantial shareholder without the requirement of stating the dates and the prices that he sold. Koon, who founded IJM Corp, Gamuda Bhd and Mudajaya Group Bhd, has a large following among retail investors on his investments in stocks. Among investors, Koon is seen as a sort of “hero” who understands the market well. His stock picks are followed closely by most in the investing community. Koon assures his followers that he has no intention to mislead people to lose money. “I have never recommend readers to buy any share if I am selling. As you know, I have written many articles about Latitude, VS and Lii Hen which have gone up a few hundred per cent over the last 2 years. If you have followed my recommendations, you would have made a huge profit. Of course, if you were too greedy and did not sell, you cannot blame me,” he said. An observer who is familiar with Bursa’s reporting procedure, acknowledges that it is a tedious process to report dealings in shares for substantial shareholders. “Even if a substantial shareholder managed to sell only 5,000 shares a day, he would have to make the filing with Bursa. He will have to file with Bursa no matter how little he managed to buy or sell on a daily basis. This becomes difficult especially when the company is illiquid and the substantial shareholder can sell a low volume of shares in one day and yet have to make an announcement,” said the observer. In Latitude Tree, for example, a company which Koon was previously a substantial shareholder, average daily trading volume is under 100,000 shares. This means that it would have been very difficult for Koon to dispose of the amount he wanted. Koon’s untimely disclosures came to the forefront when VS Industry announced to Bursa on May 4 that Koon was no longer a substantial shareholder after having sold in the market a staggering 44.08 million shares between March 18 and April 11. The announcement was only made on May 4, which was seven weeks later. Last week, Koon had emerged as a substantial shareholder in Focus Lumber. However, disclosure was only made on May 9, with filings showing that Koon had acquired a 6.71% stake, representing 6.93 million shares, in the Sabah-based hardwood manufacturer on April 11 at an undisclosed price. In the case of Latitude Tree, Koon who was a major shareholder with a 5.01% stake, only gave notice of his disposals in January, two months later. Based on filings on Jan 11 this year, he acquired, disposed and transferred Latitude shares between Nov 16 and 23. On a moral note, Koon said that after having given more than 300 scholarships to help poor students to complete their tertiary education, fewer than 10 scholarship recipients had come to thank him. “The remaining students continue to complain that the amount I gave them is not sufficient. That is human nature,” he said. He added that he had pledged to donate RM50mil to the Penang government to build student hostels. All the architectural and engineering plans are being approved and tenders will be called soon. “I have written in my will that all my remaining assets will be for charity to help poor people after I die,” he said His margin then was 150 million. Some folks can confirm it is much higher today.... yes, he swings a fairly large bat. The problem with everything was.... when he was selling, he had buy articles posted... and best of all, if you look into his blog archives .... 2016 is not there. Yup 2016... the year many questioned his postings on VS, Focus Lumber .. If I search for focus lumber I get this... https://koonyewyin.com/?s=focus+lumber  That hit was a post dated 2019... The archive section was most interesting...  WOW! Looks like the entire 2016 was gone. The year he was questioned about his untimely disclosures!!!! I believed that many had also complained because when he wrote the stock was a buy, he was selling instead!!! and if he is still swinging 150 million plus in margin ..... things could snowball really fast. do take note This post has been edited by Boon3: Jan 4 2021, 09:51 AM |

|

|

Jan 4 2021, 09:49 AM Jan 4 2021, 09:49 AM

|

Junior Member

460 posts Joined: Oct 2008 |

Any potential counter that dropped to decent entry price?

|

|

|

Jan 4 2021, 09:50 AM Jan 4 2021, 09:50 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 4 2021, 09:51 AM Jan 4 2021, 09:51 AM

|

Senior Member

3,500 posts Joined: Dec 2007 |

QUOTE(nauticat99 @ Jan 4 2021, 09:48 AM) Not enough growth room to short those, there are still holder in high range pre covid. Problem with shorting recovery stock is, if you hit it too low, future will be bright and people will buy the lows to prepare for the eventual recovery.As for stock like glove, future ahead is lower ASP, more competition, less covid yada yada. Easy to attack it and hard to get market confidence to buy in even when price is low. |

|

|

Jan 4 2021, 09:51 AM Jan 4 2021, 09:51 AM

|

Junior Member

528 posts Joined: Oct 2007 |

|

|

|

Jan 4 2021, 09:52 AM Jan 4 2021, 09:52 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 4 2021, 09:53 AM Jan 4 2021, 09:53 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 4 2021, 09:54 AM Jan 4 2021, 09:54 AM

Show posts by this member only | IPv6 | Post

#42374

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jan 4 2021, 09:56 AM Jan 4 2021, 09:56 AM

|

Senior Member

1,360 posts Joined: Mar 2010 |

|

|

|

Jan 4 2021, 09:56 AM Jan 4 2021, 09:56 AM

Show posts by this member only | IPv6 | Post

#42376

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(minum susu @ Jan 4 2021, 09:54 AM) » Click to show Spoiler - click again to hide... « Rumour has it that kyy and tyyap also got burned by recent gloves downtrend. bill11 liked this post

|

|

|

Jan 4 2021, 09:56 AM Jan 4 2021, 09:56 AM

|

Senior Member

1,360 posts Joined: Mar 2010 |

B% for Topglov at 61% though

|

|

|

Jan 4 2021, 09:57 AM Jan 4 2021, 09:57 AM

|

Senior Member

3,500 posts Joined: Dec 2007 |

Also there is a limit to the short amount, and they will have to buy back the position later also. So not to worry, probably won't get very much worse unless all these glove counters majority is populated by Margin counter than well

|

|

|

Jan 4 2021, 09:57 AM Jan 4 2021, 09:57 AM

|

Senior Member

9,789 posts Joined: Jun 2008 From: Rubber Duck Pond |

Wew woke up to bursa earthquake.

|

|

|

Jan 4 2021, 09:58 AM Jan 4 2021, 09:58 AM

|

Junior Member

587 posts Joined: May 2016 |

Market sentiments is such that when you see companies with great earnings dropping so much, you also have no confidence in the rest with lower earnings. Market drag down across all, who knows suddenly bursa comes out and cancel RSS to prevent further loss of confidence!

|

| Change to: |  0.0405sec 0.0405sec

0.62 0.62

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 08:26 PM |