QUOTE(Boon3 @ Nov 27 2020, 01:26 PM)

The potential of the company is not in question.

The question lies within the composition of the stock.

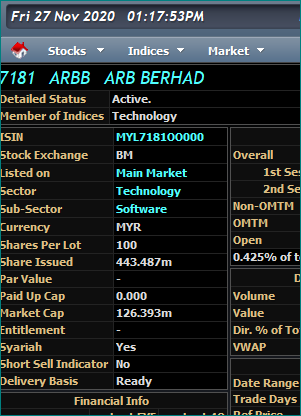

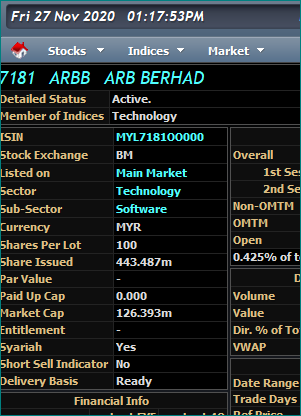

ARBB has 431 million shares.

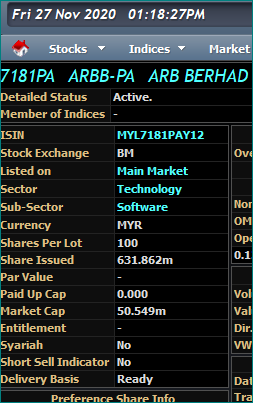

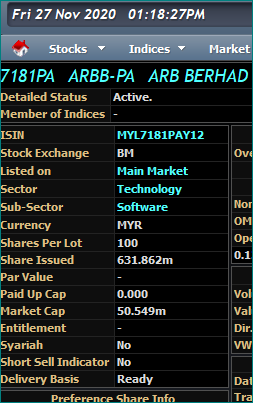

ARBB PA has 631 million shares.

sos

Conversion price is 20 sen.

This morning reference prices

ARBB-PA is 0.075

ARRB is 29 sen

Which means the PA is in the money (and it has been for a long time).

Search Bursa website... look at the many 'additional listing' announcements arising from conversion of shares.

Which means... as mentioned... one can BUY PA, Convert PA, Sell ARBB.

With such action how to go up?

Look back a couple of months ago.

Same issue with AT.

The warrant was in the money.

Hence, there exist ppl that buy warrant, convert the warrant and then sell. Profit the difference.

i see what you're trying to say. if mother increase theoratically the PA should increase too (95% of the case la, if market is efficient) except AT and a few which mother and warrant same price yesterday lol The question lies within the composition of the stock.

ARBB has 431 million shares.

ARBB PA has 631 million shares.

sos

Conversion price is 20 sen.

This morning reference prices

ARBB-PA is 0.075

ARRB is 29 sen

Which means the PA is in the money (and it has been for a long time).

Search Bursa website... look at the many 'additional listing' announcements arising from conversion of shares.

Which means... as mentioned... one can BUY PA, Convert PA, Sell ARBB.

With such action how to go up?

Look back a couple of months ago.

Same issue with AT.

The warrant was in the money.

Hence, there exist ppl that buy warrant, convert the warrant and then sell. Profit the difference.

some ppl just want to goreng

Nov 27 2020, 01:49 PM

Nov 27 2020, 01:49 PM

Quote

Quote 1.3565sec

1.3565sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled