If JP Morgan valuation is wrong.... then why don't they say CIMB is wrong too?

remember CimB had this

2021 -> 10.3 bil profit

2022 -> 5.295 bil profit

2023 -> 3.1 bil profit

Which basically saying what Macquarie and JP Morgan is saying... only difference is CIMB only dared to reduce target price of 10 to 8.90.

Reduce so much but CIMB still say 'Add' and dare not use the S word.

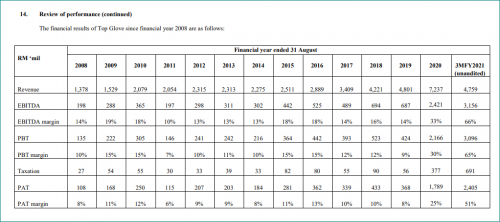

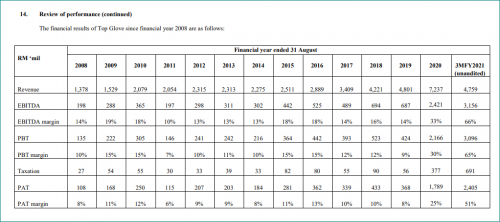

This is from TG QR...

Now we know sales = ASP (average selling price) x Num (number of gloves sold)

Do check but TG production did not increase significantly... so if Num does not increase , simple Math tells us that ASP is the multiplier effect.

Check the ebitda margins... it's pretty constant.... and we know the ASP for those years, was pretty much stable.... no drastic swing...

So clearly... what is driving the Sales revenue higher is the ASP, in which we know for a fact pre C19 it was only usd 17 but now it's about usd120.00.

So with ASP going from 17 to 120 ... isn't clear that Sales revenue rose so high... which gives TG the extremely profit margin.

Okay with this part?

This part is all about business sense... business logic... reality...

No matter what ... raw materials rising or what excuse .... in no business reality, one can raise prices from 17 to 120 in less than one year and keep on raising prices again and again. It's just not possible.

This is business common sense. Logic.

Okay... maybe ... die die... 140.. or 150 is possible (and that is the basis how net profit estimation of 10 billion is estimated) ..... but what's next?

Can still continue higher and higher meh?

If cannot ... logic tells us the chances is that ASP should fall to the usd 100 level.

If it falls that low.... what's our reference? the previous quarter where TG only (lol ... ya...only) had profits of 1.3 bil.

1.3 bil annualised is 4.2 bil net profit.

Tadaaaa..... from 10 bil ... TG profit can fall to 4.2 bil.... it's not rocket science but estimating which way the ASP will go.

Given today... can ASP go so much higher meh? Can it go higher and higher without stopping?

Can it go USD200? USD200 for 1000 pcs of glove. LOL! Gold lining gloves meh?

So for me... the risk ... is so obvious.... ASP will fall.... and the fall will mean drastic reduction in earnings.

Ahhh.... when will this happen. ( Read the edge articles again and see JP Morgan reasoning... it's really not unreasonable the way they reasoned out .... ) Will it happen late 2021? 2022? 2023?

Yes no one knows precisely but then ... this also represents the uncertainty.... Who wants to go long in a stock where the earnings could plunge anytime? This is what funds will be thinking.... it's perfectly normal. A risk assessment.

And if I have the stock or if I want to buy, I will make this very same risk assessment...

anyway this is my 3 sens....

and oh... really ... u should avoid 13 at all cost la....

feel free to disagree....

*edit... couple of big number mistakes has been corrected

*

Because cimb is a sotong bank not a public bank that is why nobody disputes the downcast. Hahah

I also bought into cimb about 6 years back, thinking it would be good to buy and keep for dividends and some capital gain. End up losing money and cut loss.

Dec 11 2020, 04:27 PM

Dec 11 2020, 04:27 PM

Quote

Quote

1.2088sec

1.2088sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled