QUOTE(Avocado @ Jun 7 2016, 03:48 PM)

Hi sifus here, as my dad is buying a new property, I wish to clarify some legal costs. Property details are as below:-

http://www.propwall.my/classifieds/1441435...tab=classifiedsThe negotiated sub-sale price is 1.1 million, loan amount is say 980k. Property type is leasehold and strata, currently rented out.

Since it is a major purchase, I wish to ask about the legal fees involved. Appreciate if any lawyer sifu here can advise:-

1. How much is the legal fees for SPA & Stamp Duty? Payable when?

2. How much is the MOT stamp duty fees? Payable when?

3. Any other SPA related charges or stamp duty not mentioned above?

4. How much is the legal fees for Loan Agreement & stamp duty? Payable when?

5. Any other Loan Agreement charges not mentioned above?

Basically, I am trying to work out the total purchase cost (in addition to the 10% down payment) and to help my dad plan his cashflow (as we are selling some smaller props to raise money for this major purchase, hence cash flow timing is important). We are an average family where every cent counts, hope you can help me.

Thanks a lot!

1. How much is the legal fees for SPA & Stamp Duty? Payable when?

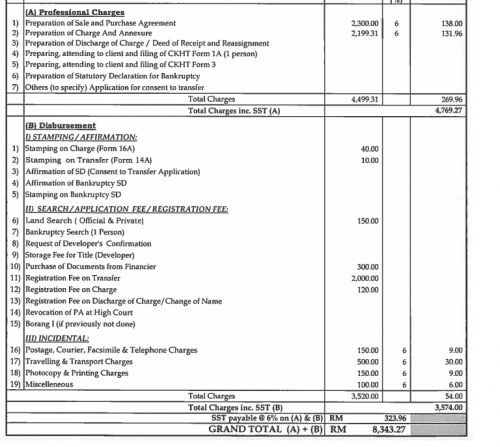

- the legal fees ONLY costs RM8,050.00, please take note that this is excluding caveat forms and disbursements.

- stamp duty for the Sale and Purchase Agreement is only RM10.00 per copy.

2. How much is the MOT stamp duty fees? Payable when?

- stamp duty itself will costs RM27,000.00

3. Any other SPA related charges or stamp duty not mentioned above?

- depending on the firms, disbursement charges varies but shouldn't be more than RM1,000.00 with GST.

4. How much is the legal fees for Loan Agreement & stamp duty? Payable when?

- legal fees ONLY costs RM7,310.00 (vary depending on the type of loan and documents involved)

- stamp duty itself will costs RM4,900.00

- usually payable upon execution of the loan agreements but can be dragged until before your loan solicitors send their advise for the disbursement of the loan

-you may want to take note of the differential sum payable too.

5. Any other Loan Agreement charges not mentioned above?

- you need to verify this with the solicitors because every firm is different in respect of their billings.

Basically, I am trying to work out the total purchase cost (in addition to the 10% down payment) and to help my dad plan his cashflow (as we are selling some smaller props to raise money for this major purchase, hence cash flow timing is important). We are an average family where every cent counts, hope you can help me.

- my word of advise, if your dad can only afford to buy a new property by selling off other properties and by selling these properties, the timing must be right then your dad is not in the position to invest in a new property with such high value especially when you mentioned "every cent counts" in your family

- if at all there is any delay in between these transactions (which will definitely occur), your dad could easily be stuck in between with nothing but unsubstantiated financial obligations.

- "flipping properties" aren't meant for people with commitment.

This post has been edited by shaniandras2787: Jun 7 2016, 06:18 PM

Jan 12 2016, 10:10 PM, updated 10y ago

Jan 12 2016, 10:10 PM, updated 10y ago

Quote

Quote

0.2713sec

0.2713sec

0.61

0.61

6 queries

6 queries

GZIP Disabled

GZIP Disabled