Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

kkk8787

|

Jan 19 2016, 04:22 PM Jan 19 2016, 04:22 PM

|

|

QUOTE(wongmunkeong @ Jan 19 2016, 04:16 PM) bad? son.. during mah time, this is nothing but just a hiccup. dont run screaming for them hills till it's down 50%-60% My ASEAN currency kuhrisis KLCI was -80%+/-  <playing the part of an old codger> Ahaha...hope doesnt cone to this this year |

|

|

|

|

|

kkk8787

|

Jan 22 2016, 11:09 PM Jan 22 2016, 11:09 PM

|

|

terrible..profit in last 1.5 year all wiped out. Did I make a huge mistake going in big few days ago during the 0.5% SC discount....hmm

|

|

|

|

|

|

kkk8787

|

Jan 22 2016, 11:52 PM Jan 22 2016, 11:52 PM

|

|

QUOTE(T231H @ Jan 22 2016, 11:37 PM) I guess not.... if you read and believe page# 97 post# 1940... Hmm ya read. Hopefully la if not the money could be kept in FD almost 4% lo |

|

|

|

|

|

kkk8787

|

Jan 23 2016, 11:43 AM Jan 23 2016, 11:43 AM

|

|

wah rugi teruk teruk,if able to recover back to pre January level in 1 month still ok

|

|

|

|

|

|

kkk8787

|

Jan 23 2016, 12:58 PM Jan 23 2016, 12:58 PM

|

|

any prediction when the global market will recover slightly, or will worsen in near term

|

|

|

|

|

|

kkk8787

|

Jan 23 2016, 01:08 PM Jan 23 2016, 01:08 PM

|

|

QUOTE(T231H @ Jan 23 2016, 01:07 PM) Everyone's Got a China Call as Markets Grapple With Who's Right George Soros says China is headed for a hard landing. Templeton Global Advisors Ltd. says it’s making a normal economic shift, while Goldman Sachs Group Inc. says investors are overstating the slowdown’s impact on the world. Who to believe? Traders are struggling to decide. http://www.bloomberg.com/news/articles/201...ith-who-s-right so question is who is right hahaha |

|

|

|

|

|

kkk8787

|

Jan 23 2016, 01:50 PM Jan 23 2016, 01:50 PM

|

|

QUOTE(wongmunkeong @ Jan 23 2016, 01:40 PM) does it really matter who's right? as long as one is investing (ie NOT TRADING) + doing asset allocation + in the accumulation phase of life (ie not retired and having no cash flow or income) most of us here are accumulators some THINKS they are traders (sorry to burst your bubble cats, wrong vehicle) why the wall of worry la funny lor - when Tesco or Gadget shops have huge % down sales people rush in to buy now, some of these same people getting scared of stock prices discount (fall) pulak. Have a plan Work the plan Dont draw the "fire escape" plan during a fire  I've stayed invested in fsm for close to 5 years. But it seems to be giving a lower return than FD so far. Maybe I always buy in at wrong time. My last major buying was during the 0.5% sc discount. Doubled my portfolio, within days everything dropped |

|

|

|

|

|

kkk8787

|

Jan 23 2016, 03:52 PM Jan 23 2016, 03:52 PM

|

|

QUOTE(ohcipala @ Jan 23 2016, 03:41 PM) What's your strategy? Lump sum investment? DCA? VCA? How long is your investment horizon? 1 month? 1 year? 5 years? Market is bad and volatile now. Be realistic la. Do you really expect to buy now and next week it'll give you a handsome return? 5 year horizon expected. Thinking of cashing out in 1 year. From the high of 11 to 12 per cent profit in total went down to 1 per cent. Value of a new saga just got wiped off within a month haha. Using dca monthly with every now and then top ups. |

|

|

|

|

|

kkk8787

|

Jan 23 2016, 03:57 PM Jan 23 2016, 03:57 PM

|

|

QUOTE(xuzen @ Jan 23 2016, 03:55 PM) I also use DCA / VCA method and my portfolio also got hit. This is one of those episodes where nothing is safe bet for the time being. Know that volatility exist, embrace it, expect it! Take note that a few months (perhaps two mths down the line) you will be happy that you did not sell everything and all went back to normal..... it happen in q42014, mid 2015 and now. Xuzen Ya I gonna stay. Not cashing out. If your prediction of 2 to 3 months is true that will be great. If this is the start of a global crisis then opps. |

|

|

|

|

|

kkk8787

|

Jan 23 2016, 09:42 PM Jan 23 2016, 09:42 PM

|

|

QUOTE(aoisky @ Jan 23 2016, 09:38 PM) err.. lower than FD, are you investing in potential fund ? or are you always selling your unit in losses ? UT yield lower than FD quite rare to me. Mine UT outperform my ASB investment. Try to VCA think long term, investing rather than trading. One of the reasons is my top ups became bigger and bigger. So a lot of the initial earning got diluted by the subsequent tops upd which became bigger and bigger. I dunno how to say. The other reason is i am stuck with a few asia pacific funds. Tried to average down by topping up when he goes lower and lower. But it just kept getting lower. Am asia pacific and rhb asia pacific. These 2 rugi besar besar |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:08 AM Jan 24 2016, 12:08 AM

|

|

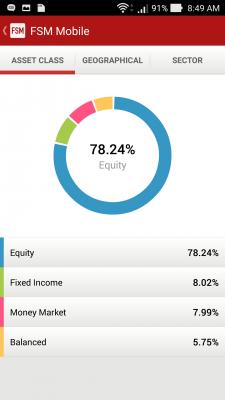

QUOTE(yklooi @ Jan 24 2016, 12:03 AM)  I understand how you felt...but with 5 years at less than FD rate,...you still stick with it? what is your ratio of FI:EQ? what is your expected ROI pa you seek when you planned your initial portfolio that are suitable to your risks? Don't just focused to much on the returns...have a bit of consideration about the higher risk for higher return..... in short...can you have a peace of mind for a good nite sleep didn't you ask FSM CIS for assistance? or try to consider a locally back tested portfolio by "lukenn" at 10.92% CAGR on last 10 yrs (2004~2014) at 50% FI : 50% EQ page# 37, post# 723 mine at 2.5 yrs at about FD rate...already BEH Tahan liao Well once it went just above but after that lagging behind. My equity is around 80 per cent. Something is wrong I think. Have to talk to specialist on monday |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 11:49 AM Jan 24 2016, 11:49 AM

|

|

|

|

|

|

|

|

kkk8787

|

Jan 24 2016, 11:51 AM Jan 24 2016, 11:51 AM

|

|

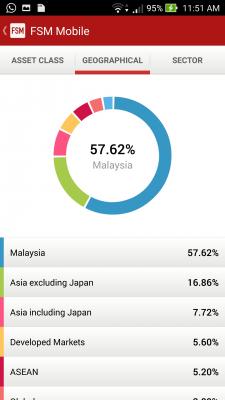

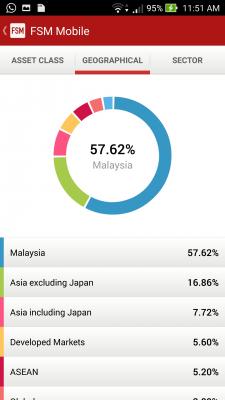

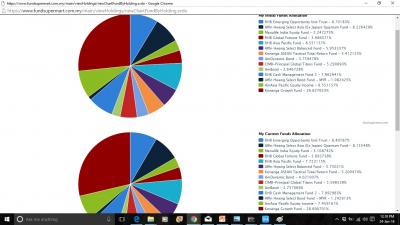

QUOTE(kkk8787 @ Jan 24 2016, 11:49 AM) U guys have being very helpful. I'll give as much info as i can, ya my allocation right Left this out Attached thumbnail(s)

|

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:14 PM Jan 24 2016, 12:14 PM

|

|

QUOTE(ohcipala @ Jan 24 2016, 12:01 PM) I think what people are asking is the allocation of each fund this Attached thumbnail(s)

|

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:16 PM Jan 24 2016, 12:16 PM

|

|

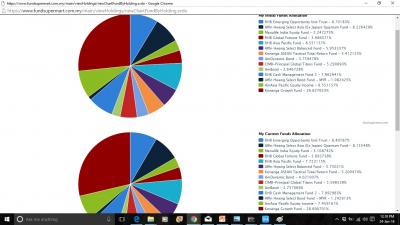

QUOTE(lukenn @ Jan 24 2016, 12:16 AM) You don't say in what proportion each fund is, so I equal weighted everything, and did a quick breakdown. Based on data ye 2015. [attachmentid=5896517] Looks like what you'd expect if 1. equal weighted. 2. lump sum investment from day 1. 3. no rebalancing. To me, it looks like 1. overweighted foreign holdings - heavy on APxJ. 2. overdiversifed to too many funds. 3. portfolio unbalanced. 4. FX exposure is a bit too high. 5. selected funds based solely on return/FSM recommendations. If you're underperforming FD, you're doing something wrong. Im not in the financial field, you are right, I base a lot on FSM recommendation and also recommendation from here. End up Rojak. Now stuck d. Whenever I see something receommended Ill itchy hand buy. I have a bit of spare cash in FD, so keep buying whenever I fell like. U see my allocation, now performing badly |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:20 PM Jan 24 2016, 12:20 PM

|

|

QUOTE(lukenn @ Jan 24 2016, 12:15 PM) Yeah, but he said he was still under performing FD...   I think its underperforming relatively, because the way I calculate wrong d. I just see the % generated by FSM, the one that says total profit how many %, ok it says 11 per cent. Then I think back ok, I started 4 years or something like that back then, if I put in FD 3 per cent by now more than that d. Its a wrong way because in FD I assume lum sum kan, while in FSM , I keep topping up the funds. SO a big portion of money not even has 4 years , some 2 years , some 1 year only, some recently topped up only 1 week only, thats why profit so low. ANyway if I just let it sail by with this portfolio should be ok kan. Seems very diversified already. |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:37 PM Jan 24 2016, 12:37 PM

|

|

QUOTE(lukenn @ Jan 24 2016, 12:36 PM) Urr.. If you like. But very tak balanced la. Either zero or hero. y ah bro, too Malaysian centric ah. I did that because long long time ago, a great some1 in this forum said Malaysian funds are better with Malaysian equities? They are not so good at picking overseas funds |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:49 PM Jan 24 2016, 12:49 PM

|

|

QUOTE(nexona88 @ Jan 24 2016, 12:48 PM) who? remember the name  sorry I really dun remember..haha...was long long time ago |

|

|

|

|

|

kkk8787

|

Jan 24 2016, 12:54 PM Jan 24 2016, 12:54 PM

|

|

QUOTE(nexona88 @ Jan 24 2016, 12:51 PM) too bad. if not can sommon he/she here now & ask for explanation  nola how can haha...he did it out of kind heart also. nobody can predict market kot. but my last regret is that during the last 0.5% SC a week back, I doubled my portfolio, within days BOM, all crashed, if top up few days later instead, even better. |

|

|

|

|

Jan 19 2016, 04:22 PM

Jan 19 2016, 04:22 PM

Quote

Quote

0.0267sec

0.0267sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled