Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

lukenn

|

Jan 28 2016, 11:20 PM Jan 28 2016, 11:20 PM

|

|

QUOTE(T231H @ Jan 28 2016, 08:15 PM) Most of the FSM investors that bought Bond / Fixed Income Funds bought these 5 funds in the past 1 week and 1 month period http://www.fundsupermart.com.my/main/fundinfo/topFunds.svdoStrange, I thought the RHB Cash Management Fund is a MMF ...   |

|

|

|

|

|

lukenn

|

Jan 31 2016, 02:21 AM Jan 31 2016, 02:21 AM

|

|

QUOTE(brotan @ Jan 30 2016, 11:02 PM) anyone has any idea why amb income trust fund over last 3 years graph also slow slope, then suddenly big spike up? happened a few times and I were having a conversation about this on 1st Jan. Its bond default recovery.  [attachmentid=5672751] This post has been edited by lukenn: Jan 31 2016, 02:22 AM |

|

|

|

|

|

lukenn

|

Feb 1 2016, 02:59 AM Feb 1 2016, 02:59 AM

|

|

QUOTE(dasecret @ Jan 31 2016, 10:01 PM) Risk is relative.... If you have bought it before 2008 you get a normal bond returns over the past 7 years. If u bought before 2008 and sold before 2010 it's a lousy investment. If you bought in 2011 then it's a brilliant bond fund so far. This is some very high level kung fu. Wise man say, if u judge a fish by its ability to climb trees, it will live it's entire life think it's stupid. |

|

|

|

|

|

lukenn

|

Feb 1 2016, 06:01 PM Feb 1 2016, 06:01 PM

|

|

QUOTE(xuzen @ Feb 1 2016, 01:50 PM) My personal preference is ... a virgin 50 y/o woman who works for 30 years as a librarian... Xuzen Kinky, but very specific. |

|

|

|

|

|

lukenn

|

Feb 3 2016, 12:20 AM Feb 3 2016, 12:20 AM

|

|

Wow this thread is so quiet these days. It actually fell the 2nd page ...

|

|

|

|

|

|

lukenn

|

Feb 3 2016, 03:21 PM Feb 3 2016, 03:21 PM

|

|

QUOTE(T231H @ Feb 3 2016, 08:11 AM) btw, so far during the month of January....how many of your clients (in %) called to ask about the direction of their portfolio or ask for a change of their allocation? Only 1 call regarding market. 2 scheduled rebalancing. No excitement over here. |

|

|

|

|

|

lukenn

|

Feb 3 2016, 03:56 PM Feb 3 2016, 03:56 PM

|

|

QUOTE(kimyee73 @ Feb 3 2016, 12:22 PM) Wah lau, my portfolio dropped like a rock  My PM EPF portfolio did much better, IRR drop from 7.13% to 6.71% only. As of 29/1/16 | | | | Nov | Dec | Jan | | Portfolio - Main | | IRR | 6.73% | 7.23% | -0.56% | | Top 3 Funds | % of Port | | | | | | EI Small Caps | 3.5% | IRR | 25.2% | 25.28% | 21.35% | | RHB Islamic Bond | 8.9% | IRR | 4.72% | 6.11% | 7.13% | | CIMB Global Titan | 1.7% | IRR | 15.39% | 14.09% | 6.34% | | Bottom 3 Funds (equity) | | | | | | | CIMB AP Dyn Income | 2.9% | IRR | -5.27% | -2.82% | -13.4% | | AMB Ethical | 5% | IRR | -18.26% | -7.77% | -10.74% | | Libra Consumer & Leisure | 3% | ROI | 1.79% | 0.26% | -9.33% |

Seems a little odd. How long have you been tracking your IRR ? The longer the period, the more stable the result. |

|

|

|

|

|

lukenn

|

Feb 3 2016, 03:57 PM Feb 3 2016, 03:57 PM

|

|

QUOTE(xuzen @ Feb 3 2016, 12:23 PM) I have just look at Hwang's monthly review and all sector: all indices are down... there is no where to hide. Only one asset class is in positive territory, i.e., GOLD. With such duldrums and huldrums, where got mood to be chatty leh? Sigh! Xuzen Told you to redeem everything and hide under your tilam. Don't belif summore la ... |

|

|

|

|

|

lukenn

|

Feb 3 2016, 03:58 PM Feb 3 2016, 03:58 PM

|

|

QUOTE(yklooi @ Feb 3 2016, 03:29 PM) That also means not much fresh funds lor ... |

|

|

|

|

|

lukenn

|

Feb 3 2016, 04:08 PM Feb 3 2016, 04:08 PM

|

|

QUOTE(river.sand @ Feb 3 2016, 04:02 PM) You wait for your clients to call  You don't proactively call 30 of them everyday? If i have 30 clients to call everyday, I won't be looking for clients already. I'll be HNI HAHAHAH This post has been edited by lukenn: Feb 3 2016, 06:34 PM |

|

|

|

|

|

lukenn

|

Feb 15 2016, 01:20 PM Feb 15 2016, 01:20 PM

|

|

Gong Xi Fa Chai everyone, slightly belated.

One week away, and there's 100 unread posts.

Hope everyone will have a good year ahead.

|

|

|

|

|

|

lukenn

|

Feb 18 2016, 09:27 PM Feb 18 2016, 09:27 PM

|

|

QUOTE(Ic3ywolf91 @ Feb 18 2016, 07:38 PM) Hello seniors and sifus, im planning to start investing via fundsupermart. I came across the following statement in the faq section. Does this mean that in an unlikely event where the platform ceases as a business, theres a possibility i will nt be getting back my units? (Since non epf funds are not registered under my name) Thanks in advance : WHEN I BUY FUNDS FROM FUNDSUPERMART, IN WHOSE NAME WILL THE UNITS BE REGISTERED IN?

A: For cash investments, all units will be registered under iFAST Nominees Sdn. Bhd. For EPF Account 1 investment, they will be registered in your names. These units are segregated from the company’s assets.

You can contact our hotline (03)2149 0567 for any problems regarding your investments and iFAST Capital Sdn. Bhd. will liaise on your behalf with the fund managers.As with all CUTA and IUTA platforms, the cash funds are bought in the principals name. In the event of company bungkus, the principal will have to pass along the account holder details and holdings, either back to the asset manager, or whoever who buys them out, or go through forced liquidation, with funds returned to customers. For EPF-MIS purchases, the asset manager has direct access to your details. Look up their terms and conditions to see what happens when bad shit happens. In either case, your major concern here is record keeping. If you keep your statements in order, and keep track of all transactions, it will be to your benefit in the event of a messy winding down. |

|

|

|

|

|

lukenn

|

Feb 26 2016, 12:25 AM Feb 26 2016, 12:25 AM

|

|

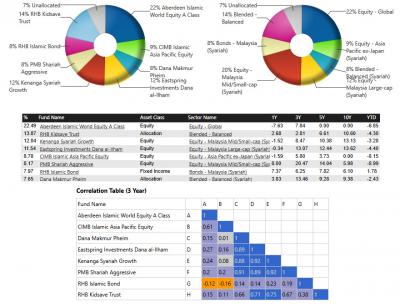

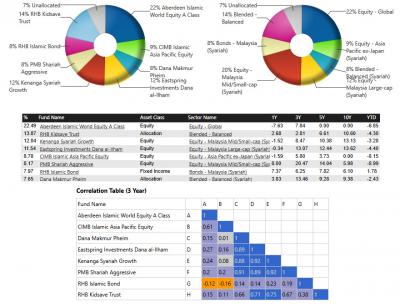

QUOTE(Muhammad Abdul Latif @ Feb 22 2016, 04:17 PM) Hi, I am new at this Forum and also a new investor in FSM. Have been investing for about six months in shariah funds. Here is my portfolio, would appreciate any observation on it to improve. Thanks. Latif QUOTE(T231H @ Feb 22 2016, 05:03 PM)  my uneducated guess,... Malaysia EQ heavy Asia Pac maybe can increase by another 5~10% too much over lapping of funds in Malaysia EQ (this includes those from "Balanced" funds) good diversification of fund houses.. calling lukenn....what say you? Hi guys. Sorry for the late reply. Been busy. Just has a look at the list of funds, no time to do a full analysis. Maybe this weekend. Anyway, I'm thinking : 1. Has been very volatile. 2. Foreign exposure too high. 3. Fixed income too low. 4. Too many funds. 5. Foreign funds are probably highly correlated. 6. Local equity funds are probably highly correlated. |

|

|

|

|

|

lukenn

|

Mar 5 2016, 10:29 AM Mar 5 2016, 10:29 AM

|

|

QUOTE(voyage23 @ Mar 3 2016, 10:43 PM) What do you guys think of Manulife's PROGRESS fund? Not in FSM but when my friend compared it with EI small caps and KGF over 5 years, it is comparable The 3 funds you're looking at are all local, small/mid cap funds. You can probably put in KAF Vision, RHB Smart Treasure into the same list too.  This post has been edited by lukenn: Mar 5 2016, 08:10 PM

This post has been edited by lukenn: Mar 5 2016, 08:10 PM |

|

|

|

|

|

lukenn

|

Mar 5 2016, 08:30 PM Mar 5 2016, 08:30 PM

|

|

QUOTE(Muhammad Abdul Latif @ Feb 22 2016, 04:17 PM) Hi, I am new at this Forum and also a new investor in FSM. Have been investing for about six months in shariah funds. Here is my portfolio, would appreciate any observation on it to improve. Thanks. Latif Tried to get as close as I can to your portfolio. Proxy RHB Dana Hazzem with RHB Kidsave. It used to be RHB Dana Kidsave. Dont have you RHB REgional fund either. A bit too new.

|

|

|

|

|

|

lukenn

|

Mar 6 2016, 12:12 AM Mar 6 2016, 12:12 AM

|

|

QUOTE(voyage23 @ Mar 5 2016, 11:01 PM) Hey thanks! Looks like it's really comparable to EISC and KGF. I am using my EPF to invest in Manulife (either Progress or Flexi funds) as the application is easier as compared to if I were to do it myself from FSM. In my own portfolio in FSM I am holding both EISC and KGF actually. If you're already holding 2 small cap funds in your portfolio, why would you add another ? |

|

|

|

|

|

lukenn

|

Mar 6 2016, 11:03 AM Mar 6 2016, 11:03 AM

|

|

QUOTE(dasecret @ Mar 6 2016, 09:01 AM) So what's the conclusion? Let me try 😅 1. Consolidate the Malaysian equity funds? I'd drop shariah aggressive, too volatile - YES2. Move some to bond funds? - YES3. Put more in Asia pac funds 😈 - NOOOOOOOOOOOoooo..ooo...ooooo...ooooo

|

|

|

|

|

|

lukenn

|

Mar 6 2016, 07:58 PM Mar 6 2016, 07:58 PM

|

|

QUOTE(dasecret @ Mar 6 2016, 05:39 PM) Yes. Biggest risk at the moment would be RHB Asian total return fund cos it's a bond fund. Doesn't follow stock market rally that's happening at the moment For the equity funds, if you entered early this year, maybe not as bad, since you would gain from the market rally But if you bought at the highest point last year .... 😓 RHB ATR       |

|

|

|

|

|

lukenn

|

Mar 7 2016, 10:05 AM Mar 7 2016, 10:05 AM

|

|

QUOTE(dasecret @ Mar 7 2016, 09:57 AM) lukenn Msia slow, don't buy foreign funds.... how ler? Keep all money in MMF?   Time to PANIC Time to PANIC  Sell everything and go on holiday |

|

|

|

|

|

lukenn

|

Mar 7 2016, 10:07 AM Mar 7 2016, 10:07 AM

|

|

QUOTE(iamoracle @ Mar 7 2016, 10:05 AM)  Time to Invest !!! Time to Invest !!!  Cancel holiday and buy high risk, small cap equity funds !! |

|

|

|

|

Jan 28 2016, 11:20 PM

Jan 28 2016, 11:20 PM

Quote

Quote

0.0291sec

0.0291sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled