QUOTE(Kaka23 @ Jan 18 2016, 08:06 AM)

OK, will ask once I had felt fear and anxiety myself, first hand,....ELSE I would not know what he is talking about when he told me .Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Jan 18 2016, 08:38 AM Jan 18 2016, 08:38 AM

Return to original view | Post

#101

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jan 19 2016, 02:14 PM Jan 19 2016, 02:14 PM

Return to original view | Post

#102

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(T231H @ Jan 19 2016, 12:36 PM) it is always good to reflects upon the what we had been given and what we had achieved so far...... even though some peopled achieved more than others maybe after this current storm is over, one can reevaluate his fund selections and switch into those that has the risks and investment objectives that are suitable to one emotions of fear one felt under current situation. FSM did encourage one to reflects upon what one had and the achievement status of what one had periodically...there are many articles on rebalancing, so that one can investing globally with profitability under higher probability. *replace the word "reflection" with "review" if one does not want to feel so spiritually. |

|

|

Jan 20 2016, 07:16 PM Jan 20 2016, 07:16 PM

Return to original view | Post

#103

|

Senior Member

8,188 posts Joined: Apr 2013 |

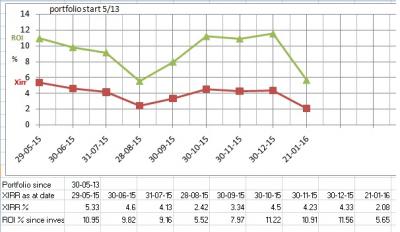

with no end in sight yet......IRR is already < 3%

to be honest...it could have been a lot worst, if not by luck i sold off Hw Jpn Growth and HSAO on 4 Jan and reentered on 18 Jan (combined total is about 20% of portfolio value) This post has been edited by yklooi: Jan 20 2016, 08:25 PM Attached thumbnail(s)

|

|

|

Jan 20 2016, 07:22 PM Jan 20 2016, 07:22 PM

Return to original view | Post

#104

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(brotan @ Jan 20 2016, 06:43 PM) How Does One Predict Equity Market Returns? In this article, we highlight the 3 key components of equity market returns, allowing investors to estimate the potential returns one may expect from an investment in the stock market. Author : iFAST Research Team http://www.fundsupermart.com.my/main/resea...t-Returns--1385 |

|

|

Jan 22 2016, 02:51 PM Jan 22 2016, 02:51 PM

Return to original view | Post

#105

|

Senior Member

8,188 posts Joined: Apr 2013 |

Boring day eh?... for a little bit of "Tahi lembu jantan".

i made 6 out of 10 transaction into these TOP sales fund last week. Titatn and India are in top 5.... China and ponzi 2.0 Attached image(s)  |

|

|

Jan 22 2016, 02:56 PM Jan 22 2016, 02:56 PM

Return to original view | Post

#106

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(brotan @ Jan 22 2016, 01:32 PM) "The cavalry might be coming to the rescue in terms of the central banks starting to sound more dovish," Shane Oliver, head of investment strategy in Sydney at AMP Capital Investors, told Bloomberg TV. "There’s a little bit of light at the end of the tunnel. We’ve probably seen the worst and by the end of the year things will be a lot brighter than they are now." After a rout that has wiped several trillion dollars off global markets so far this year, the prospect that two of the planet's biggest central banks were ready to step in finally gave investors something to cheer about. On Thursday, European Central Bank boss Mario Draghi highlighted concerns about the impact of plunging equity and oil prices on already weak inflation and pledged to reconsider its monetary policy at its March policy meeting. Japan's Nikkei Asian Review reported that the head of the Bank of Japan, Haruhiko Kuroda, is weighing up his own plans to fend off the threat of deflation caused by the oil crisis. The latest developments spread some much-needed confidence around trading floors, sending Tokyo shares surging 3.6% by the break. Hong Kong was 2.5% higher, Shanghai gained 0.7% and Sydney added 1.3%, while there were also gains of more than 1% in Seoul, Taipei, Singapore and Manila. http://www.bangkokpost.com/news/asia/83584...-stimulus-hopes or will the cavalry being ambushed by the Oil cartels and the communists.... This post has been edited by yklooi: Jan 22 2016, 02:59 PM |

|

|

|

|

|

Jan 22 2016, 07:45 PM Jan 22 2016, 07:45 PM

Return to original view | Post

#107

|

Senior Member

8,188 posts Joined: Apr 2013 |

just for the "Fun" of it.....go update your portfolio performance as at 21 Jan ....

I think many would my XIRR is 2.08% on the consolation....it is still higher than my lowest (since data captured) which is xirr 1.85 in 25 Aug 2015 (Global Rout) and xirr 1.99 at 1 Sept This post has been edited by yklooi: Jan 22 2016, 07:53 PM |

|

|

Jan 22 2016, 07:48 PM Jan 22 2016, 07:48 PM

Return to original view | Post

#108

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 22 2016, 08:00 PM Jan 22 2016, 08:00 PM

Return to original view | Post

#109

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 22 2016, 09:15 PM Jan 22 2016, 09:15 PM

Return to original view | Post

#110

|

Senior Member

8,188 posts Joined: Apr 2013 |

I think this is timely and may helps many that are still pondering as to what should they do at this junture.....

What Should You Do If You Invested At The “Top”? Given that a -20% decline is no trivial matter, investors might be seeking ways to reduce overall drawdowns and potentially recover their losses quickly given what has been one of the worst starts to a new year in financial market history. iFAST Research Team ..... January 22, 2016 https://secure.fundsupermart.com/main/artic...-The-Top--11233 |

|

|

Jan 23 2016, 07:00 PM Jan 23 2016, 07:00 PM

Return to original view | Post

#111

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Jan 12 2016, 10:27 PM) QUOTE(Pink Spider @ Jan 12 2016, 11:00 PM) Average IRR during 2015 was 6.7% Average 12-months rolling return during 2015 was 11.4% Peak was 17.9% Trough was 8.5% Now u know how bad the past few days were QUOTE(Pink Spider @ Jan 23 2016, 05:49 PM) but the variance of yr 12 months returns comparing 2015 is I think I will use portfolio data captured as at 21 Jan NAV as a mile stone to see how 2016 faired from it.... (I think 21 Jan NAV will be the lowest this year)(don't ask me why I think so...b'cos I just think so unless the CHINESE devalue its YUAN again later this year which I think they will too. This post has been edited by yklooi: Jan 23 2016, 07:08 PM |

|

|

Jan 24 2016, 12:03 AM Jan 24 2016, 12:03 AM

Return to original view | Post

#112

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(kkk8787 @ Jan 23 2016, 01:50 PM) I've stayed invested in fsm for close to 5 years. But it seems to be giving a lower return than FD so far. Maybe I always buy in at wrong time. My last major buying was during the 0.5% sc discount. Doubled my portfolio, within days everything dropped what is your ratio of FI:EQ? what is your expected ROI pa you seek when you planned your initial portfolio that are suitable to your risks? Don't just focused to much on the returns...have a bit of consideration about the higher risk for higher return..... in short...can you have a peace of mind for a good nite sleep didn't you ask FSM CIS for assistance? or try to consider a locally back tested portfolio by "lukenn" at 10.92% CAGR on last 10 yrs (2004~2014) at 50% FI : 50% EQ page# 37, post# 723 mine at 2.5 yrs at about FD rate...already BEH Tahan liao Attached thumbnail(s)

|

|

|

Jan 24 2016, 12:13 AM Jan 24 2016, 12:13 AM

Return to original view | Post

#113

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jan 24 2016, 12:25 AM Jan 24 2016, 12:25 AM

Return to original view | Post

#114

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(lukenn @ Jan 24 2016, 12:16 AM) ......... Looks like what you'd expect if 1. equal weighted. 2. lump sum investment from day 1. 3. no rebalancing. To me, it looks like 1. overweighted foreign holdings - heavy on APxJ. 2. overdiversifed to too many funds. 3. portfolio unbalanced. 4. FX exposure is a bit too high. 5. selected funds based solely on return/FSM recommendations. If you're underperforming FD, you're doing something wrong. |

|

|

Jan 24 2016, 11:34 PM Jan 24 2016, 11:34 PM

Return to original view | Post

#115

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Vanguard 2015 @ Jan 24 2016, 11:24 PM) ......I see. So if ordinary investors ask the CIS for their advice, would they just say please follow one of the FSM Recommmeded Portfolios, do RSP and have a long term investing horizon of 5 years and above? no-lah.....when they called upon to review,....they will ask some personal info/details and if one is ok with the risks and returns of the current holdings.when one said,..i wanted higher ROI and can stomach the volatility....then they will review . they would then would make some suggestion....to change the holdings it is up to individual to follow thru with it... |

|

|

Jan 24 2016, 11:45 PM Jan 24 2016, 11:45 PM

Return to original view | Post

#116

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(kkk8787 @ Jan 24 2016, 11:27 PM) Value lost that much coz portfolio imbalance haha. Well I think high value are those hitting 7 figure ones. I personally wont put 7 figure into it, real estate maybe I did ask before on funds specifically. They will explain la based on lets say current condition bla bla bla...we think that china will be so and so. However volatility might be seen in short term, we advice customer to stay invested and ride through the volatility. They will give u pros and cons but at the end you still need to make the call to buy or not I think this also applies to paid consultant services too.... |

|

|

Jan 25 2016, 12:17 AM Jan 25 2016, 12:17 AM

Return to original view | Post

#117

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(kkk8787 @ Jan 24 2016, 11:51 PM) ........ If some1 can just take they money and say ok i guarantee yearly divident is 5.5% , I think i also happy d. Guaranteed return wo higher than FD the money he had make by giving you 5.5% pa is just too good..... yes history may not repeat, but a least it is a good guide. I "just think" your 5.5% pa can be "easily" achieved if you just put 50% in FD at 4% and 50% buy into these funds Attached thumbnail(s)

|

|

|

Jan 25 2016, 12:28 AM Jan 25 2016, 12:28 AM

Return to original view | Post

#118

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 25 2016, 10:19 AM Jan 25 2016, 10:19 AM

Return to original view | Post

#119

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(river.sand @ Jan 25 2016, 08:15 AM) I don't monitor my UT investment daily, but I know there are some people here who compute IRR everyday ............. hope my definition of monitoring is of the same page with others. my monitoring is capturing and recording the data. that is it....nothing else.....as to why?...for the fun of it and b'cos I am free. btw,...this routine is not suitable to everyone even though they are as free as me....b'cos sometimes the sights of the captured data is so "not good" and that may lead them to do something that they would not do in normal time. But sometimes I too wished that I had taken action earlier from the sight of the data. This post has been edited by yklooi: Jan 25 2016, 10:43 AM |

|

|

Jan 25 2016, 06:47 PM Jan 25 2016, 06:47 PM

Return to original view | Post

#120

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Jan 25 2016, 06:35 PM) Really? that is GOOD... Oil prices fell 4 percent on Monday as Iraq announced record-high oil production feeding into a heavily oversupplied market, wiping out much of the gain made in one of the biggest-ever daily rallies last week. http://www.thestar.com.my/business/busines...ing-oversupply/ will this 4% dropped be reflected in tomorrow Eq mkts? |

|

Topic ClosedOptions

|

| Change to: |  0.0484sec 0.0484sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 12:16 AM |