QUOTE(Boon3 @ Apr 7 2020, 04:32 PM)

Never did I mention I will touch AirAsia. I have no interest in it. Seriously. What la.

As for AAX, clearly it was a non investable stock from day one. I dare say so when I am a mere trader.

As for a AirAsia.

Quote: Gomen could charge a premium for its guarantee like insurance company. AK is still liable to banks, is not a bailout or free money like to MH.

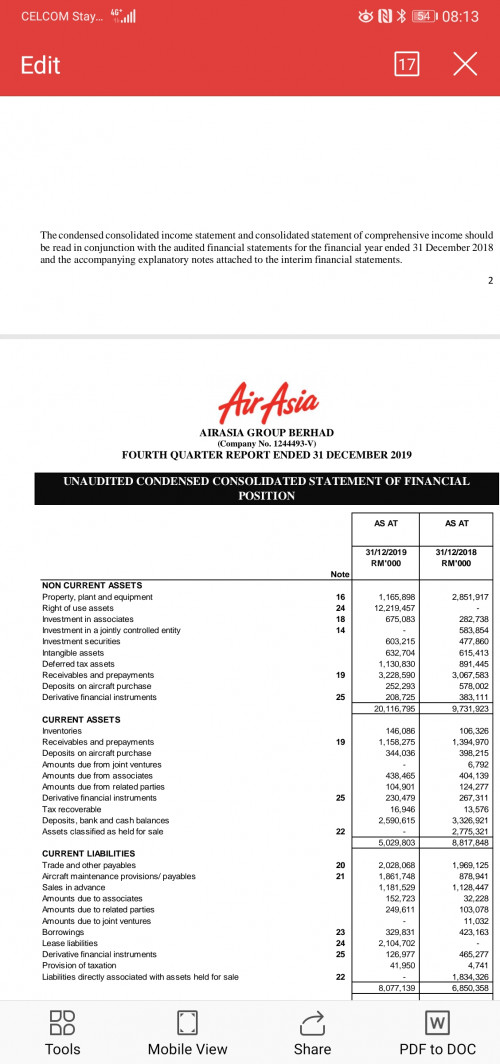

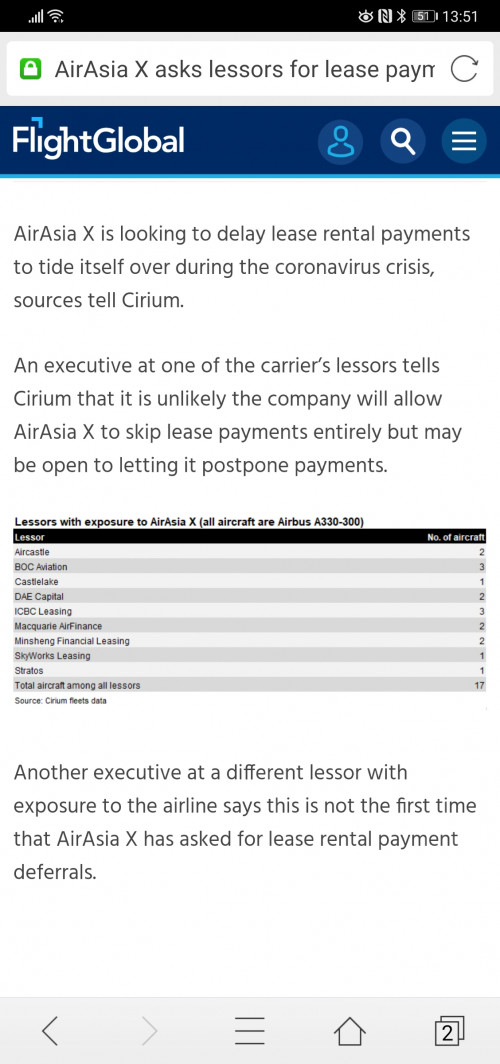

The problem with what you mentioned is that because AA adopted the asset light strategy of sale and leaseback, it doesn't have any feasible asset left (if you followed my arguments earlier). Its planes are sold to the lessors. So how could govt even consider giving such a loan guarantee?

And based on AA track record, it definitely does not deserve any bailout at all! That's my opinion and that's what I am stressing.

Got money from sale and leaseback, 5 billion plus, gave it all back as special dividend (a move which clearly benefited the big 2 shareholder!)

Gomen often issue guarantee for glc (without charging premium), is not unprecedented. AK is a viable business, after economy returned back to normal, it will generate tax, etc for the gomen.

Assets light mean higher return on capital employed, better for shareholders. it is normal for airlines to lease their fleet e.g. MH.

Special dividend was given to all AK shareholders, not limited to 2 shareholders only.

you and i may not like tf, doesn't mean AK is not worth saving.

QUOTE(nexona88 @ Apr 7 2020, 04:33 PM)

lolz..

I don't know want to pity or cry for your noobness...

bib boss @Boon3 knows in & out of AA & its business models..

that's why whenever he post. me look from afar

If he is familiar with airlines business, he should knows iata code.

This post has been edited by icemanfx: Apr 7 2020, 05:27 PM

Mar 20 2020, 04:50 PM

Mar 20 2020, 04:50 PM

Quote

Quote

0.0422sec

0.0422sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled