QUOTE(lola88 @ Jul 20 2024, 01:29 AM)

If I were to sell all the stocks, wouldn’t it incur more loss? For example, if I sell the stocks now, which I bought at a cheaper entry price, wouldn’t I incur more loss if I were to buy them again at a new brokerage account at a higher price?

Thanks!🙏

No haha. Think again.

Suppose you bought 1 unit of stock XYZ at 10 SGD with Moomoo, it rises to 100 SGD. You sell your 1 unit and you

realized a profit of 90 SGD. Once you realize your profit, the money is yours.

Then you buy back again at T+1 or more likely, T+2 depending on how fast your can withdraw cash to your new broker (e.g. FSM SG). In the span of 2 days or so the stock price probably moves around 4-5% under normal market conditions (assume you time it well and avoid volatile periods like quarterly results' announcements etc.). If it goes up 4-5% in the span of 2 days, then you will buy back your stocks at 104 SGD a unit or 105 SGD a unit and thus you fork out an extra 4-5 SGD plus brokerage fee of around 8-9 SGD on top of the 100 SGD cash you cashed out from your previous brokerage account.

What matters here is the

future stock price trajectory. The past profit of 90 SGD which has been realized is now reinvested in the same stock; you could have done it differently, say you use the 100 SGD to buy stock ABC at your new FSM SG account instead if you think stock ABC has better potential compared to stock XYZ

in the future. Or in another scenario, if you do nothing in the first place, your 100 SGD would have stayed in Moomoo and continues to enjoy capital appreciation from stock XYZ. 3 situations are possible, they are all mutually exclusive scenarios, in the absence of new sources of funding.

To sum up:

1. You can't change the past with the present. (Your profits and loses since day 0 of investing in stock XYZ remains there until you realize them).

2. But you can change the future with the present. (Your future profits and loses depends on how you allocate your money today.)

3. You can let the past continues into the future at present by

(i) doing nothing at present (Keep stock XYZ at Moomoo and continue earning your money in Moomoo) or

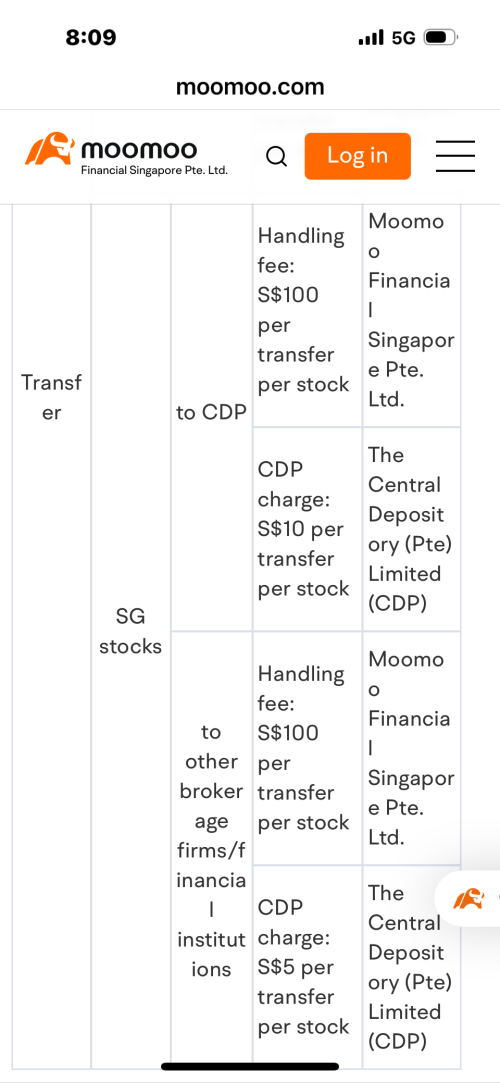

(ii) by shifting the positions between different accounts at present. (Move stock XYZ from Moomoo to FSM SG and continue earning money from stock XYZ but in a different brokerage account, the underlying exposure is still to stock XYZ, but the ownership changes from Moomoo to you, in CDP).

Hope that helps.

Jul 14 2024, 05:41 PM

Jul 14 2024, 05:41 PM

Quote

Quote

0.0230sec

0.0230sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled