Anyone can show me example on how to calculate car loan interest for tax exemption? Car loan can be exempted for self employed right?? please help.

Personal relief Income tax, legally, reduce income tax

Personal relief Income tax, legally, reduce income tax

|

|

Jun 21 2012, 06:27 PM Jun 21 2012, 06:27 PM

|

Newbie

3 posts Joined: Jan 2012 |

Anyone can show me example on how to calculate car loan interest for tax exemption? Car loan can be exempted for self employed right?? please help.

|

|

|

|

|

|

Jun 22 2012, 03:07 AM Jun 22 2012, 03:07 AM

|

Junior Member

4 posts Joined: Jun 2012 |

QUOTE(logicguyz @ Jun 12 2012, 09:07 PM) I have a question for myself. I just got an offer to work oversea. The duration is more than a year. If let say my company pay the oversea tax do i still need to pay msia tax? my salary is in RM by local agency with epf and socso. What i know if i was paid in foreign currency then i dont have to pay msia tax but now is different and with epf some more. Hi, i think you do not need to pay malaysia tax because your source of income is derived from overseas. Having said that, there is also a treshold (how many mths spent in msia/overseas) used by LHDN to determine if you are actually on business trip overseas or really working overseas. If on business trip, that will definitely attract msia tax. Hope this give you some idea. Suggest you visit lhdn website for more info.Thank you for valuable advise. Cheers |

|

|

Jun 22 2012, 11:18 PM Jun 22 2012, 11:18 PM

|

Junior Member

6 posts Joined: May 2012 |

|

|

|

Jun 23 2012, 10:17 PM Jun 23 2012, 10:17 PM

|

Senior Member

1,110 posts Joined: Oct 2008 |

Question: Personal income tax

My tax filing was done online and completed. They notified I still owe them cash because tax I am liable for 2011 is not fully covered by my PCB deductions for 2011. Thus I wired the cash amount via maybank2u. Last week LHDN sent me a check to refund money- this amount is >the cash amount wired. I am afraid that this is a case of "bank error in your favor". Any expert opinion on this? |

|

|

Jun 24 2012, 01:09 AM Jun 24 2012, 01:09 AM

|

All Stars

21,318 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(kaiserwulf @ Jun 23 2012, 10:17 PM) Question: Personal income tax Check your E-Lejar for details....My tax filing was done online and completed. They notified I still owe them cash because tax I am liable for 2011 is not fully covered by my PCB deductions for 2011. Thus I wired the cash amount via maybank2u. Last week LHDN sent me a check to refund money- this amount is >the cash amount wired. I am afraid that this is a case of "bank error in your favor". Any expert opinion on this? |

|

|

Jun 25 2012, 12:45 PM Jun 25 2012, 12:45 PM

|

Senior Member

550 posts Joined: Feb 2010 |

i got a question.

Though Im a sole proprieter and got a fren who helps me with my taxes (Borang B - with business income), I would like to know how to calculate the capital allowance for things I use in my business like airconds, furniture,etc. It'd like to do the calculation on my own if i canwithout having to ask my fren to do it, but i need to understand how to do it first. In my understanding, for example, if a piece of furniture i use in my premise is bought at rm1000 , im entitled for a 20percent initial allowance, right? and that means 1000-200=800. Right? and every year I'm also entitled to 10percent annual allowance. So,if this is my third year of business, the calculation is rm1000 - 200 (initial allowance) - 100 -100 -100= rm 500. correct? I already try to read up stuff on it but would appreciate if someone can tell me what i calculated above is correct. thank u. |

|

|

|

|

|

Aug 30 2012, 12:34 PM Aug 30 2012, 12:34 PM

|

Junior Member

359 posts Joined: Feb 2009 |

QUOTE(Denise_D @ Apr 26 2012, 10:29 PM) Hi all, Does anyone know the answer to this? i've got one question regarding the housing loan interest claim... last year i did my first claim with my wife 5k:5k. so for this year can i claim full amount 10K under myself only? and subsequent 3rd year (final) back to 50:50 ? possible? anyone did before? thanks I filed 50:50 previously but would like to switch to 100:0 for next filing. Thanks in advance. |

|

|

Aug 30 2012, 12:53 PM Aug 30 2012, 12:53 PM

|

Senior Member

3,970 posts Joined: Nov 2007 |

Is PCB calculated based on fixed rate? (example rate for 2011, 10-20k 3%, 5-10k 3%, less than 5k 1% etc). seems like i got charged more than the 1% every month for my PCB. why ya?

|

|

|

Aug 30 2012, 03:08 PM Aug 30 2012, 03:08 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(onlinepaycheck @ Aug 30 2012, 12:34 PM) Does anyone know the answer to this? According to earlier replies, if S&P both names, then 50-50. Unless you have specifically mention in S&P that, e.g. you own 2/3 and wife 1/3. Or other %.I filed 50:50 previously but would like to switch to 100:0 for next filing. Thanks in advance. QUOTE(pisces88 @ Aug 30 2012, 12:53 PM) Is PCB calculated based on fixed rate? (example rate for 2011, 10-20k 3%, 5-10k 3%, less than 5k 1% etc). seems like i got charged more than the 1% every month for my PCB. why ya? It's fixed amount, based on your monthly salary. Similiar like how EPF deduction works.Refer PDF below. [URL=http://www.hasil.gov.my/pdf/pdfam/SCHEDULESTD2010.pdf]JADUAL POTONGAN CUKAI BULANAN SCHEDULE OF MONTHLY TAX DEDUCTIONS[/URL] |

|

|

Aug 30 2012, 11:20 PM Aug 30 2012, 11:20 PM

|

Senior Member

3,970 posts Joined: Nov 2007 |

QUOTE(cute_boboi @ Aug 30 2012, 03:08 PM) According to earlier replies, if S&P both names, then 50-50. Unless you have specifically mention in S&P that, e.g. you own 2/3 and wife 1/3. Or other %. thanks alot!It's fixed amount, based on your monthly salary. Similiar like how EPF deduction works. Refer PDF below. JADUAL POTONGAN CUKAI BULANAN SCHEDULE OF MONTHLY TAX DEDUCTIONS so when next year file for income tax i can submit and request refund if got extra? or they will auto do it? |

|

|

Aug 31 2012, 10:03 PM Aug 31 2012, 10:03 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(pisces88 @ Aug 30 2012, 11:20 PM) thanks alot! Next year you need to fill up assessment for year 2012, do all the calculations, and submit. Then wait LHDN confirm, and will bank-in or send you the cheque. so when next year file for income tax i can submit and request refund if got extra? or they will auto do it? On your side, make sure all declarations are correct and no evade, under declare, etc. anything illegal. If get caught and audit, kantoi ... |

|

|

Sep 1 2012, 03:59 PM Sep 1 2012, 03:59 PM

|

Newbie

3 posts Joined: May 2008 |

I am a estate agent. Recently I just sold a RM 20 mil property.

The commission I'll get direct from the property owner is about RM800k. What can I do with the future tax planning. or is there any way to reduce the taxes? Please advise ,thanks. |

|

|

Sep 28 2012, 11:01 PM Sep 28 2012, 11:01 PM

|

All Stars

21,318 posts Joined: Jan 2003 From: Kuala Lumpur |

Latest from Budget 2013

■ Child tax relief be increased from RM4,000 to RM6,000 per child for children aged 18 and above and receiving receiving full-time tertiary education. ■ The current relief of RM3,000 for savings in the National Education Savings Scheme (SSPN) will be increased to RM6,000. This post has been edited by ronnie: Sep 28 2012, 11:16 PM |

|

|

|

|

|

Feb 4 2013, 01:48 AM Feb 4 2013, 01:48 AM

|

Junior Member

25 posts Joined: Dec 2008 From: Pls read all terms & and conditions b4 purchase*Tq |

useful thread. will have a proper look when i free =)

|

|

|

Feb 4 2013, 09:52 AM Feb 4 2013, 09:52 AM

|

Junior Member

147 posts Joined: Oct 2012 From: KL/Klang Valley |

QUOTE(pretty~ @ Feb 4 2013, 01:48 AM) For BE, an insurance plan can reliex tax up to RM12,000. If your tax bracket is let say 20%, you can save up to RM2400 per annum. If you still have 30 years left to work before you retire, the amount that you would have saved is a whopping 30 x RM2400 = RM72,000. PM me for details. |

|

|

Feb 4 2013, 10:44 AM Feb 4 2013, 10:44 AM

|

Junior Member

25 posts Joined: Dec 2008 From: Pls read all terms & and conditions b4 purchase*Tq |

sorry ya, what is BE? @.@

|

|

|

Feb 4 2013, 10:45 AM Feb 4 2013, 10:45 AM

|

Senior Member

867 posts Joined: Apr 2010 From: Buddha Hand |

remove

This post has been edited by BlackPen: Feb 4 2013, 10:49 AM |

|

|

Feb 4 2013, 10:46 AM Feb 4 2013, 10:46 AM

|

Senior Member

867 posts Joined: Apr 2010 From: Buddha Hand |

|

|

|

Feb 4 2013, 06:07 PM Feb 4 2013, 06:07 PM

|

Junior Member

25 posts Joined: Dec 2008 From: Pls read all terms & and conditions b4 purchase*Tq |

|

|

|

Mar 4 2013, 11:27 AM Mar 4 2013, 11:27 AM

|

Junior Member

147 posts Joined: Oct 2012 From: KL/Klang Valley |

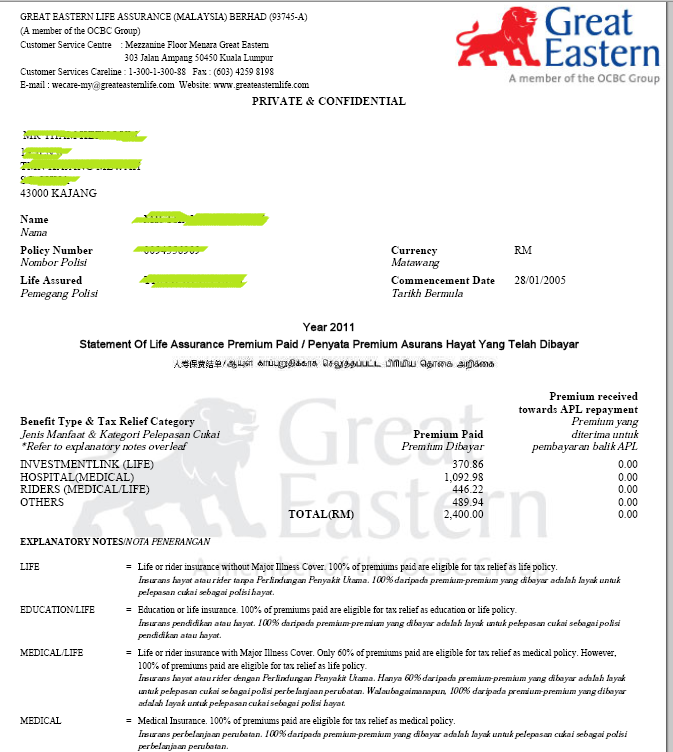

QUOTE(pretty~ @ Feb 4 2013, 06:07 PM) emm... so pm u for...? I mean if you are not sure of how much you can relief your tax from your existing insurance plan then you can ask me. sorry ya, not so proffesional in this field. tq i m going to find accountant and start to pay this yr For example, you can get a tax relief statement from your insurance company to see how much tax you can relief.  |

| Change to: |  0.0567sec 0.0567sec

1.04 1.04

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 06:15 AM |