Outline ·

[ Standard ] ·

Linear+

USD/MYR drop, V2

|

MGM

|

Sep 25 2015, 07:55 AM Sep 25 2015, 07:55 AM

|

|

QUOTE(dreamer101 @ Sep 25 2015, 07:44 AM) MGM, Malaysia had Extra Oil Money in 1997/1998. Now, Petronas has cash flow problem and need to use its own cash reserve. Enjoy the show!!! It will not be like any crashes that Malaysia had before. Dreamer May be it is time to call all GLC n Malaysian abroad to do a National Service and to sell their foreign assets n repatriate back to Malaysia (~rm1 trillion).  |

|

|

|

|

|

MGM

|

Sep 28 2015, 02:48 PM Sep 28 2015, 02:48 PM

|

|

QUOTE(AVFAN @ Sep 27 2015, 07:50 PM) just curious... .. the fsm guy - did he describe what it will take to get back to 3.80? .. anyone speculated it might even go to 6.0 and under what conditions? Don't think so, what I gathered from the talk it is better to invest in battered assets than toppish one like US. Recommended markets China, EM, BRIC & Japan but not Euro & US. |

|

|

|

|

|

MGM

|

Sep 29 2015, 02:04 PM Sep 29 2015, 02:04 PM

|

|

QUOTE(topearn @ Sep 29 2015, 01:58 PM) What about RMB ? Shd be as good as SGD, rite ? Better. |

|

|

|

|

|

MGM

|

Sep 30 2015, 05:56 PM Sep 30 2015, 05:56 PM

|

|

It boils down to a little bit of luck. Cos there are also things that we can't control. What if war break out in ME, and world oil output is cut into half, just if?

|

|

|

|

|

|

MGM

|

Oct 1 2015, 07:04 PM Oct 1 2015, 07:04 PM

|

|

wa, so negative, I want to get out.  The budget shortfall may be "in the region" of 1% of gross domestic product at the end of the decade compared with a current deficit of 3.2%, the New Straits Times reported, citing Najib’s comments to fund managers and investors in New York. - See more at: http://www.themalaysianinsider.com/malaysi...h.BtJ4wTvd.dpufThis post has been edited by MGM: Oct 1 2015, 07:07 PM |

|

|

|

|

|

MGM

|

Oct 3 2015, 08:34 AM Oct 3 2015, 08:34 AM

|

|

QUOTE(Pink Spider @ Oct 3 2015, 05:51 AM) negative returns? LOL! my EXPENSIVE local mutual funds (but investing offshore) plus my KLSE stocks have been giving me 14% returns over past 12 months now I know dreamer is truly dreaming!!  I think his investm is 100% in USD , so in MYR terms maybe +30%.  This post has been edited by MGM: Oct 3 2015, 08:41 AM This post has been edited by MGM: Oct 3 2015, 08:41 AM |

|

|

|

|

|

MGM

|

Oct 3 2015, 08:42 AM Oct 3 2015, 08:42 AM

|

|

QUOTE(Ramjade @ Oct 3 2015, 08:36 AM) That one cannot believe.  THey said RM won't go past 3.8 last time. Sadly my parents still believe in them.  Maybe they believe Newton's Law. |

|

|

|

|

|

MGM

|

Oct 3 2015, 09:54 AM Oct 3 2015, 09:54 AM

|

|

Tak boleh tahan lah, why dreamer so slow reply one.

|

|

|

|

|

|

MGM

|

Oct 5 2015, 09:48 AM Oct 5 2015, 09:48 AM

|

|

QUOTE(Hansel @ Oct 5 2015, 09:41 AM) Well,... MR Dreamer,... if the USD does weaken against our RM, it will giveme an opportunity window to convert more of my RM into the USD.I still have RM sitting in Msia, waiting to go out. And if the USD strengthens against all currencies, then I might convert some USDs into the SGDs to prepare to go into the REITs and dividend stocks. Either way, I'll have something to do. How low are u going to lower your MYR assets weightage? Or like dreamer, almost zero? |

|

|

|

|

|

MGM

|

Oct 5 2015, 10:36 AM Oct 5 2015, 10:36 AM

|

|

QUOTE(Hansel @ Oct 5 2015, 10:22 AM) Till now, the STI is green. But the SGD is weakening against the USD, in spite of the Dollar Index dropping now. Sentiment in Sgo is not good, gents,... But I'm not converting my USD back into the SGD yet,... more to drop fro the SGD. This guy is saying otherwise: http://www.internationalman.com/articles/h...financial-order |

|

|

|

|

|

MGM

|

Oct 5 2015, 11:48 AM Oct 5 2015, 11:48 AM

|

|

QUOTE(AVFAN @ Oct 5 2015, 11:08 AM) yep, the last i read, markets now price in 43% rate hike only in march 2016 and 100% in dec 2016. so, it's equities party time - at least for a while until new indications emerge. and yes, i am not timing but been adding bits of sg reits - to me, this one is the best bet among all options available - us etf's, sg stocks, bursa stocks, dci, unit trusts, gold, fx cash, etc...  Will the downturn for Spore properties affects SG-reits? |

|

|

|

|

|

MGM

|

Oct 6 2015, 03:27 PM Oct 6 2015, 03:27 PM

|

|

QUOTE(prody @ Oct 6 2015, 01:23 PM) But a Honda Accord price has gone up only 30% since 20 years ago. |

|

|

|

|

|

MGM

|

Oct 6 2015, 04:20 PM Oct 6 2015, 04:20 PM

|

|

QUOTE(prody @ Oct 6 2015, 03:39 PM) If the Ringgit stays this weak that number is about to change dramatically. In 1995 USD/MYR was 2.6., so price of Accord has actually come down if in USD, ie from usd48000 to usd35000. |

|

|

|

|

|

MGM

|

Oct 6 2015, 04:26 PM Oct 6 2015, 04:26 PM

|

|

QUOTE(prody @ Oct 6 2015, 04:23 PM) Too bad we don't pay in US$ here. Or even better if we could pay similar prices as in the US.    |

|

|

|

|

|

MGM

|

Oct 7 2015, 02:04 PM Oct 7 2015, 02:04 PM

|

|

Wonder this reversal is cos by TPPA or Templeton's statement or something else? http://www.bloomberg.com/news/articles/201...n-the-spotlighthttp://www.bloomberg.com/news/articles/201...ket-opportunityThis post has been edited by MGM: Oct 7 2015, 02:05 PM |

|

|

|

|

|

MGM

|

Oct 7 2015, 04:38 PM Oct 7 2015, 04:38 PM

|

|

QUOTE(Hansel @ Oct 7 2015, 04:09 PM) NO man,... can never catch the bottom. Convert over slowly. But if you must know when to catch NEAR THE BOTTOM, do this :- a) for the USD : wait for the mtg between RUssia and S.Arabia,... if the talks break down, then it's near. Or - some big guy at the FOMC says that the rate hike is still on-track this year, then it's near. b) for the SGD : observe the MAS announcement next Wednesday morning. Now's the time,....    SURE ANGPOW STYLE SURE ANGPOW STYLE  Edited : grammar errors. Russia and Saudi have common enemy in IS.  |

|

|

|

|

|

MGM

|

Oct 8 2015, 02:45 AM Oct 8 2015, 02:45 AM

|

|

QUOTE(Showtime747 @ Oct 7 2015, 11:39 PM) Is the following rumour sounds legit ? Insiders with information rushing to convert their forex back to RM knowing the above news would be explosive ?    If this factor is taken off, MYR should be at par with Thai Baht ie MYR/Baht=10 or USD/MYR=3.60.  Also hope that a unity govt will take over and all citizens will work to strengthen the economy. http://www.thestar.com.my/Business/Busines...oint/?style=bizTens of billions of USD going to convert back to MYR? This post has been edited by MGM: Oct 8 2015, 03:02 AM |

|

|

|

|

|

MGM

|

Oct 8 2015, 07:02 AM Oct 8 2015, 07:02 AM

|

|

This is one good piece of news for those SMEs which have credit purchases in USD without hedging. This will reverse the exch rate loss they have been suffering esp the last few months.

|

|

|

|

|

|

MGM

|

Oct 8 2015, 08:00 AM Oct 8 2015, 08:00 AM

|

|

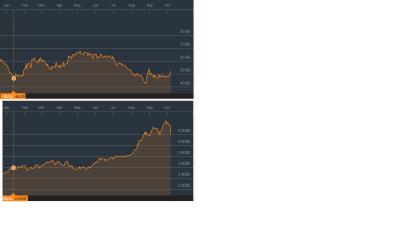

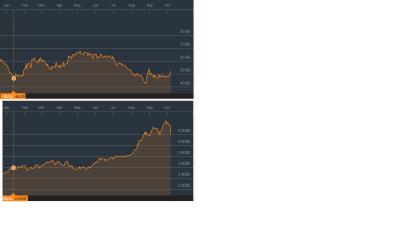

Don't see much co-relation btw Oil n USD/MYR. Most likely cos of the 2.6b issue. This post has been edited by MGM: Oct 8 2015, 08:02 AM Attached thumbnail(s)

|

|

|

|

|

Sep 25 2015, 07:55 AM

Sep 25 2015, 07:55 AM

Quote

Quote

0.0546sec

0.0546sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled