-Information displayed might be obsoleted by the time you reading here. Hence, please keep yourself updated from time till time.

-I'm not any Public Mutual funds agent at all. Nor I got any employment relationship to Public Bank(and any banks globally). Some members who reading this thread might got an WRONG impression that I'm promoting Public Mutual funds. As a matter of fact, I'm an investor out of millions in the market. I responsible for what i saying here. Notwithstanding the aforesaid, I'm not guarantee myself to anyone here that, one day I could not be a Public Mutual fund agent in the future. Personally I invested quite a lot of funds. Since Public Mutual fund quite reliable, may be there is why me or anyone keep mentioning that. The fact is simple as that. Believe or not, is up to individuals here.

Guess, I would need to spend much time in this section. I do play some investment. Problem is I doing that by agent. Thus, still many stuffs I'm unaware of. Just listening to the agent/unit trust. Recently I got some $ invested in Public Savings Fund. Was quite a big amount. Therefore,... what is this actually. I'm still quite blur. However yesterday I receive a RM 180 cheque already. Is this fund good?

I was told by the agent. It's 40% for saving. 60% for investment only. I was given two choice that time. One is Public Savings Fund, the other is Public Islamic Dividend Fund. He said that Islamic Dividend Fund is much more safer than Saving. As the value only at 0.2585(buy) 0.2752(sell). While Public Savings Fund is 0.6715(sell) and 0.7151(buy). I invested at about 0.68(if not mistaken)

Anyone got funds investment?! Please share your opinions...

Tomorrow would get back here again. Thanks for viewing.

edited:

Layman's notes:

I like to make my own notes while reading. In this way, it's more efficient than just reading it. Of course, I'm just a beginner.

-The 3.75% charges make me hold the bond as long as possible. Thus, once and before any fund or bond to buy. Think carefully first. Once invest, then must wait for a long time for it to recover.

-Investment is better than fixed term deposits because of the factor of inflation. Nonetheless, as we knew, investments itself got Market risks, Particular Stock Risk, Liquidity Risk, Interest Rate Risk, credit Risk, Manager's risk, Loan financing risk, Risk of non-Compliance, Risk of Non-Compliance with Syariah Requirements, Currency risk and country risk.

-Some people who working might need to buy a car, or a house. Everyone needs that. But these stuffs not cheap. That is why Fund and bond exist for people to plan saving in a period of time, say 3 or 5 years with HIGH interest rate yet lower risked. In a way, it indeed much better than the ordinary Fixed term deposit in our bank. Bond, Fund investment method could be 2 types, one can invest in one big amount and wait for 3 or 5 years to get high interest(this normally are just extra money). Another one is by investing monthly, it's actually a type of saving. For us to fulfill our dream.

-For the first time I heard that mutual fund/unit trust is more risk than market shares. If and when anyone listen or read this stuff. Be more careful to those people who said above. Perhaps they never buy any shares and do funding yet.

-Experiences hunt,... please refer to

Post# 65 by vincecyc

Post# 107 by stmu

Most posts by khoong25

Post# 705, 712, 713, 721 by rexis

Post# 962 by low yat 82

Post# 963 by Geminist

-Some words to keep in mind when me playing with fire(shares? Fund? Forex?)

*Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. If there is no such amount, don't play. by Ed Seykota

-Basically, when you investing in Funds or so called Mutual Funds. The first day launching is the best day for hunting. As normally there will be 1% of free bonus units to be offered or some sort of other offers. Thus, please pay attention to the newspaper. or talk to your bank friends closely. It's where and how to put you at a more beneficial stage. Early birds always got something to eat.

-

QUOTE(cherroy @ Aug 22 2006, 11:18 PM)

I think a lot of people don't realise the UT distribution can be taken as cash rather reinvest. Although reinvesting is not that bad, but everytime you reinvest you lose 5% from it. When you buy UT, you must fill in and instruct them to get the distribution as cash or else they will automatically reinvest for you.

Personally think that taking cash is much better than reinvest.

Personally think that taking cash is much better than reinvest.

edifgrto: "I just make phone call to the Fund agent, being told that, as for the charging is only one time for purchasing only. While reinvesting, there is no charges at all. I'm a bit puzzled on this, what to do now is, to wait for the Fund Statement arrived. Currently I do got one fund having this case..."

-Indeed, why me so interested in these Mutual fund also known as Unit Trust(You might ask this?). Because share market is for someone much more clever than me. I made a huge lost that enough to be a lesson for me to stick with what suitable for myself(Simple as that). Just let those soldiers go to the battle field. Me more interested in lower risk, lower profits only... if any...

-Reading people make money from Share market is so easy, but people playing share market seems no one never make any lost before. My first investment made my RM 16,000.00 went down to drain. Nothing gain back,... not even one cent!

-For general information of market, economic of Malaysia

http://www.pwc.com/pdf/my/eng/publications/mamy.pdf

http://siteresources.worldbank.org/INTEAPH...sia-March06.pdf

Post #1175 by whtrader in Investment thread regarding Forex scams

-Some related websites that I might need to dig out information. Indeed, somehow... case like we went KFC for fried Chicken but we seldom(or never) visited KFC website perhaps. Therefore, same case here. Does not mean I always do reading from the sites. Then, I(or anyone) would surely make money. Just for reference, perhaps...(more to be added...) Some mutual agents inside the spoiler. Since it keeps growing. I decided to put them in Spoiler, for better viewing.

» Click to show Spoiler - click again to hide... «

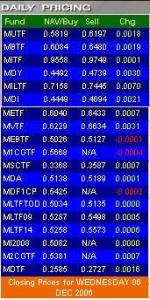

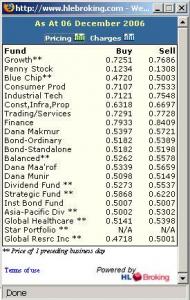

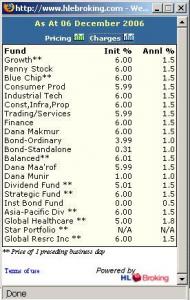

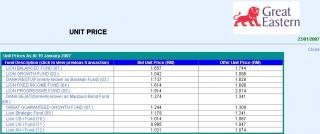

-Added some Fund Pricing attachments, collected from bank websites for pricing references. I'm not so sure if this fine?! If it's not permitted, I would take it out. Please let me know if it's not appropriate.

-dreamer101: What people did not tell you is in stock trading, if you do not do margin and stock option, you only lose the money that you invested in. In Forex, because of leverage and you must do levarage to make real money in forex, you can lose up to 20 times the money you put in.

Post# 1227 in Investment thread.

-louislim2: before you invest,make sure you can save your money like coins,that is the hardest part,and the most important part!!do you believe i can buy a motor cycle by cash just only i save my coins??i save until full of a big long bottle.when i count is around 6000.omg...i save for 4years,everyday throw in all my coins that if have.that it,this is the started point.you want to invest,just invest your attitude!!

Post# 1340 in Investment thread.

-luqmanz: It depends on how much return you expect to get. If your are hoping to get 25-30% ... that's almost impossible. ...

A good performing mutual fund can give return up to 15-18%.

Post# 1419 in Investment thread.

-pidah: when the Composite Index going higher, the Fund Manager will switch the Equity fund to Bond fund/Money Market Fund (Fixed Deposit) where as here you will gain more RM. But when the KLCI going down, the FM will switch back the fund frm Bond Fund to Equity Fund. (here u gain more units). As i mention before, source of U.Trust - Rise of Unit Price (Capital appreciation).

Post# 1432 in Investment thread.

edifgrto: I think I seriously would have to call my agent to ask about this switching stuff.

-pidah: and also you must remember that there are 3 type of source of return from UT which are:

1. The rise in unit price (We call it capital appreciation)

2. The annual dividend/distribution/bonus declared

3. The unit split declared.

Post# 1423 in Investment thread.

-Post# 1457 by Drian was something about Fund. However, he has not read pidah's post in 1423(which was in his previous page). Hence, his calculation becoming not accurate. To thoroughly get the calculation... you just need to throw RM 1000(probably) since the first year. Then, you would know how much income generated over the period. Drian did his work without invested real money in. And the most important thing is, not all funds are good. As luqmanz stated, not all funds are bad either. Else, there is no risk. Money would just fall from the sky. And, I won't create this thread here.

-To check the latest fund prices. It's to go to the each fund manager website to check. Alternatively, we can use The Star or OSK188. Which they allowing the public to check freely. Though me got the account with OSK188. But it's quite convenient for me to know the price without logging in. The advantages of OSK188, perhaps it allowing me to put all my invested funds in my favorite. Please note the price dated.

-For whom might interested in funding, getting high profit yield like 25% per month is impossible. However, by picking the right ones, the ranges for return on investment(ROI) for 4 weeks(1 month) are,

For selected best equity funds, higher risk

ROI, 1.13% to 3.29%

For selected best Mixed Asset funds, moderated risk

ROI, 0.55% to 3.88%

For selected best bond funds, lower risk

ROI, 1.31% to 3.50%

-Thanks to Oriental Daily News that giving me this set of information of Capital Guaranteed Funds performance as at year 2006. I have attached it for members that might interested in full capital protection fund type. Please pay attention to their average yield in 1 year. At least 6.27% annually is higher than our saving in banks.

-27th Feb 2007 is an interesting day. As when the CI dropped over 50pts what gonna happen to the funds I invested?! I better note this down for my reference here.

-to be continued later,...

Source: Note ideas from prospectus, and also some of my own opinions.

Some off-topic stuff in the SPOILER

» Click to show Spoiler - click again to hide... «

This post has been edited by edifgrto: Apr 29 2007, 08:36 PM

Attached thumbnail(s)

Nov 15 2006, 09:39 PM, updated 19y ago

Nov 15 2006, 09:39 PM, updated 19y ago

Quote

Quote 0.0228sec

0.0228sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled