QUOTE(kart @ Mar 27 2018, 10:48 PM)

Is there a minimum amount of tax refund that will be credited by Inland Revenue Board Of Malaysia, into the saving account of the taxpayer?

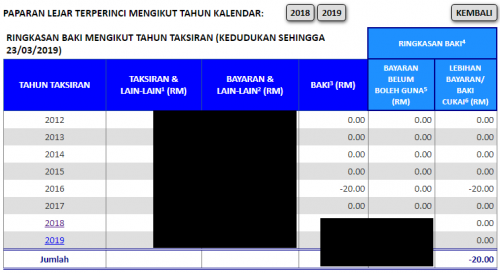

Assume that after I completed e-Filing, the system determines that I only have RM 5.00 of income tax paid in excess (lebihan bayaran tahun taksiran). Would Inland Revenue Board credit RM 5.00 into my saving account this year, or let RM 5.00 be combined with income tax paid in excess next year?

Thank you for your advice.

5. Bayaran Balik Yang Kurang Daripada RM100.00 Bagi Syarikat AtauAssume that after I completed e-Filing, the system determines that I only have RM 5.00 of income tax paid in excess (lebihan bayaran tahun taksiran). Would Inland Revenue Board credit RM 5.00 into my saving account this year, or let RM 5.00 be combined with income tax paid in excess next year?

Thank you for your advice.

RM50.00 Bagi lndividu

(a) LHDNM akan memberitahu pembayar cukai melalui surat

pemberitahuan jika jumlah bayaran balik adalah kurang daripada

RIV]100.00 bagi syarikat atau kurang daripada RM50.00 bagi individu.

(b) Sekiranya tiada permohonan dibuat oleh pembayar cukai, amaun kredit

di dalam lejer pembayar cukai akan dihantar ke tahun berikutnya.

© Jika pembayar cukai memohon untuk mendapatkan bayaran balik,

permohonan tersebut mestilah dibuat dalam tempoh yang dinyatakan

dalam surat pemberitahuan.

(d) Pembayar cukai layak mendapat pampasan jika bayaran balik dibuat

di luar tempoh masa yang diperuntukkan di bawah Seksyen 111D ACP

1967 .

This post has been edited by ClarenceT: Mar 28 2018, 11:54 AM

Mar 28 2018, 11:54 AM

Mar 28 2018, 11:54 AM

Quote

Quote

0.1957sec

0.1957sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled