LHDN still cannot pay via credit card?

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Dec 31 2022, 03:27 PM Dec 31 2022, 03:27 PM

Return to original view | Post

#81

|

Senior Member

6,429 posts Joined: Jun 2005 |

LHDN still cannot pay via credit card?

|

|

|

|

|

|

Apr 2 2023, 08:47 PM Apr 2 2023, 08:47 PM

Return to original view | IPv6 | Post

#82

|

Senior Member

6,429 posts Joined: Jun 2005 |

|

|

|

Jul 10 2023, 06:53 PM Jul 10 2023, 06:53 PM

Return to original view | IPv6 | Post

#83

|

Senior Member

6,429 posts Joined: Jun 2005 |

I just notice my YA2021 lebihan bayar (about RM130) has not refund to me.. this year I’ve payable amount of RM120, do I still need to pay or I can offset from the lebihan bayar that they have not refund to me?

|

|

|

Jul 10 2023, 07:33 PM Jul 10 2023, 07:33 PM

Return to original view | IPv6 | Post

#84

|

Senior Member

6,429 posts Joined: Jun 2005 |

|

|

|

Jul 10 2023, 07:37 PM Jul 10 2023, 07:37 PM

Return to original view | IPv6 | Post

#85

|

Senior Member

6,429 posts Joined: Jun 2005 |

|

|

|

Jul 12 2023, 11:16 AM Jul 12 2023, 11:16 AM

Return to original view | Post

#86

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(ClarenceT @ Jul 11 2023, 12:52 PM) You may call it tax surcharge, admin fee, processing fee etc. our gov is LPPL, additional charges by merchant is not allow for credit card usage, but, if done by gov, it is allow... There will be a surcharge if use E-wallet to pay LHDN in the future. --- The public will now be able to use e-wallets to pay for the services offered by federal ministries and their departments. Revealed in a Treasury circular dated 21 January 2022, the notice stated that e-wallet payments will be accepted for both over-the-counter and online transactions (via mobile app or website) at all federal ministries and departments. Additionally, the government will be required to bear the service charges, except for transactions carried out with the Inland Revenue Board (LHDN) and the Customs, as well as non-revenue receipts such as loan repayments. The service charges for these exceptions will be charged to the payer instead. |

|

|

|

|

|

Jul 12 2023, 11:19 AM Jul 12 2023, 11:19 AM

Return to original view | Post

#87

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(mamamia @ Jul 10 2023, 06:53 PM) I just notice my YA2021 lebihan bayar (about RM130) has not refund to me.. this year I’ve payable amount of RM120, do I still need to pay or I can offset from the lebihan bayar that they have not refund to me? BTW, anyone has experience on this? Do i still need to pay 2022 tax despite i've credit from YA2021 that still not refunded to me? |

|

|

Jul 12 2023, 03:56 PM Jul 12 2023, 03:56 PM

Return to original view | Post

#88

|

Senior Member

6,429 posts Joined: Jun 2005 |

|

|

|

Feb 26 2025, 11:55 AM Feb 26 2025, 11:55 AM

Return to original view | Post

#89

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(BboyDora @ Feb 26 2025, 09:37 AM) hi all, i wanna ask about CP500. pay early no issue, as long as u select the right year.i saw the date wrongly and make early payment. the "tarikh kena bayar"is 1st March 2025 (Ansuran 1) . I had paid on 1st Feb 2025. so, should I pay again for the (Ansuran 1)? then it will lebihan bayaran already. or I pay for the next one (Ansuran 2)? will I get the penalty? I tried to call LHDN , all call no pick up. Live chat all bot. |

|

|

Feb 26 2025, 01:02 PM Feb 26 2025, 01:02 PM

Return to original view | Post

#90

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(BboyDora @ Feb 26 2025, 12:15 PM) no year selected as I pay base on "Nombor bil" ya, no issue.. no worry.. as long as not late payment, LHDN will is more than happy to receive money in advance.so, Nombor bil is xxxxx, Ansuran 1 (Tarikh Kena bayar 1st March 2025). but I pay the amount according to nombor bil xxxx on 1st Feb. I read back the notice, I think ok gua as long as I pay the nombor bilangan. because it say "kenaikan cukai 10% akan dikenakan ke atas ansuran yang tidak dibayar. " I think as long as I pay, suppose no issue. apek ady tua need to decipher these kind of things thank you so much!!!!! |

|

|

Mar 5 2025, 03:27 PM Mar 5 2025, 03:27 PM

Return to original view | Post

#91

|

Senior Member

6,429 posts Joined: Jun 2005 |

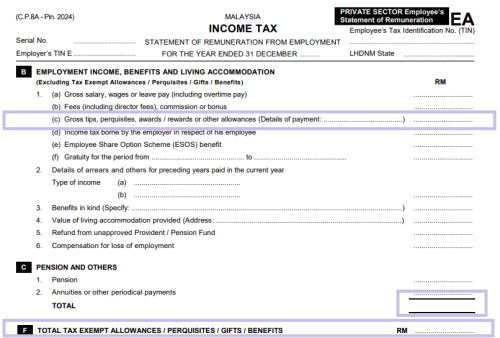

Hi All, can anyone help me to understand on the tax exemption income for Long Service award:

long service award (provided that the employee has exercised an employment for more than 10 years with the same employer). i've 10 years long service award in July 2024, so, am I consider working more than 10 years and entitled for tax exemption of up to RM2000 for YA2024 as by end of Dec 2024, I've worked 10 years + 5 months.. |

|

|

Mar 6 2025, 11:27 AM Mar 6 2025, 11:27 AM

Return to original view | Post

#92

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(1mr3tard3d @ Mar 6 2025, 12:30 AM) should be entitled to but which section in EA was the long service award?  if not section F, then u r in the same shoes as above |

|

|

Apr 23 2025, 04:35 PM Apr 23 2025, 04:35 PM

Return to original view | Post

#93

|

Senior Member

6,429 posts Joined: Jun 2005 |

this year e-filling for BE form is due on 30 April? no extension?

|

|

|

Jul 5 2025, 01:39 PM Jul 5 2025, 01:39 PM

Return to original view | IPv6 | Post

#94

|

Senior Member

6,429 posts Joined: Jun 2005 |

|

| Change to: |  0.1981sec 0.1981sec

0.80 0.80

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 09:29 PM |