QUOTE(Barricade @ Mar 14 2022, 03:50 PM)

5-10 minutes before this was ok, yes it is having errorThis post has been edited by leanman: Mar 14 2022, 04:09 PM

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 14 2022, 04:09 PM Mar 14 2022, 04:09 PM

Return to original view | Post

#21

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

|

|

|

Mar 25 2022, 08:31 PM Mar 25 2022, 08:31 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

Apr 7 2022, 10:29 PM Apr 7 2022, 10:29 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

2,253 posts Joined: Aug 2005 |

Submitted 14 Mar, got my refund today. Last check eLejer yesterday no update but refunded today.

|

|

|

Apr 12 2022, 05:27 PM Apr 12 2022, 05:27 PM

Return to original view | Post

#24

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(adele123 @ Apr 12 2022, 12:32 PM) Btw, anyone done pindaan to be form after receiving refund? Like forgotten book receipt, trying to increase relief I found a receipt of testkit i bought in 2021. https://www.hasil.gov.my/individu/lain-lain...nan-pindaan-be/ Based on this macam boleh QUOTE(celciuz @ Apr 12 2022, 12:38 PM) Last year I made similar mistakes with the books, did the pindaan but never gotten the money. Oh well. I made pindaan on YA2020 till today nothing yet, and it was quite a substantial amount for me, about 1k+ to be refunded back. Planning to make appointment to see them earlier but was thinking to get back my refund 1st for YA2021. Got my refund last week and will make appt to see them on the refund due from last year's pindaan |

|

|

Apr 15 2022, 03:31 PM Apr 15 2022, 03:31 PM

Return to original view | Post

#25

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(adele123 @ Apr 12 2022, 12:32 PM) Btw, anyone done pindaan to be form after receiving refund? Like forgotten book receipt, trying to increase relief I found a receipt of testkit i bought in 2021. https://www.hasil.gov.my/individu/lain-lain...nan-pindaan-be/ Based on this macam boleh QUOTE(celciuz @ Apr 12 2022, 12:38 PM) Last year I made similar mistakes with the books, did the pindaan but never gotten the money. Oh well. QUOTE(leanman @ Apr 12 2022, 05:27 PM) I made pindaan on YA2020 till today nothing yet, and it was quite a substantial amount for me, about 1k+ to be refunded back. Planning to make appointment to see them earlier but was thinking to get back my refund 1st for YA2021. Got my refund last week and will make appt to see them on the refund due from last year's pindaan I made an appointment and went to see an officer yesterday. I made a pindaan in April last year after filing my BE for YA2020. Company issued a wrong EA, forgot about the RM6 BIK. Therefore, file in pindaan for it. Until yesterday no news on the JR. You know what the officer said?Income tax was waiting for me to submit documentation for the pindaan made. Without any doc, they would not proceed or assess or take action. I was telling him then, that was because it will lead to JR, that's why they don't bother, if that leads to a JA, I think immediately they will take action. That officer also laughing out loud. Let's see now how long would it take to refund me. This post has been edited by leanman: Apr 15 2022, 03:33 PM |

|

|

Apr 18 2022, 08:45 PM Apr 18 2022, 08:45 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

|

|

|

Mar 4 2023, 04:30 PM Mar 4 2023, 04:30 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(patrickthissen @ Mar 2 2023, 11:02 PM) Hello, want to ask for "Perbelanjaan rawatan perubatan, keperluan khas dan penjaga untuk ibu bapa" Yes..Is cataract eyes surgery consider part of rawatan perubatan? patrickthissen liked this post

|

|

|

Apr 12 2023, 11:58 PM Apr 12 2023, 11:58 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(xiaomoon @ Apr 11 2023, 02:40 PM) I got mine refunded after 18 calendar days xiaomoon liked this post

|

|

|

Jan 9 2024, 04:04 PM Jan 9 2024, 04:04 PM

Return to original view | Post

#29

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

Jan 11 2024, 08:41 PM Jan 11 2024, 08:41 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,253 posts Joined: Aug 2005 |

For sports registration, say I register in Dec 23 for an event to take place in 2024, do I claim it in YA 23 or 24?

|

|

|

Jan 12 2024, 07:34 AM Jan 12 2024, 07:34 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

Apr 8 2024, 02:53 PM Apr 8 2024, 02:53 PM

Return to original view | Post

#32

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

Apr 27 2024, 09:11 PM Apr 27 2024, 09:11 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(coolguy99 @ Apr 26 2024, 09:01 AM) Same here. Looks like it will take some more time. Guess this is why some people submit as early as possible. QUOTE(jacklsw86 @ Apr 26 2024, 05:55 PM) QUOTE(CyberKewl @ Apr 27 2024, 07:18 AM) already more than 1 month stil havent get refund. anyone from march batch gotten refund? mine submitted 26th March...mytax show no record QUOTE(tonYe @ Apr 27 2024, 12:33 PM) I think we will need to wait a bit more since officially it says within 30 working days. With raya and weekends probably need another 2 weeks QUOTE(fruitie @ Apr 27 2024, 12:37 PM) I don’t recall it took so long for them to refund us in the past. This time it is already a month since I submitted my tax but haven’t got back the refund.  Submitted 21/3, got refunded on 6/4 This post has been edited by leanman: Apr 27 2024, 09:12 PM |

|

|

|

|

|

May 7 2024, 07:32 AM May 7 2024, 07:32 AM

Return to original view | IPv6 | Post

#34

|

Senior Member

2,253 posts Joined: Aug 2005 |

|

|

|

May 17 2024, 03:26 PM May 17 2024, 03:26 PM

Return to original view | Post

#35

|

Senior Member

2,253 posts Joined: Aug 2005 |

when you are doing your online filing, you should be able to see how much is your refund there and then. by default, in LHDN site, the amount already shown 1 month less vs your EA form.

I don't remember you need to declare your PCB, be default it will pull out from the system in the filing page |

|

|

Jan 20 2025, 03:17 PM Jan 20 2025, 03:17 PM

Return to original view | Post

#36

|

Senior Member

2,253 posts Joined: Aug 2005 |

similar as above, me and my wife got a joint name property and rented out. She is on a lower tax bracket, therefore can she file the rental income only by herself? the rental agreement was done up under both our names.

|

|

|

Mar 11 2025, 03:53 PM Mar 11 2025, 03:53 PM

Return to original view | Post

#37

|

Senior Member

2,253 posts Joined: Aug 2005 |

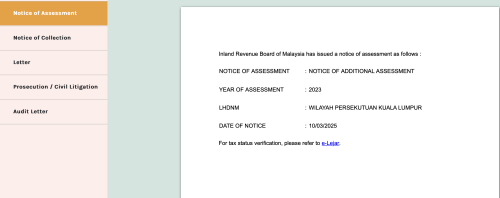

QUOTE(raaj1818 @ Mar 11 2025, 03:48 PM)  Hi guys, I just noticed my inbox in the MyTax website, and I saw this notice for the year 2023 and also 2022. The thing is it's dated 10/03/2025 so that's causing a bit of panic for me. Can anyone shed some light on this on what it means? Tried calling LHDN hotline, no one is answering it. Thanks in advance! |

|

|

Mar 12 2025, 12:39 PM Mar 12 2025, 12:39 PM

Return to original view | Post

#38

|

Senior Member

2,253 posts Joined: Aug 2005 |

QUOTE(raaj1818 @ Mar 11 2025, 04:03 PM) I opened it and I saw there is an amount indicated at the Assessment & Others 1 (RM) column and the balance shows a negative value at the far right in that row. That's an additional assessment (tax payable) but not sure you need to pay directly or can use that to offset any overpayment of your taxDoes that mean I need to pay the amount, or its just an additional tax that has been imposed that I can claim? |

| Change to: |  0.5368sec 0.5368sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 11:41 PM |