QUOTE(poooky @ Jul 8 2025, 10:50 AM)

I-Lindung has medical card product?Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Jul 8 2025, 11:41 AM Jul 8 2025, 11:41 AM

Return to original view | Post

#1281

|

All Stars

14,920 posts Joined: Mar 2015 |

|

|

|

|

|

|

Jul 8 2025, 12:01 PM Jul 8 2025, 12:01 PM

Return to original view | Post

#1282

|

All Stars

14,920 posts Joined: Mar 2015 |

|

|

|

Jul 8 2025, 12:05 PM Jul 8 2025, 12:05 PM

Return to original view | Post

#1283

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(poooky @ Jul 8 2025, 12:03 PM) Is that for Critical illness plan and not medical card?Look out for plans that has "Direct withdrawal from EPF Account" stated This post has been edited by MUM: Jul 8 2025, 12:07 PM |

|

|

Aug 15 2025, 03:53 PM Aug 15 2025, 03:53 PM

Return to original view | Post

#1284

|

All Stars

14,920 posts Joined: Mar 2015 |

|

|

|

Aug 30 2025, 06:46 AM Aug 30 2025, 06:46 AM

Return to original view | IPv6 | Post

#1285

|

All Stars

14,920 posts Joined: Mar 2015 |

MOF: Income from crypto activities subject to Income Tax Act 1967

By Bernama 29 Aug 2025, https://theedgemalaysia.com/node/768702 Attached thumbnail(s)

|

|

|

Sep 29 2025, 10:28 AM Sep 29 2025, 10:28 AM

Return to original view | Post

#1286

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(Syracuse @ Sep 29 2025, 10:18 AM) Hi tax experts, I need some help Not a tax expert here.I am employed full-time in public sector in technical position, and roughly three months ago a company has contracted me to some side gigs (e.g repair services, consultation services) - around 2-3 times this year, and they have paid me around 150-200 ringgit per visit. The company has recently asked for my tax identification number to fill CP58. Question: Do I need to declare income from such non-regular side gigs during tax filing next year? I don't remember the exact amount they paid me already, because I'm paid in cash. The total amount they paid me for all the services provided should be around RM 400-600, but I don't know the exact figure anymore. Previously, did you issue them any invoice or did you sign any payment receipt notes issued by your customers after received cash payment from them or did they banked the payment directly into your bank account? I think, .....Yes, any side income earned in Malaysia, if hv evidence of you receiving payment for it should be declared together with your yearly ITR filing. If not sure of the exact number, use the highest one. Ha ha This post has been edited by MUM: Sep 29 2025, 10:57 AM |

|

|

|

|

|

Oct 28 2025, 05:50 AM Oct 28 2025, 05:50 AM

Return to original view | Post

#1287

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(paraben @ Oct 27 2025, 11:13 PM) Just noticed that this year tax reliefs for sports and gym, expanded to include parents. I have bought pickleball bats for parents, but then notice pickleball was not in the recognised sports activities (as per this Tax Relief link I found from reddit). Anyone can confirm? Perhaps can Try these links for some added info while you wait for responses from real tax gurus.SOALAN LAZIM PELEPASAN CUKAI PENDAPATAN INDIVIDU BERKAITAN SUKAN MULAI TAHUN TAKSIRAN 2024 https://www.kbs.gov.my/phocadownload/2024/K...0Sukan%20V1.pdf Is picket balls a sport encompassed in the 103 types of sports that have been gazetted under the Sports Development Act ? https://www.kbs.gov.my/phocadownload/2023/P...%202023%201.pdf paraben liked this post

|

|

|

Oct 28 2025, 11:31 AM Oct 28 2025, 11:31 AM

Return to original view | Post

#1288

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(QuinntheQueen @ Oct 28 2025, 11:04 AM) anyone invested into PRS before? saw that it is one of the ways to get tax relief similar to how it is for EPF. Found this on gogglemy friend suggested Versa cos they are giving out rm50 to those cash in rm3k. plus some other promo to get 4%+0.2% if cash into their save fund. PRS RM50 Bonus Quest (“Campaign”) Terms & Conditions PRS RM50 Bonus Quest (“Campaign”) is organised by Versa Asia Sdn Bhd (“Versa”) and shall be subject to the terms and conditions herein (“Terms and Conditions”). https://versa.com.my/prs-rm50-bonus-boost-c...rms-conditions/ cash in RM3,000 into any PRS funds via Versa (aka Versa Retirement funds) and unlock these exciting benefits: https://versa.com.my/stack-and-earn-prs-rm50-bonus-quest/ By completing any of these Quests, you’ll be eligible to stack and earn 9%* or MORE nett returns in Versa Save! Find out more here: https://versa.com.my/stack-and-earn-more-mo...h-versa-quests/ More, .(with FAQs). https://versa.com.my/stack-and-earn-prs-rm50-bonus-quest/ Just ask your friend, what is the % of Sales Charges they will charge when you buy thru them? And, For more discussion about Versa or PRS funds, try to post at their respective threads This post has been edited by MUM: Oct 28 2025, 11:44 AM |

|

|

Oct 28 2025, 03:40 PM Oct 28 2025, 03:40 PM

Return to original view | Post

#1289

|

All Stars

14,920 posts Joined: Mar 2015 |

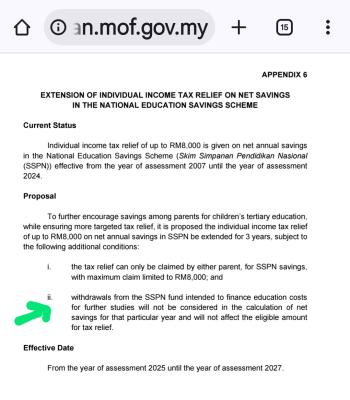

QUOTE(ccschua @ Oct 28 2025, 03:23 PM) Hi, I made substantial withdrawal from PTPTN and deposit into EPF at the beginning of the year. the year end has come, I need to deposit 8k + whatever withdrawn. Since money is tightproblem is the withdrawn amount that is placed in EPF is difficult to be taken out, can I submit children university bill to substantiate ? or just skip 1 year. If for me, i would just skip 1 year , dont deposit again this year, since I had already taken out that money this year. I would just hv my spouse contribute this year and hv my spouse claim tax relief this year. Since money is tight, instead of returning whatever I had taken out this year + 8k to qualify for max tax relief, I would just ask myself spouse to put in 8k to get max tax relief this year. If the uni bill can match the withdrawn amount (uni bill same or more than withdrawn amount), then can check with lhdn......I think can. But if the uni bill is 80k but you withdrawn 100k, then i think must top up balance 20k + 8k. Image info from https://www.yycadvisors.com/deposited-and-w...PN-account.html https://belanjawan.mof.gov.my/pdf/belanjawa...tax-measure.pdf This post has been edited by MUM: Nov 1 2025, 09:13 AM Attached thumbnail(s)

|

|

|

Today, 10:32 AM Today, 10:32 AM

Return to original view | Post

#1290

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(Wolgie @ Dec 11 2025, 09:54 AM) Good day. Not a qualified tax comment.1) If put money from father side 8k, then mother side put 8k, still consider mother side can claim 8k tax?? 2) If put money from father side 8k, then mother side no put $$, do mother side still can claim 8k tax?? (maybe father side tax lower tthen mother side, so want put to mother side) 3) how lhdn know the $$ take out is for education? 4) my dautgther is MMU Foundation, consider relief 2k or 8k? (she start the Nov2025) ** Account is seperate For yr Q1, .effective 2025, only either 1 parent can claim Q2, ...if file separately, ...tax relief will be given to the one that has the net saving in their sspn account. Father opened for child A has 1 account, mother open for child A will hv another separate account LHDN will just see which account has net saving for that calendar year. Q3, ..... seems like need to submit form. See attached image from https://logmasuk.my/how-to-withdraw-sspn/ Q4, ...looks like that is in another tax relief category. Attached image is from https://www.hasil.gov.my/media/vvglk3ad/exp...es_be2024_2.pdf Thus I think, just think should be 8k Attached thumbnail(s)

|

|

|

Today, 12:35 PM Today, 12:35 PM

Return to original view | IPv6 | Post

#1291

|

All Stars

14,920 posts Joined: Mar 2015 |

QUOTE(wa11er @ Dec 11 2025, 12:21 PM) Good day! While waiting for real tax sifus to comment.I have a question about corporate income tax in Malaysia. Does the tax year for enterprises always follow January to December? For example: Suppose Enterprise A gets a job from Company B and quotes RM10,000. A then subcontracts the job to Company C for RM9,000. This happens in December 2025. C completes the job and informs A before year-end. A invoices B, and B pays just before New Year's. But C only sends its invoice to A on January 3, 2026. In this case, does A have to report the full RM10,000 as income for 2025 tax purposes, without deducting the RM9,000 expense yet? Meaning, A pays tax on RM10,000 for 2025? Or can the expense be claimed in 2025 since the work was done then? Any insights or links to IRB guidelines would be great—thanks! I googled and a found this, .... Hope it could provides you with some things to read while waiting. https://phl.hasil.gov.my/pdf/pdfam/PRNo7_2001_2.pdf https://www.hasil.gov.my/en/company/basis-p...od-for-company/ Attached thumbnail(s)

wa11er liked this post

|

| Change to: |  0.0283sec 0.0283sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 01:24 PM |