QUOTE(moiskyrie @ Mar 1 2025, 10:58 PM)

IF follow this site, ...https://taxpod.com.my/articles/medical-expe...-tax-deduction/

Attached thumbnail(s)

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 1 2025, 11:02 PM Mar 1 2025, 11:02 PM

Return to original view | IPv6 | Post

#1241

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(moiskyrie @ Mar 1 2025, 10:58 PM) IF follow this site, ...https://taxpod.com.my/articles/medical-expe...-tax-deduction/ Attached thumbnail(s)

|

|

|

|

|

|

Mar 2 2025, 12:00 PM Mar 2 2025, 12:00 PM

Return to original view | Post

#1242

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(labtec @ Mar 2 2025, 11:36 AM) We can only claim tax relief for Parent if the receipt payor name is us, not parent name? I think, just think,Most of my parent medical receipt payor name is my parent name. IF, the the bill and receipt are of different names, then, The invoice or payment bill must state your parent name and them attach the receipt to it. The receipt must have the name of the tax relief claiming children. Relationship can be proven from birth cert or legal adoption papers if needed. IF, the payment receipt is under the parent name, then any tax relief claiming children can use it to claim tax relief. Again, Relationship can be proven from birth cert or legal adoption papers if needed |

|

|

Mar 3 2025, 11:51 AM Mar 3 2025, 11:51 AM

Return to original view | Post

#1243

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(cHaRsIeWpAu^^ @ Mar 3 2025, 09:55 AM) hi for parent caregiver, Just guess, just guess only.if its shared by siblings, we just divided by number of pax? eg we're hiring caregiver 5k per month, but the caregiver center receipt is under my sister name, so we siblings can divide? After having fulfilled as per image from explanatory notes. For your scenario, .. Do a documentation for claims under this clause item, in advance in preparation of just in case lhdn audit. It should at least contains minimum info like Total carer cost incured with attached compiled receipts for that ITR year. Total you are claimed as per your ITR for that year. Balance who is claiming, how much each of them are claiming, their names, relationship, nric and tax file numbers. So it will make it easier for the lhdn auditor to confirm. Easier and faster for them, easier and faster you go home. Ha ha ha. Just my guess This post has been edited by MUM: Mar 3 2025, 11:52 AM Attached thumbnail(s)

cHaRsIeWpAu^^ liked this post

|

|

|

Mar 4 2025, 07:20 AM Mar 4 2025, 07:20 AM

Return to original view | Post

#1244

|

All Stars

14,945 posts Joined: Mar 2015 |

If long time still no "cukai ditafsirkan",

If long time no go have tea at lhdn, Then, be prepare lor. Ha ha ha |

|

|

Mar 4 2025, 06:23 PM Mar 4 2025, 06:23 PM

Return to original view | Post

#1245

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(spreeeee @ Mar 4 2025, 05:14 PM) husband: permanent worker, EA - kena taxed. Just guess as I am not a qualified tax consultant.spouse: part time worker, no epf, CP58. should husband declare tax as "berasingan", or "diri sendiri di mana pasangan tiada pendapatan / tiada punca pendapatan / ada pendapatan dikecualikan cukai" 2nd option ok? since this term "ada pendapatan dikecualikan cukai" looks appropriate? spouse: part time worker, no epf, CP58, got exceed the tax file opening threshold of something like, RM 3x,xxx income pa? I would read articles previuosly mentioning separate filling hv more benefits under most conditions. Anyway, while waiting value added responses, Try read this for some added info "The best way to find out if you should file jointly or separately with your spouse is to prepare the tax return both ways. Double check your calculations and then look at the net refund or balance due from each method. If you use e-filing to file for your tax returns, you will be able to see the tax due for each individual and compare it with the joint assessment. This way, you will be able to see which filing status gives you the biggest tax savings." Should You Get Joint Or Separate Income Tax Filing As A Couple? https://www.imoney.my/articles/i-do-tax-returns https://www.accaglobal.com/my/en/student/ex...assessment.html |

|

|

Mar 5 2025, 02:54 AM Mar 5 2025, 02:54 AM

Return to original view | IPv6 | Post

#1246

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(babyevil82 @ Mar 5 2025, 02:36 AM) Is that claimable? While waiting for value added responses, I google and found this.- Complete medical examination for self, spouse or child Perform endoscopy due to gastric issue. -Basic supporting equipment for disabled self, spouse, child or parent Purchase wheelchair during serious illiness but recovered after a period. Hope it can provides you with some info while younwait for answers https://www.google.com/url?sa=t&source=web&...aRK86eR3CSDoBHU Attached thumbnail(s)

babyevil82 liked this post

|

|

|

|

|

|

Mar 5 2025, 05:33 AM Mar 5 2025, 05:33 AM

Return to original view | Post

#1247

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(babyevil82 @ Mar 5 2025, 03:38 AM) Thanks for help.Appreciated! Endoscopy is a specific examination into 1 area....thus perhaps that falls into the last paragraph of the terms as stated in that earlier image?Seems like both items are not eligible for tax relief.Sad. However for item1, performed endoscopy was requested by specialist. So is that consider defined by MMC? Just my guess babyevil82 liked this post

|

|

|

Mar 10 2025, 09:21 AM Mar 10 2025, 09:21 AM

Return to original view | Post

#1248

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(a-ei-a @ Mar 10 2025, 08:22 AM) Just asking, are these items cater to medical treatment, special needs and carer expenses for parents category of the tax relief claim?If it is, the list may hv to be determined by medical practitioners registered with the MMC. |

|

|

Mar 11 2025, 06:17 PM Mar 11 2025, 06:17 PM

Return to original view | Post

#1249

|

All Stars

14,945 posts Joined: Mar 2015 |

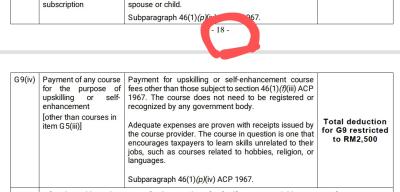

QUOTE(laceruffles91 @ Mar 11 2025, 05:43 PM) Lifestyle relief as follows: From Purchase or subscription of books, journals, magazines, newspaper (including electronic newspapers), and other similar publications for the purpose of enhancing knowledge. Purchase of personal computer, smartphone, or tablet. Internet subscription. Any other upskilling or self-enhancement courses. What are considered upskilling or self enhancement courses? Is meditation included? BE 2024 Explanatory Notes https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf Attached thumbnail(s)

laceruffles91 liked this post

|

|

|

Mar 12 2025, 09:02 PM Mar 12 2025, 09:02 PM

Return to original view | Post

#1250

|

All Stars

14,945 posts Joined: Mar 2015 |

|

|

|

Mar 13 2025, 11:36 AM Mar 13 2025, 11:36 AM

Return to original view | Post

#1251

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(erdingerbier @ Mar 13 2025, 11:31 AM) Hi Gurus, last year I did Full Body Medical Checkup, can this claimable under "Complete medical examination for self, spouse or child" ? https://www.hasil.gov.my/en/individual/indi...me/tax-reliefs/ |

|

|

Mar 13 2025, 12:01 PM Mar 13 2025, 12:01 PM

Return to original view | Post

#1252

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(erdingerbier @ Mar 13 2025, 11:45 AM) The item 7 (i) "Complete medical examination for self, spouse or child" is equivalent to self Full Body Checkup right ? Try read image in post 10474 erdingerbier liked this post

|

|

|

Mar 13 2025, 12:10 PM Mar 13 2025, 12:10 PM

Return to original view | Post

#1253

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(erdingerbier @ Mar 13 2025, 12:05 PM) Nice nice, thanks for sharing. I usually find it sufficient for my need to get it from lhdn site (ex: from that link in post 10474 and Usually this kind of detailed document can be obtained from mytax website ? BE 2024 Explanatory Notes https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf There are more detailed info out there. This post has been edited by MUM: Mar 13 2025, 12:21 PM |

|

|

|

|

|

Mar 13 2025, 12:11 PM Mar 13 2025, 12:11 PM

Return to original view | Post

#1254

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(erdingerbier @ Mar 13 2025, 12:08 PM) I would like to ask 1 more item, which the "Education and medical insurance (Restricted RM 3000)", this can be combined of Self Medical Insurance + Child Medical Insurance ? Perhaps can Click on this link BE 2024 Explanatory Notes https://www.hasil.gov.my/media/i3xpkyx4/exp...es_be2024_2.pdf for some explanation? This post has been edited by MUM: Mar 13 2025, 12:20 PM |

|

|

Mar 13 2025, 12:45 PM Mar 13 2025, 12:45 PM

Return to original view | Post

#1255

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(erdingerbier @ Mar 13 2025, 12:31 PM) I have checked this BE 2024 Explanatory Notes, it stated at "G19 Education and medical insurance" I read it as ..... can combined if met all state those tnc.A deduction not exceeding RM3,000 is available on insurance premiums in respect of education or medical benefits for an individual, husband, wife, or child. Does it mean that the insurance premium relief is not able to be combined with the Child's one ? :confused: For a sure confirmed one, please check with lhdn. Then tell us the confirmed answer. Thks. This post has been edited by MUM: Mar 13 2025, 12:53 PM Attached thumbnail(s)

lj0000 and erdingerbier liked this post

|

|

|

Mar 15 2025, 02:21 PM Mar 15 2025, 02:21 PM

Return to original view | Post

#1256

|

All Stars

14,945 posts Joined: Mar 2015 |

As at 18 Mar 2024

QuickCheck: Is dental treatment tax deductible? https://www.thestar.com.my/news/nation/2024...uctible-in-2023 While many may know that medical expenses are claimable, some are saying that dental expenses for themselves are also claimable. Is this true? Verdict: FALSE No, dental treatment is not a claimable tax break for yourself, spouse or child just yet. As long as the procedure is not for aesthetic purposes, one can claim tax relief for parents' dental treatments. This means that if they needed to pull a tooth or plug a cavity, it's claimable. Not so if they are whitening their teeth. Teeth restoration and replacement involving crowning, root canal, and dentures also cannot be claimed under this tax relief. Currently, it's capped at RM8,000, but in this bracket are expenses for any other medical treatment your parents may need. It's important to note that the medical care has to be provided and evidenced by a registered medical practitioner or carer who is not you, your spouse or your child. Also, your parents must reside in Malaysia and the treatments done must be in the country. |

|

|

Mar 15 2025, 10:41 PM Mar 15 2025, 10:41 PM

Return to original view | Post

#1257

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(ronnie @ Mar 15 2025, 09:45 PM) buying meds for hypertension for Parents from pharmacist like BIG, Caring - is it tax deductible as relief of the RM8k ? Looking at this, ....https://www.google.com/url?sa=t&source=web&...aRK86eR3CSDoBHU I interpreted it as a yes, but the medication need to be certified by............, as necessary for regular treatment of parent's disease. That is just my interpretation, .what is yours? Attached thumbnail(s)

|

|

|

Mar 22 2025, 08:22 AM Mar 22 2025, 08:22 AM

Return to original view | IPv6 | Post

#1258

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(bing0212 @ Mar 21 2025, 11:57 PM) Studied diploma few years ago and started paying back PTPTN, can claim tax relief under Education fees? May I ask, What is the name of that Diploma?If I am not wrong, just some Diploma course that can claim tax relief. Huumph, paid for it few years ago, now only want to claim, ..... during that year of incured that course fees, how much tax did you kena pay for that year? |

|

|

Mar 29 2025, 05:48 AM Mar 29 2025, 05:48 AM

Return to original view | Post

#1259

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(bing0212 @ Mar 28 2025, 11:16 PM) Not a tax advice I could be wrong I think cannot claim bcos of this reasoning, .... laptop or handphone purchased in that calender can only be used to claim tax relief for that calendar year. Anyway, as the fees is abit large, it is a waste not to try claim tax relief benefits to reduce taxes, you can try seek answer from lhdn. |

|

|

Mar 29 2025, 11:06 AM Mar 29 2025, 11:06 AM

Return to original view | IPv6 | Post

#1260

|

All Stars

14,945 posts Joined: Mar 2015 |

QUOTE(CPURanger @ Mar 29 2025, 11:00 AM) I m not sure this is the right place to ask. I am looking for explanatory lhdn notes be 2024 (english) pdf. I manage to get malay version but not english from google. Try this?Please share the link, thanks. Select type and year https://www.hasil.gov.my/en/forms/download-...orm-individual/ CPURanger liked this post

|

| Change to: |  0.2314sec 0.2314sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 08:15 AM |