QUOTE(wongmunkeong @ Oct 17 2017, 08:42 AM)

Yeah yeah, well done! I can retire liao as the PM basher Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Oct 17 2017, 10:22 AM Oct 17 2017, 10:22 AM

Return to original view | Post

#61

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Oct 31 2017, 04:12 PM Oct 31 2017, 04:12 PM

Return to original view | Post

#62

|

Senior Member

1,498 posts Joined: Nov 2012 |

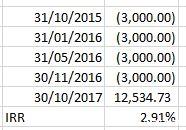

QUOTE(atyt1985 @ Oct 31 2017, 03:31 PM) I am curious to know the current top performing funds too for Public Mutual. I did an initial investment on PITSEQ with EPF since Oct 2015 for RM12k however the return so far well i think its pretty slow No need to think, I calculated for you. The annualised return is 2.91% per annum, if you left the money in EPF you would have made more than double the return.Oct 2015- RM3k Jan 2016- RM3k May 2016- RM3k Nov 2016- RM3k *Total so far RM12k invested in PITSEQ  |

|

|

Jan 11 2018, 01:45 PM Jan 11 2018, 01:45 PM

Return to original view | Post

#63

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(j.passing.by @ Jan 8 2018, 04:08 PM) Here is another reason, aside from the high service charges, not to support Public Mutual. Wah, how can CS do that to our lowyat no.1 PM fans?As an organisation, Public Mutual does not see you as a client of theirs. You are not their customer, as you are a customer of your UT agent (UT consultant). If you approached the company directly, you won’t get any friendly service a customer would expect to get. I always come away with a feeling that I have somehow interrupted their daily siesta and they are annoyed and wondering why I am bothering them with my silly question instead of referring my silly question to my UT agent. The company seems to be moving more towards internet as an added service; but on the other hand, the company seems to expect major announcements to flow to the customer via their UT agents instead of communicating it via their website. Case in point is the recent change in the free switching entitlement. If you browse through the news and announcement segment of their website, there is no notice of any pending changes to the free switches entitlement by Gold and Elite Gold Members. Not in their main webpage either. If there is any other form of notice of pending changes to the customer, maybe there are… but me - a regular Joe and investor and customer – I am not aware of or were alerted to the change. So, I asked my silly question… and in their reply, I somewhat felt that I am blind, and should have read the benefits that are clearly stated within the Mutual Gold page. Yes, Public Mutual Sdn Bhd and her good customer service… thank you for your astute and precise reply. A standard no-fault-lies-with-us reply…. ========= It was a very good first 4 days in the new year... my port gained more than 1% - though it is not as good as Yang Huiyan’s 2 billlion. Happy New Year 2018... the rally continues... I hate to repeat this, but what is the compelling reason that you are still a loyal customer to them? I know you also buy from FSM and all, is PM attractive in its own way? Sincerely want to know |

| Change to: |  0.1969sec 0.1969sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 12:15 PM |