QUOTE(iqlas @ Jun 27 2020, 02:14 PM)

I do see your point.

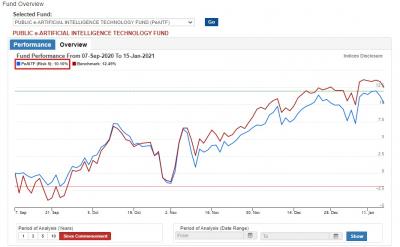

However my angle is more towards if the fund manager was able to beat the benchmark in its own industries by a higher margin. Would that means maybe potentially there are more undervalued stock in that particular market that can help generate growth for the investor?

That kind of things

The benchmark may just be a value. That may not be universally adopted by others... It is just a value.. That looks to be fluid n not fixed... However my angle is more towards if the fund manager was able to beat the benchmark in its own industries by a higher margin. Would that means maybe potentially there are more undervalued stock in that particular market that can help generate growth for the investor?

That kind of things

Any way, if you liked to use that, just go ahead as you think that it is valid n fruitful to use.

This post has been edited by yklooi: Jun 27 2020, 02:19 PM

Jun 27 2020, 02:18 PM

Jun 27 2020, 02:18 PM

Quote

Quote

0.0251sec

0.0251sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled