QUOTE(YoungMan @ Aug 6 2019, 10:51 PM)

Thank you... Another question:

how does DDA/DCA actually help in growing the fund when each transaction is charged 5%? Say I start with 2k in fund A, and then consistently put in RM200 monthly, but each rm200 there is a 5% fee. I tend to feel like I am losing the game to the sc. Forgive this newcomer with very limited knowledge in mutual fund.

Secondly what will happen if I choose none from the name of agent when making a new investment online? Will it randomly put to another PM agent?

Finally... Wish me luck in Public U.S Equity.

how does DDA/DCA actually help in growing the fund when each transaction is charged 5%?

you still will have 95% of that RM 200 monthly added into the fund....(RM190 pm added into the fund)

This RM190 pm is a form of savings for the long-term.

It requires patience, discipline and not being effected by market movements and in the end of the duration of your investment objectives you will have a large pool of money (if all goes well according to plan).

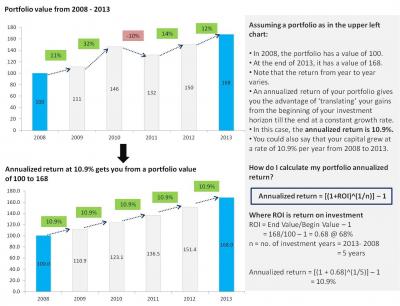

In short, DDA/DCA helps to grow your investment steadily with no market timing involved.

It smoothen the NAV price volatility and reduce exposure to risk that is associated with making a single large purchase.

on the agent thing....no idea, but i think and my wild guess is they will randomly put a PM UTC

YES, you will need more than luck in this Public U.S Equity.....when compared its YTD performance with other US equities funds....

also many "experts" and data thinks the US is on the high side of being expensive in terms of PE valuation, thus hope you have other funds other than this US exposed fund.

Attached thumbnail(s)

Dec 18 2018, 12:54 PM

Dec 18 2018, 12:54 PM

Quote

Quote

0.1078sec

0.1078sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled