QUOTE(T231H @ Jun 27 2020, 05:10 PM)

If like that, gg 😱😱This post has been edited by ironman16: Jun 27 2020, 07:42 PM

Public Mutual Funds, version 0.0

|

|

Jun 27 2020, 06:05 PM Jun 27 2020, 06:05 PM

Show posts by this member only | IPv6 | Post

#2001

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Jun 27 2020, 11:33 PM Jun 27 2020, 11:33 PM

|

Junior Member

35 posts Joined: May 2020 |

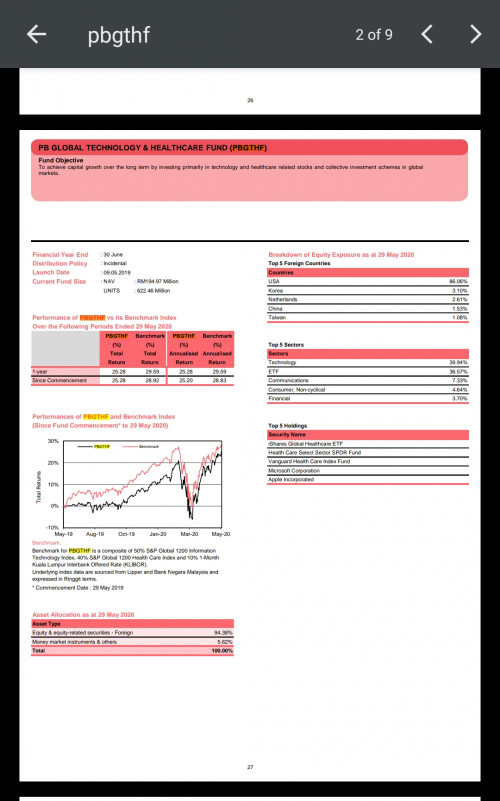

QUOTE(yklooi @ Jun 27 2020, 09:53 AM)   For better comparison, this is the latest Monthly Fund Report (MFR of May 2020) for both fund. PeISMF benchmark are; = 90% S&P Global 1200 ESG Shariah + 10% 3-month Islamic Interbank Money Market rate. PBGTHF benchmark are; = 50% S&P Global 1200 Information Technology Index + 40% S&P Global Health Care Index + 10% 1-month KLIBOR rate. PeISMF top 5 holding consists of; - Apple Inc - Alphabet Inc - Microsoft Corp - MasterCard Inc - Visa Inc **PeISMF exposure to US market are 71.02% While PBGTHF top 5 holding consists of; - iShares Global Healthcare ETF - Health Care Select Sector SPDR - Vanguard Healthcare Index - Microsoft Corp - Apple Inc ** PBGTHF exposure to US market are 86.06% Which means, if US market are bad, PBGTHF are more affected compared to PeISMF. However, since both fund are focusing more into Technology sector the most, both fund are quite stable. |

|

|

Jun 28 2020, 11:50 AM Jun 28 2020, 11:50 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

iqlas, hope you find this latest information useful in your fund selection quest anyway, did your current agent provided that much information as kapitan? time to consider kapitan? kapitan gambit and iqlas liked this post

|

|

|

Jun 28 2020, 09:00 PM Jun 28 2020, 09:00 PM

|

Junior Member

35 posts Joined: May 2020 |

QUOTE(yklooi @ Jun 28 2020, 11:50 AM) iqlas, hope you find this latest information useful in your fund selection quest anyway, did your current agent provided that much information as kapitan? time to consider kapitan? It is my duty to make any prospect well-informed about the fund that caught their interest. In the end, it's client money. Hard earned money. So, of course if I put my shoes as a client, I would be very upset if my investment doesn't do any good. Explaining which fund are affected by which market is how my approach work. At least it gives the client better insight on which market to focus or avoid. |

|

|

Jul 1 2020, 05:50 PM Jul 1 2020, 05:50 PM

Show posts by this member only | IPv6 | Post

#2005

|

All Stars

12,387 posts Joined: Feb 2020 |

Public Mutual launches two income funds

KUALA LUMPUR: Public Mutual launched two new funds -- Public e-Income Fund (PeINCF) and Public e-Islamic Income Fund (PeISINCF) – on Wednesday which seek to provide annual income over the medium to long-term period. https://www.thestar.com.my/business/busines...-funds#cxrecs_s |

|

|

Jul 1 2020, 07:56 PM Jul 1 2020, 07:56 PM

Show posts by this member only | IPv6 | Post

#2006

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Jul 1 2020, 05:50 PM) Public Mutual launches two income funds so this two fund of UT is money market or FI??? KUALA LUMPUR: Public Mutual launched two new funds -- Public e-Income Fund (PeINCF) and Public e-Islamic Income Fund (PeISINCF) – on Wednesday which seek to provide annual income over the medium to long-term period. https://www.thestar.com.my/business/busines...-funds#cxrecs_s normally PM will charge sales charge on FI.... |

|

|

|

|

|

Jul 2 2020, 01:49 PM Jul 2 2020, 01:49 PM

|

Senior Member

1,099 posts Joined: Jan 2019 |

guys, recently I've been approach by few agents asking me to withdraw from EPF and invest in Public Mutual with a promise of 8% return. is this doable? i find it hard to believe.. why would i withdraw from EPF with 6% dividen to invest in Public Mutual? also, i thought Bank Negara made it illegal to promise percentage of return to customer? This post has been edited by JoeK: Jul 2 2020, 01:50 PM kapitan gambit liked this post

|

|

|

Jul 2 2020, 01:53 PM Jul 2 2020, 01:53 PM

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(JoeK @ Jul 2 2020, 01:49 PM) guys, recently I've been approach by few agents asking me to withdraw from EPF and invest in Public Mutual with a promise of 8% return. Should be the EPF approved MIS funds. is this doable? i find it hard to believe.. why would i withdraw from EPF with 6% dividen to invest in Public Mutual? also, i thought Bank Negara made it illegal to promise percentage of return to customer? Did they say that the 8% is guaranteed? If you can earn up to 8%, it also has chance to go the other way (-8%). |

|

|

Jul 2 2020, 02:00 PM Jul 2 2020, 02:00 PM

|

Senior Member

1,099 posts Joined: Jan 2019 |

|

|

|

Jul 2 2020, 02:02 PM Jul 2 2020, 02:02 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2020, 02:02 PM Jul 2 2020, 02:02 PM

Show posts by this member only | IPv6 | Post

#2011

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(JoeK @ Jul 2 2020, 02:00 PM) If you have the black and white of them guaranteeing 8% returns, you can post them here. Else it’s just verbal promotion tactics to entice customers to sign up for their plan. |

|

|

Jul 2 2020, 02:03 PM Jul 2 2020, 02:03 PM

|

Senior Member

1,099 posts Joined: Jan 2019 |

QUOTE(yklooi @ Jul 2 2020, 02:02 PM) QUOTE(victorian @ Jul 2 2020, 02:02 PM) If you have the black and white of them guaranteeing 8% returns, you can post them here. Else it’s just verbal promotion tactics to entice customers to sign up for their plan. yes. not in black and white. they just write in LinkedIn message promising 8% returns.any of you manage to achieve 8% before? |

|

|

Jul 2 2020, 02:06 PM Jul 2 2020, 02:06 PM

Show posts by this member only | IPv6 | Post

#2013

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(JoeK @ Jul 2 2020, 02:03 PM) yes. not in black and white. they just write in LinkedIn message promising 8% returns. Lol 8% is easy, some can even go up to 10-20%.any of you manage to achieve 8% before? The thing is, is it guaranteed? EPF is good is because it guarantees a minimum return of 2.5%, so it will never go below zero. |

|

|

|

|

|

Jul 2 2020, 02:07 PM Jul 2 2020, 02:07 PM

Show posts by this member only | IPv6 | Post

#2014

|

Senior Member

1,099 posts Joined: Jan 2019 |

|

|

|

Jul 2 2020, 02:08 PM Jul 2 2020, 02:08 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(JoeK @ Jul 2 2020, 02:03 PM) yes. not in black and white. they just write in LinkedIn message promising 8% returns. do you think that can be submitted to the PM office?any of you manage to achieve 8% before? yes, 8% is achieveable, depends on for how long this 8% will last, and when you bought it and what fund did you bought. but most of the time, most of the funds this 8% is not sustainable in the long run....my personal experience.....losses will happens too This post has been edited by yklooi: Jul 2 2020, 02:08 PM |

|

|

Jul 2 2020, 02:08 PM Jul 2 2020, 02:08 PM

Show posts by this member only | IPv6 | Post

#2016

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jul 2 2020, 02:10 PM Jul 2 2020, 02:10 PM

Show posts by this member only | IPv6 | Post

#2017

|

Senior Member

1,099 posts Joined: Jan 2019 |

QUOTE(yklooi @ Jul 2 2020, 02:08 PM) do you think that can be submitted to the PM office? Can share your experience? The good return and the bad return you've experienced in public mutual?yes, 8% is achieveable, depends on for how long this 8% will last, and when you bought it and what fund did you bought. but most of the time, most of the funds this 8% is not sustainable in the long run....my personal experience.....losses will happens too |

|

|

Jul 2 2020, 02:16 PM Jul 2 2020, 02:16 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2020, 04:05 PM Jul 2 2020, 04:05 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(JoeK @ Jul 2 2020, 02:09 PM) at times, for some PM funds, it can be higher than that in a year....just look at some compilations as in page 93, post 1842 and 1843 https://forum.lowyat.net/topic/3580942/+1840 |

|

|

Jul 2 2020, 04:40 PM Jul 2 2020, 04:40 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(T231H @ Jul 2 2020, 04:05 PM) at times, for some PM funds, it can be higher than that in a year.... Thanks for referring to my posts which were posted in February.just look at some compilations as in page 93, post 1842 and 1843 https://forum.lowyat.net/topic/3580942/+1840 While last year was indeed a good year for equity funds... with annual returns up to 32%, try not to miss the following remark: "Though last year was a good year for equities funds, the returns were recovering from their negative returns in 2018..." In the long term, things may even out and the expected returns could be around 8%. Or maybe less. More likely less, if the sales charge is as high as 5% on each purchase. In the short term, it is all due to market timing and luck. "Long term" in all the investment articles and advices should be read as regular purchases over the long term. This is much difference from making a one time purchase (or split the amount to several purchases) and hold the investment for many years. The expected returns in the latter method is still dependent on market timing and luck. Lastly, if the money is from EPF's account 1, EPF also sells funds from its online portal, I-Invest. It is linked directly to EPF's Account 1. So, no paper work necessary. It sells funds from all the fund companies, and it charges much much lower service or sales charge at about 0.5%. |

| Change to: |  0.1287sec 0.1287sec

0.38 0.38

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 11:41 PM |