QUOTE(nexona88 @ Jun 30 2015, 06:53 PM)

Yesterday my portfolio down 1.7%wondering how much will it go up tomorrow.....

Fundsupermart.com v10, Double digit (portfolio) growth!

|

|

Jun 30 2015, 07:04 PM Jun 30 2015, 07:04 PM

Return to original view | Post

#221

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jun 30 2015, 07:23 PM Jun 30 2015, 07:23 PM

Return to original view | Post

#222

|

Senior Member

8,188 posts Joined: Apr 2013 |

P/E Ratio: It's Not A Crystal Ball

By Investopedia Staff What goes up ... well, sometimes it stays up for an awfully long time. A common mistake among beginning investors is the short selling of stocks because they have a high P/E ratio. If you aren't familiar with short selling, it's an investing technique by which an investor can make money when a shorted security falls in value. (For more on this, check out the Short Selling tutorial.) First of all, we believe that novice investors shouldn't be shorting. Secondly, you can get into a lot of trouble by valuing stocks using only simple indicators such as the P/E ratio. Although a high P/E ratio could mean that a stock is overvalued, there is no guarantee that it will come back down anytime soon. On the flip side, even if a stock is undervalued, it could take years for the market to value it in the proper way. Security analysis requires a great deal more than understanding a few ratios. While the P/E is one part of the puzzle, it's definitely not a crystal ball. Read more: http://www.investopedia.com/university/per...p#ixzz3eXlNqF4e |

|

|

Jun 30 2015, 07:25 PM Jun 30 2015, 07:25 PM

Return to original view | Post

#223

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(deeplyheartbroken @ Jun 30 2015, 07:08 PM) Sorry, I don't know,...I think "most" forummers here also don't know if there is this thing...But, then there may be at times,...some superb one may flies in here to provide their own insights.... This post has been edited by yklooi: Jun 30 2015, 08:40 PM |

|

|

Jun 30 2015, 08:37 PM Jun 30 2015, 08:37 PM

Return to original view | Post

#224

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(heaven.33 @ Jun 30 2015, 08:31 PM) Also a new player here...wanna ask if 1k is a very low investment? We wont be seeing any difference with this amount of investment? Thanks. to some people RM 1000 can feed a family for a month...NEVER look down on monies...you can use it to have a hands on, on the emotional aspect of UT investing.... I think some funds allows initial minimum investment amount of RM 100 too goto FUNDS INFO/FUNDS SELECTOR...after selected the parameters....click generate table.... after that list came out.....click FUND INFO TABLE.... the min amount is stated there This post has been edited by yklooi: Jun 30 2015, 08:42 PM |

|

|

Jun 30 2015, 11:08 PM Jun 30 2015, 11:08 PM

Return to original view | Post

#225

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(heaven.33 @ Jun 30 2015, 10:34 PM) *UT is an investment, as with any investment, there are risk of not seeing profits too. QUOTE(heaven.33 @ Jun 30 2015, 10:36 PM) Yea there are indeed some minimum investment amount. I just think that 1k may not be able to create a diversified portfolio. this may not be "Perfect" and not be to others liking, but I think this is quite diversified,,,,RM 1000 can have a 80% bond fund a global fund an Asia X Jpn fund a small cap fund a m'sia fund This post has been edited by yklooi: Jun 30 2015, 11:29 PM Attached thumbnail(s)

|

|

|

Jun 30 2015, 11:19 PM Jun 30 2015, 11:19 PM

Return to original view | Post

#226

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jul 1 2015, 12:19 PM Jul 1 2015, 12:19 PM

Return to original view | Post

#227

|

Senior Member

8,188 posts Joined: Apr 2013 |

1) Under the factsheets, I don't understand "3 yr Annualised Volatility" and "3 yr Sharpe ratio". I thought volatility is measured by percentage.

Quantitative Measures Of Investment Risk http://www.fundsupermart.com.my/main/resea...?articleNo=1723 2) How do u judge if it is a big cap or small cap fund? based on the "Fund Size"? based from what was written in the fund factsheet/prospectus or FUNDS INFO/FUNDS SELECTOR.....under SPECIALIST SECTOR...click small to medium companies 3) Where do i see the "dividend" part for each fund? mostly is in the fund factsheet...example http://www.fundsupermart.com.my/main/admin...heetMYHWSOF.pdf btw,...don't pay too much attention to the distribution....it makes no different to the amount of monies you have in the fund. 4) I dont really understand the numbers on the Performance table as well as the Performance Chart (what does the numbers on the left of the chart means?) it is the % of cumulative growth.....ex..if it shows 150...means 50% cumulative growth 5) what are the types of funds (diversifying question) that u guys look into? I know theres the "Fund Selector" and options like "Main Categories", "Specialist Sectors" and "Geographical Sectors". What else? look to set up a diversify portfolio http://www.fundsupermart.com.my/main/resea...pl?articleNo=59 Basic Steps To Construct An Investment Portfolio http://www.fundsupermart.com.my/main/resea...?articleNo=1753 Enhance Your Portfolio Returns Like A Pro http://www.fundsupermart.com.my/main/resea...?articleNo=2193 |

|

|

Jul 1 2015, 05:03 PM Jul 1 2015, 05:03 PM

Return to original view | Post

#228

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2015, 12:05 AM Jul 2 2015, 12:05 AM

Return to original view | Post

#229

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2015, 12:11 AM Jul 2 2015, 12:11 AM

Return to original view | Post

#230

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2015, 08:41 PM Jul 2 2015, 08:41 PM

Return to original view | Post

#231

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Mayet @ Jul 2 2015, 08:02 PM) If intra switch from eq to bond, i know there is tier charge incur. if yes would it be worth to do so? from EQ to BOND....you obtain credits...TIA Q: How do I gain credit? A: When you switch equity fund (2% sales charge) to lower tier fund (0% to 1.5% sales charge); or lower tier funds to 0%, you will obtain credits accordingly Q: Is credit system applicable to all switching? A: No, Credit system is only applicable to Intra-switch, not for Inter-switch. However, there are certain funds which are not available for Intra-Switch. Please refer to SWITCHING OF FUND FAQ for more information more info... http://www.fundsupermart.com.my/main/faq/faq.svdo?id=2001 |

|

|

Jul 2 2015, 09:08 PM Jul 2 2015, 09:08 PM

Return to original view | Post

#232

|

Senior Member

8,188 posts Joined: Apr 2013 |

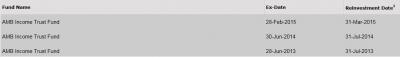

QUOTE(eleven dragon @ Jul 2 2015, 09:01 PM) Ya..im thinking of that too, but it is not written yet in the distribution page..unlike previously they written it clearly. with risk rating 1, it shouldn't drop such a big gap, if it's true drop..that's just too terrible Attached thumbnail(s)

|

|

|

Jul 3 2015, 07:44 AM Jul 3 2015, 07:44 AM

Return to original view | Post

#233

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(guy3288 @ Jul 3 2015, 12:31 AM) My portfolio showed 2 negatives: Am Commodities Eq -7.57% Am Precious metal -6.1% Fed up i top up 5k each for them today. Question is if they go further south, should i top up more? Thanks for anyone care to comment. bcos others does not understand your risk profile/appetite better than you. This post has been edited by yklooi: Jul 3 2015, 08:23 AM |

|

|

Jul 3 2015, 08:48 AM Jul 3 2015, 08:48 AM

Return to original view | Post

#234

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(guy3288 @ Jul 3 2015, 08:34 AM) THanks for all the comments. they had this article Actually i dont really look at the allocation % in each category. Make quite abit, i switch out to CMF. Down quite a bit, i switch in back from CMF. Am commodities is the recommended FSM fund, FSm must have done its homework before listing it as the recommended funds right? It has been negative in my portfolio for quite some time already. 3 Misconceptions Of Our Recommended Funds List http://www.fundsupermart.com.my/main/resea...?articleNo=3983 Frequent switching of funds after they "make quite a bit" to CMF will cost you SC monies when switching into EQ later when the intended EQ fund are "down quite abit". (would be Preferred if you can set a portfolio allocation and stick with it for maybe 3 yrs) IF switching in and out of funds is your likings...try intra switching (EQ to Bond) of the same FH,...when you feels like opportunity comes again..intra switch back to EQ....no SC This post has been edited by yklooi: Jul 3 2015, 08:58 AM |

|

|

Jul 3 2015, 02:29 PM Jul 3 2015, 02:29 PM

Return to original view | Post

#235

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0464sec 0.0464sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 03:00 PM |