QUOTE(moosset @ Apr 10 2020, 03:11 PM)

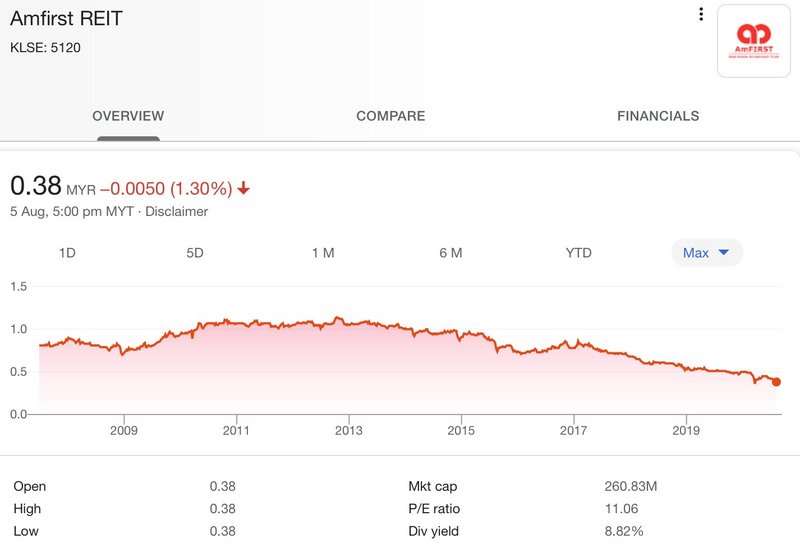

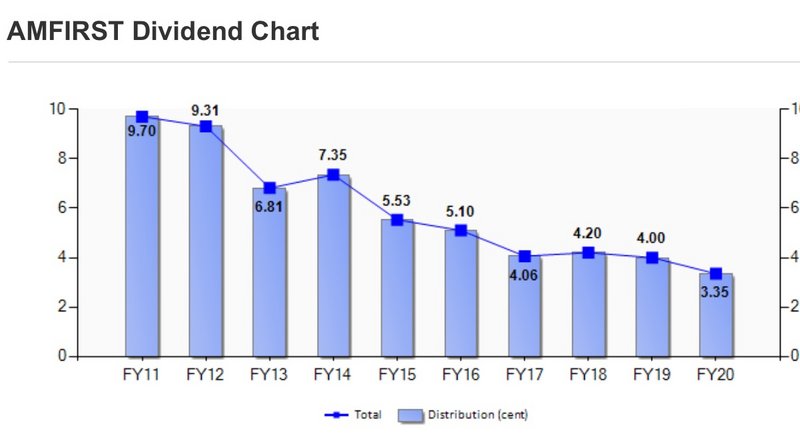

already hold it for a few years. Regret didn't sell when it was RM 2+ ....

there are other attractive stocks now, so want to get out of this and buy something else.

You should sell it when it started to go downtrend. i did. But in fact i regretted also at first.there are other attractive stocks now, so want to get out of this and buy something else.

I have changed my strategy only collect when its low. when it go downtrend, I should not sell it. But now Covid pulak.

Unless the business is bad. As of now, u wont go wrong with SUNREIT, PAVREIT and IGBREIT. Just go there and sit for half day you can tell.

But now Covid so I think its hard. its cheap now but Im not buying until 3Q only decide.

Anyway, its still on the downtrend for most of them, It might/will still go lower I believe.

This post has been edited by knight: Apr 11 2020, 02:19 PM

Apr 11 2020, 02:17 PM

Apr 11 2020, 02:17 PM

Quote

Quote

0.1045sec

0.1045sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled