QUOTE(wil-i-am @ Aug 2 2015, 03:18 PM)

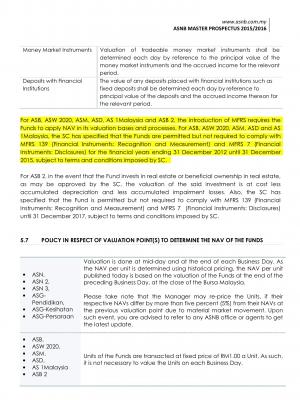

On page 5 of MP, it mentioned 'Pricing - Fixed @ RM1/unit'

All Fixed price funds is not Capital Guarantee

When ASNB launched ASN in 1981, it was Fixed price. Later, they convert ASN from Fixed to Variable price in 1991

Thank you sir.All Fixed price funds is not Capital Guarantee

When ASNB launched ASN in 1981, it was Fixed price. Later, they convert ASN from Fixed to Variable price in 1991

QUOTE(wil-i-am @ Aug 3 2015, 09:34 AM)

During 1991 era, investors of ASN were given a choice to (i) convert from ASN to ASB on 1:1 basis or (ii) stay status quo

Oh..in that case still ok, still can opt to remain in fixed price fund. Not a total conversion.

Aug 3 2015, 10:40 AM

Aug 3 2015, 10:40 AM

Quote

Quote

0.0511sec

0.0511sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled