Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

|

|

Feb 17 2015, 04:11 PM Feb 17 2015, 04:11 PM

Return to original view | Post

#1

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

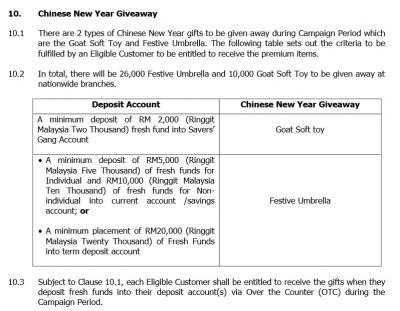

Anybody putting FD for Ambank's "Deposit for gold" promo? 4.08% fo 8 months. Hoping to win some gold

|

|

|

|

|

|

Feb 17 2015, 04:46 PM Feb 17 2015, 04:46 PM

Return to original view | Post

#2

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

Feb 23 2015, 03:16 PM Feb 23 2015, 03:16 PM

Return to original view | Post

#3

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

Today went to Ambank to put FD for the "Deposit for Gold" campaign. Umbrella no stock have to go again next week!

|

|

|

Feb 23 2015, 05:38 PM Feb 23 2015, 05:38 PM

Return to original view | Post

#4

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Momo14 @ Feb 23 2015, 05:15 PM) QUOTE(Bonescythe @ Feb 23 2015, 05:33 PM) Now i feel my bank so lousy.. u all talk umbrella, hamper, chicken essence, diary and so on.. mine ntg.. Umbrella is for everybody la..... I don't have any special accounts.....

More info here (3rd advertisement) : http://www.ambank.com.my/eng/promotions |

|

|

Feb 25 2015, 11:30 AM Feb 25 2015, 11:30 AM

Return to original view | Post

#5

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(BoomChaCha @ Feb 25 2015, 11:25 AM) I received one SMS from Am Bank: Amsignature gets 0.05% higher i.e 4.08 + 0.05%. Can also get umbrella and join the deposit for gold promo AMSignature Priority Banking: Enjoy 4.13% pa (8 months) for min FD/TD of RM 20K. Promo ends 30/4/15. T&C at http://www.ambank.com.my/eng/promotions |

|

|

Feb 26 2015, 11:38 AM Feb 26 2015, 11:38 AM

Return to original view | Post

#6

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

|

|

|

Feb 26 2015, 12:01 PM Feb 26 2015, 12:01 PM

Return to original view | Post

#7

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(giko @ Feb 26 2015, 11:47 AM) Lucky you. I haven't strike any yet! Now no promo yet eh.....Here's the promo for this month = http://www.ptptn.gov.my/web/guest/promosi-ptptn Did you strike this one? = http://www.ptptn.gov.my/docs/PemenangCabut...15_20012015.pdf Yup, that's the one.... Tomorrow going ambank to put more FD and get another umbrella... This post has been edited by kmarc: Feb 26 2015, 12:04 PM |

|

|

Feb 27 2015, 09:30 PM Feb 27 2015, 09:30 PM

Return to original view | Post

#8

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

Mar 8 2015, 11:21 AM Mar 8 2015, 11:21 AM

Return to original view | Post

#9

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

Just wanna a question to our FD kakis/experts here. When you have some savings to put into FD, do you:

1) Straight away go to the bank to put FD or 2) Accumulate more then only put into FD Option (1) will result in many trips to the bank while option (2) makes you lose interest while waiting but results in less trips to the bank. |

|

|

Mar 8 2015, 11:46 AM Mar 8 2015, 11:46 AM

Return to original view | Post

#10

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Bonescythe @ Mar 8 2015, 11:40 AM) QUOTE(Bonescythe @ Mar 8 2015, 11:41 AM) But the hindsight of placing fd online is.. no freebies like umbrella la.. book la.. tumbler la.. but the good one is easy fast n quick n convenient QUOTE(Bonescythe @ Mar 8 2015, 11:44 AM) I got a fren went to place FD in taman connaught bank.. Haha.... I also had to pay RM10 because forgot to put parking ticket.End up placing 10k fd, and get a police saman worth rm 100 as a package as well Online FD is convenient but the interest rates are much much lower, no specialist promotion (e.g. lucky draw, etc) and as you mentioned, no freebies..... |

|

|

Mar 9 2015, 09:41 PM Mar 9 2015, 09:41 PM

Return to original view | Post

#11

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(ultraman29 @ Mar 9 2015, 10:58 AM) for me i count la, if the "trip" is worth the effort to make the extra sum of money. if not much difference but too much trouble, then i skip. QUOTE(aeiou228 @ Mar 9 2015, 12:15 PM) I guess the answer is pretty straight forward. It all boils down to how much is the amount. Yeah, sounds logical. The banks around my area are inconvenient when it comes to parking.....1) Big amount straight way go make placement. 2) Small amount, just accumulate first. For cost of travelling, different ppl different cost. Some ppl zero cost because his work place is walking distance to the banks. If you incur travelling cost, just weight the travelling cost with your potential FD daily interest and see which one more heavy. |

|

|

Mar 10 2015, 02:12 PM Mar 10 2015, 02:12 PM

Return to original view | Post

#12

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

Mar 10 2015, 02:29 PM Mar 10 2015, 02:29 PM

Return to original view | Post

#13

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

|

|

|

Mar 10 2015, 02:50 PM Mar 10 2015, 02:50 PM

Return to original view | Post

#14

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

|

|

|

Mar 29 2015, 10:34 PM Mar 29 2015, 10:34 PM

Return to original view | Post

#15

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

Anybody knows which banks offers the best foreign currency time deposit interest rate for AUD?

Planning to save some AUD for possible use in about 10-15 years. |

|

|

Mar 30 2015, 06:49 AM Mar 30 2015, 06:49 AM

Return to original view | Post

#16

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(gsc @ Mar 29 2015, 11:30 PM) Ocbc used to have the promo of additional 5% for one month foreign currency FD. The promo still on when I checked with Ocbc last month. Some banks give good FD rate but poor exchange rate. This is how these banks taking back the free lunch .....you need to compare the FD and exchange rate as a total package Any good website to check? I find it difficult to hunt for the information on each banks' website. Either I cannot find the information or it is deeply buried somewhere in the website....... |

|

|

Mar 30 2015, 07:29 PM Mar 30 2015, 07:29 PM

Return to original view | Post

#17

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Gen-X @ Mar 30 2015, 09:57 AM) kmarc - so from the above, you can see that going with a bank that offer higher Interest Rate may not be good as their exchange rate may not be favorable to you. Thx for the advices. My aim is to accumulate AUD just in case I send my children to Australia in the future. I was told that if I put in Foreign account FD (i.e. AUD), I can use the money next time without converting back to MYR. At least can earn some FD interest along the way rather than buying foreign currency and keep under the bed growing fungus! Since you are wanting to deposit in AUD long term (up to 15 years - wonder if that bank still around, hahaha) - my advise to you (from my personal experience): 1. is go talk to the banks on their requirements and VERY IMPORTANT how much discount they can offer you for FOREX (usually for amount more than RM20K, they can give you better rates). 2. Start monitoring AUD/MYR (Bloomberg is a good place to start MYR/AUD and then go for interactive chart which gives you by the minute, hour, daily and monthly updates and you will then get a feel what DAY of the week and best TIME to exchange AUD with our local banks where they update at least twice a day). For your info, I manage to TT AUD/MYR back in January at 2.79 (with UOB which is the lowest rate I have gotten so far in the last 3 years) - that's 3.49% lower than current conversion rate which is better than any AUD FD rates currently! Point is, convert at low FOREX rate and it will give you more AUD in the long run. 3. Start reading Australia news portal Business Section to get a feel where the exchange rate is heading. Every 2 weeks you will see some comments on statement made by Reserve Bank of Australia (RBA). As my time period is 10-15 years, I'm not too concern about fluctuating AUD although dropping MYR is a concern. It would be something like DCA. At the end of the day, I want to have some foreign currency to use. Maybe you can blog on the topic "Best methods to save foreign currency for future use". This post has been edited by kmarc: Mar 30 2015, 07:32 PM |

|

|

Mar 30 2015, 09:01 PM Mar 30 2015, 09:01 PM

Return to original view | Post

#18

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Gen-X @ Mar 30 2015, 08:40 PM) Bro, true you can transfer the money in the future without converting to RM. Yup, I do understand that we don't have a crystal ball to see how the future will be like. Like most people, I won't be putting all in one basket. Diversify some into AUD. If AUD appreciate, I'm happy. If it goes down, what to do...... Since you are new to AUD thingy, like I said, go monitor.... read news about AUD and see charts. I can't advise you or anyone on Foreign Currency as to me it is gambling. I don't know the future. I am sure you heard many people who bought USD at 3.8 during the late 90s and was kicking themselves for years, now more than 17 years (ignoring the years our RM was pegged), USD/MYR have yet to reach 3.8!!! Well, it may soon, but if the guy had deposited the money in RM in our FD 17 years ago, today he will have more than two times USD! If you had deposited money into AUD FD last year or two years ago and the money still in AUD today, you'll be kicking yourself because AUD has depreciated more than 10% or even 20%. Like I said, go see interactive chart.... try to get a feel... your objective and mine are the same, to get as much AUD from our RM. I mentioned this before, AUD/MYR went as low as 2.3 back in 2009, but I not so greedy..... I hoping for 2.5 so that I can convert more RM to AUD and go buy property there and it's like getting 20% discount from today's rate. But if it never reaches 2.5 but go back up to 3.3, then too bad for me, hahaha. Like I said, it's gambling. And you mentioned JUST IN CASE send your children to Australia, what if you sent them elsewhere? 15 years a long time. Maybe then... SGD/MYR is at 1.0 and AUD/MYR at 1.5, like 40 years ago Having said the above, I guess many people are converting their RM into other currencies .... and there is no right or wrong but matter of timing only. Oh yes, like I mentioned earlier, which bank gives you the best interest rate plus taking into consideration of the "discount" when converting. I chose AUD at the moment because some cities in Australia looks good as a place for education as well as retirement. Who knows, maybe next time I change my mind but that's not a big problem as I have many eggs in the basket. |

|

|

Mar 30 2015, 09:42 PM Mar 30 2015, 09:42 PM

Return to original view | Post

#19

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Gen-X @ Mar 30 2015, 09:19 PM) Yah, what you said in the first paragraph is a fact and based on current situation, a smart move. Ouch! Didn't realize that Australia would be an expensive place to retire. Will look into that. Maybe retire somewhere else and go Australia for vacation. As for retirement? You got Visa to retire there? If no, you better got tons of money for medical bills for your old age. Got few millions of AUD to invest now, you can easily get a VISA with no age limit. But that may change soon, e.g. Canada just stopped their investment Visa and Singapore couple years back. I tell you, freaking expensive place for a retiree. There, everything goes up on 1st January of every year. They adjust everything based on inflation rate. Today, I just read the Australia government discussing about raising GST again. Yes, Australia does have several world's top ranked universities, but depending on what degree one graduates with now, finding a job there is not easy for years to come, their unemployment rate is at record high currently. 15 years time maybe boom again and jobs plentiful. And in my article A Little Bit Of This and A Little Bit Of That - Volume I, Chapter VIII - I mentioned I was lucky, I had no knowledge where USD/MYR was heading when I sent my son to US in 2009 and AUD/MYR too when I decided to sent my daughter to Melbourne 3 years back. Turned out, luck was on my side and I got to save some RM. YES, FD interest rates better than Savings Account. FREE money you don't want? hahaha. Anyway, will study further on Foreign currency FD accounts of different banks. Thx for your insight. |

|

|

Apr 3 2015, 08:43 PM Apr 3 2015, 08:43 PM

Return to original view | Post

#20

|

|

Elite

14,576 posts Joined: May 2006 From: Sarawak |

QUOTE(Gen-X @ Apr 3 2015, 06:31 PM) kmarc and AVFAN - AUD/MYR went below 2.8 yesterday and getting nearer to 5 year low (2.72). If go below 2.72, then it is getting nearer to my target of 2.5, but then maybe I will turn extremely greedy and hope for 2.3, hahaha. |

|

Topic ClosedOptions

|

| Change to: |  0.0566sec 0.0566sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 03:38 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote