The hidden costs of investing in US equity ETFs

Experts point out that it is not all about the fees. There are also currency, trading costs, spreads and tax considerations

by Emma Boyde (AN HOUR AGO)

QUOTE

Checking your investments too often can be a good way to end up out of pocket.

This wisdom, gained from behavioural finance experiments showing that too much information leads to “myopic loss aversion”, could lead investors to believe they should just “set it and forget it”. However, experts insist you should know what you own, and even if you want to retain the same exposure, you should check to see if there is now a cheaper way of doing so.

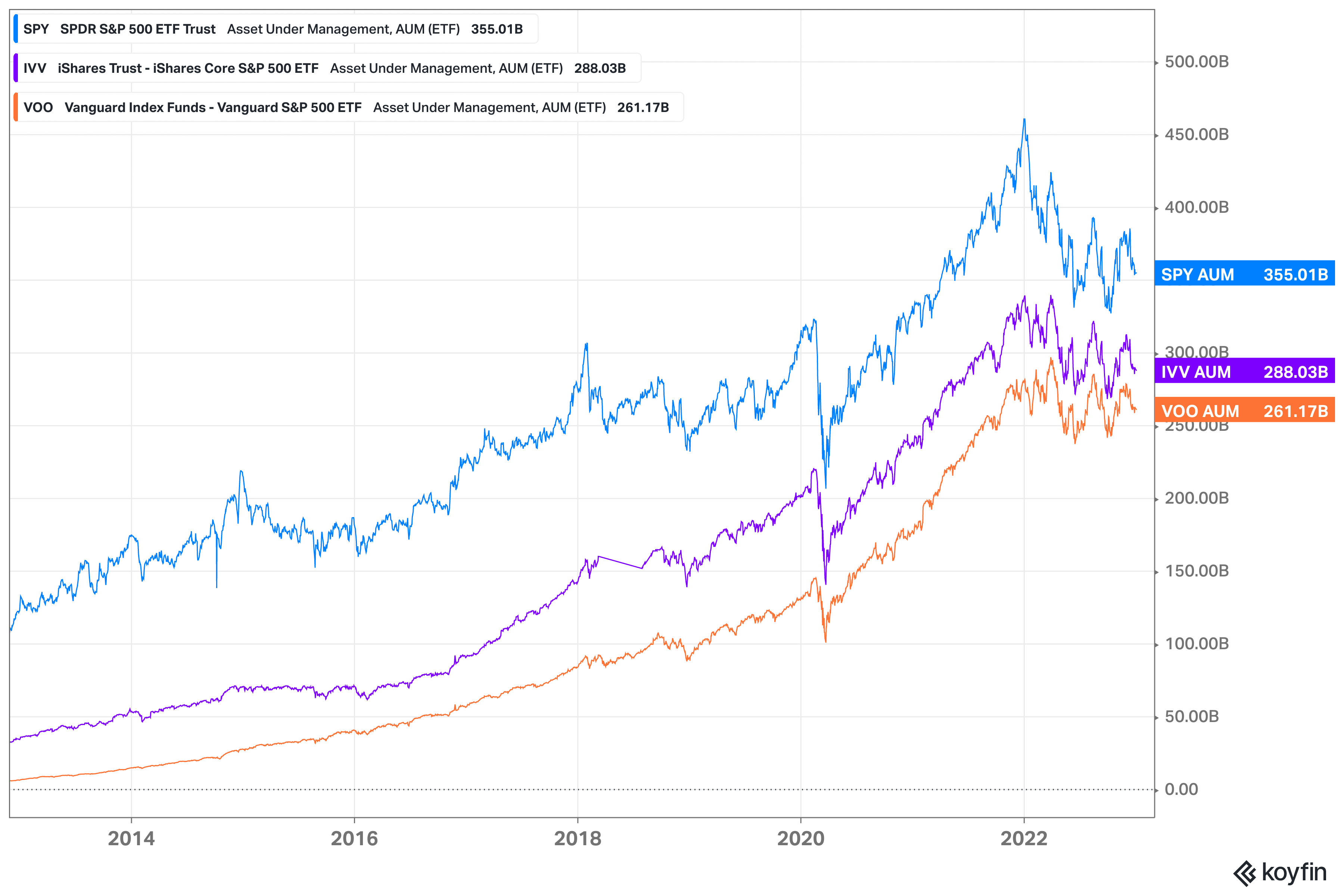

In the fast-evolving investment fund industry, this can often be the case. First, exchange traded funds usually offer much lower fees than their mutual fund counterparts, and this partly explains why they continue to grab market share. But even within the ETF market, price competition has been fierce, so it is worth checking whether a lower-fee version of the ETF you already own has been launched.

Then, after looking at fees, the decisions become increasingly complex, experts warn, and there are additional considerations if you are an overseas investor of a US equity fund.

First, you should consider the cost of moving to another fund with the same exposure.

There will be trading fees to consider. If your original investment has appreciated significantly in price, there could be a parallel significant capital gains tax to pay.

Investors should also think carefully and seek advice on choosing their desired fund.

“When investors are thinking about funds, they should think about several factors after they have worked out their desired exposure. These include currency, fees, trading spreads and tax considerations,” said Brett Pybus, head of iShares Emea investment and product strategy.

He points out that it can be a complex task to balance all of these costs and there is no one-size-fits-all advice to give an investor because it depends on their individual circumstances.

However, Pybus said that tax was something investors frequently overlooked.

“The behaviour we observed in the past is that people tended to look for the largest and most liquid product and tended to ignore tax complications, but clients we speak to today understand why we have developed different ETFs with the same exposure,” Pybus said.

For investors intent on gaining exposure to US equities, an important factor to look out for is withholding tax on dividends.

When a US company pays a dividend to a non-US citizen, a 30 per cent tax rate applies, although many overseas jurisdictions have a treaty that halves this to 15 per cent, Roger Wise, tax partner at law firm Willkie Farr & Gallagher, explained. The tax applies to distributions by US ETFs and mutual funds.

The dividend tax burden helps to explain why there are far more Ireland-domiciled Ucits ETFs — Ireland benefits from the tax treaty — than Luxembourg-domiciled Ucits ETFs, which have to pay the full amount.

“A US ETF or mutual fund is not necessarily tax-efficient for a non-US investor,” Wise said.

Nonetheless, investors who have genuinely taken the set-it-and-forget-it advice might still own the US-domiciled versions of US equity ETFs, which predate their overseas-domiciled counterparts. This ownership is another thing to think carefully about. While you could save by moving to an Ireland-domiciled Ucits ETF, for example, you would still face capital gains tax when you sell your original holding.

Also, while an investor might end up better off tax-wise by investing in a non-US-domiciled fund, they might lose out in terms of liquidity and fees.

A fund with higher liquidity might have narrower spreads, lowering the cost of trades, Wise pointed out. But it depends on how much you intend to trade — for most self-directed retail investors, who are trading in relatively smaller amounts, liquidity might be a relatively insignificant factor.

When balancing tax considerations, there are further complexities relating to your intermediary, for example if you have US equity exposure through a pension scheme or insurer.

Pension plans and other institutions such as sovereign wealth funds will rely on their own tax status and might be able to avoid paying US withholding tax, but not all institutions have this status.

“Not all institutions and countries are tax exempt. All pension funds might not have agreements and many private banks, for example, can certainly be liable to withholding tax,” said Keshava Shastry, global head of capital markets for DWS, an asset manager.

For investors based in the US and Europe, there are well-established locally listed ETFs that offer investors the ability to invest across the globe. For investors in some markets in Asia and Latin America, it might be that holding a Ucits ETF is tax-efficient for some exposures, such as US equities, away from their home markets.

“We always say investors should know what they own. And for ETF investors, that also means looking at the domicile of the ETF they hold,” Pybus said.

This wisdom, gained from behavioural finance experiments showing that too much information leads to “myopic loss aversion”, could lead investors to believe they should just “set it and forget it”. However, experts insist you should know what you own, and even if you want to retain the same exposure, you should check to see if there is now a cheaper way of doing so.

In the fast-evolving investment fund industry, this can often be the case. First, exchange traded funds usually offer much lower fees than their mutual fund counterparts, and this partly explains why they continue to grab market share. But even within the ETF market, price competition has been fierce, so it is worth checking whether a lower-fee version of the ETF you already own has been launched.

Then, after looking at fees, the decisions become increasingly complex, experts warn, and there are additional considerations if you are an overseas investor of a US equity fund.

First, you should consider the cost of moving to another fund with the same exposure.

There will be trading fees to consider. If your original investment has appreciated significantly in price, there could be a parallel significant capital gains tax to pay.

Investors should also think carefully and seek advice on choosing their desired fund.

“When investors are thinking about funds, they should think about several factors after they have worked out their desired exposure. These include currency, fees, trading spreads and tax considerations,” said Brett Pybus, head of iShares Emea investment and product strategy.

He points out that it can be a complex task to balance all of these costs and there is no one-size-fits-all advice to give an investor because it depends on their individual circumstances.

However, Pybus said that tax was something investors frequently overlooked.

“The behaviour we observed in the past is that people tended to look for the largest and most liquid product and tended to ignore tax complications, but clients we speak to today understand why we have developed different ETFs with the same exposure,” Pybus said.

For investors intent on gaining exposure to US equities, an important factor to look out for is withholding tax on dividends.

When a US company pays a dividend to a non-US citizen, a 30 per cent tax rate applies, although many overseas jurisdictions have a treaty that halves this to 15 per cent, Roger Wise, tax partner at law firm Willkie Farr & Gallagher, explained. The tax applies to distributions by US ETFs and mutual funds.

The dividend tax burden helps to explain why there are far more Ireland-domiciled Ucits ETFs — Ireland benefits from the tax treaty — than Luxembourg-domiciled Ucits ETFs, which have to pay the full amount.

“A US ETF or mutual fund is not necessarily tax-efficient for a non-US investor,” Wise said.

Nonetheless, investors who have genuinely taken the set-it-and-forget-it advice might still own the US-domiciled versions of US equity ETFs, which predate their overseas-domiciled counterparts. This ownership is another thing to think carefully about. While you could save by moving to an Ireland-domiciled Ucits ETF, for example, you would still face capital gains tax when you sell your original holding.

Also, while an investor might end up better off tax-wise by investing in a non-US-domiciled fund, they might lose out in terms of liquidity and fees.

A fund with higher liquidity might have narrower spreads, lowering the cost of trades, Wise pointed out. But it depends on how much you intend to trade — for most self-directed retail investors, who are trading in relatively smaller amounts, liquidity might be a relatively insignificant factor.

When balancing tax considerations, there are further complexities relating to your intermediary, for example if you have US equity exposure through a pension scheme or insurer.

Pension plans and other institutions such as sovereign wealth funds will rely on their own tax status and might be able to avoid paying US withholding tax, but not all institutions have this status.

“Not all institutions and countries are tax exempt. All pension funds might not have agreements and many private banks, for example, can certainly be liable to withholding tax,” said Keshava Shastry, global head of capital markets for DWS, an asset manager.

For investors based in the US and Europe, there are well-established locally listed ETFs that offer investors the ability to invest across the globe. For investors in some markets in Asia and Latin America, it might be that holding a Ucits ETF is tax-efficient for some exposures, such as US equities, away from their home markets.

“We always say investors should know what they own. And for ETF investors, that also means looking at the domicile of the ETF they hold,” Pybus said.

Source: https://www.ft.com/content/b28f80ed-9a54-4e...36-0be6a7ed6f23

Dec 23 2022, 10:28 AM

Dec 23 2022, 10:28 AM

Quote

Quote

0.1075sec

0.1075sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled