QUOTE(Dealus @ Nov 25 2019, 09:39 AM)

Hi guys, I've got TradeStation and Instarem set up but I'm struggling to identify all the steps needed to transfer the funds into my TradeStation account.

My current situation and assumptions are

1) I'm accessing TradeStation through IB's website and there I need to initiate a 'Wire' deposit request (Sending Institution : Instarem, Account Number : NA, Nickname : Instarem)

2) Get 'Wire' transfer details (e.g. ABA Routing Number, Bank Account) from IB to be inserted in Instarem

3) In Instarem, state recipient as 'corporate', bank in USA, company name - Interactive Brokers UK Limited, ACH number based on ABA Routing Number in IB, Bank Address in UK

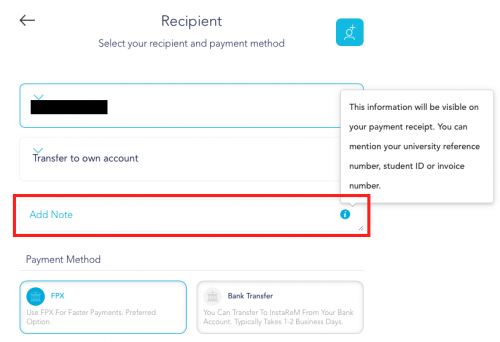

4) I don't see a section in Instarem to insert my IB account reference (e.g. U3297777 / Lucas Ah Chong)

Can someone validate this please? Or some step by step guide? Thanks!

For #4 should be this section:My current situation and assumptions are

1) I'm accessing TradeStation through IB's website and there I need to initiate a 'Wire' deposit request (Sending Institution : Instarem, Account Number : NA, Nickname : Instarem)

2) Get 'Wire' transfer details (e.g. ABA Routing Number, Bank Account) from IB to be inserted in Instarem

3) In Instarem, state recipient as 'corporate', bank in USA, company name - Interactive Brokers UK Limited, ACH number based on ABA Routing Number in IB, Bank Address in UK

4) I don't see a section in Instarem to insert my IB account reference (e.g. U3297777 / Lucas Ah Chong)

Can someone validate this please? Or some step by step guide? Thanks!

*Disclaimer: I myself transfer to my own SG account first and do a FAST transfer to IB's SG Citibank

Nov 25 2019, 07:24 PM

Nov 25 2019, 07:24 PM

Quote

Quote 0.0939sec

0.0939sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled