QUOTE(Ramjade @ May 26 2019, 08:18 PM)

BlueStacks? I can't even do Google 2FA with it - I'm guessing it's missing some device ID crucial to identify it as a unique deviceAll about ETFs / Foreign Brokers, Exchange traded funds

All about ETFs / Foreign Brokers, Exchange traded funds

|

|

May 26 2019, 09:37 PM May 26 2019, 09:37 PM

Return to original view | Post

#21

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jun 18 2019, 09:21 PM Jun 18 2019, 09:21 PM

Return to original view | Post

#22

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Chounz @ Jun 18 2019, 04:47 PM) hi all Sifus, would like to know is it only IB and Captrader can link to SG Bank account? wanna save some bank charges when doing TT. IB, CapTrader, TradeStation all the same. For FAST transfer source from a SG bank you can create a Wire type deposit notification.I hav an account with traderstation but cant link to SG Bank account. So the only way to fund is through wire transfer. Or any cheap way to deposit fund? interactivebrokers.com -> top right Login -> Web Portal -> Transfer & Pay -> Transfer Funds -> Choose a New Deposit Method -> SGD -> Wire It will display to you the account number unique to you, also make sure in transfer message to recipient you enter your account and/or your name This post has been edited by roarus: Jun 18 2019, 09:21 PM |

|

|

Jun 21 2019, 10:43 PM Jun 21 2019, 10:43 PM

Return to original view | Post

#23

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Jun 20 2019, 07:41 PM) hyperzz, rjb123, roarus you know of any ETFs which track the dividend aristocrats/champions that's on LSE? I only know of one. I'm assuming specifically you're referring to S&P Dividend Aristocrats?Not that I know of, quick search returned one that tracks the exact index by SSGA/SPDRS - which is likely the one you know. Any reason you're looking for something that holds high yield USA stocks? Even at 15% rate, it's still a huge chunk of return withheld by Uncle Sam. This post has been edited by roarus: Jun 21 2019, 10:43 PM |

|

|

Jun 21 2019, 11:57 PM Jun 21 2019, 11:57 PM

Return to original view | Post

#24

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Jun 21 2019, 10:50 PM) Actually what I know of is only UDVD. Was thinking if there are alternatives. I am open to ideas than UDVD That's the SSGA one. Very briefly the list is described as high yield counters that has increasing dividend payouts for the past 25 years.I like dividend investing and if I can get dividends aristocrat of US at 15% tax vs 30% tax why not? For one you'll be missing out on: i. counters that might not give returns in dividend but in capital gains ii. or counters with relatively good yield but not consistently increasing ii. young companies Perhaps consider the fact that there are some regions e.g. Malaysia, Singapore, HK that you should be chasing dividends while for others it's better to go for cap gains? After all, we aren't subject to US cap gains Looking up UDVD on Yahoo! Finance also suggests VHYD by Vanguard, it's a wider net All World High Yield instead of just US focused. Both UDVD and VHYD have volume, though the spread is subjective to one's acceptance. |

|

|

Jun 22 2019, 09:43 AM Jun 22 2019, 09:43 AM

Return to original view | Post

#25

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Jun 22 2019, 07:17 AM) Money is not yours until is in your bank account. Depends on what you do with that dividend money. If in accumulating phase you're pouring it back to the same fund, you'll be equally exposed to drawdowns as a non distributing fund. But if you would like the flexibility to take the money as annual vacation or put it in other investment baskets, you're not wrong too.With dividend stocks/ETF definitely there's a pay. So far the dividend aristocrats have outperform the s&p500. My personal preference is having an accumulating fund where available, rebalance semi-annually during my accumulating phase. Once retired I'll just drawdown the same time I've been rebalancing semi-annually. You may play around with SPY vs SDY at portfoliovisualizer.com. You can compare as far back as 2006 to cover the 2008 crash. However to get actual total returns for us Malaysian tax payer you'll have to manually factor in the WHT from the income returns. |

|

|

Jul 2 2019, 11:58 PM Jul 2 2019, 11:58 PM

Return to original view | Post

#26

|

Senior Member

1,042 posts Joined: Jan 2003 |

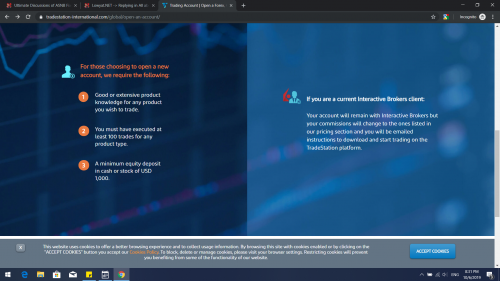

For those hoarding/farming cash to meet minimum opening amount, TradeStation Global initial deposit lowered to $1000

Source: main page latest news carousel, their FAQ still states $5000 https://www.tradestation-international.com/global/ |

|

|

|

|

|

Jul 8 2019, 09:41 PM Jul 8 2019, 09:41 PM

Return to original view | Post

#27

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(toiletking2006 @ Jul 8 2019, 08:43 PM) May i know what document u submited for the proof of identity? I recall submitting IC as well, mine is the new type with small black white photo if it helps in any way.i uploaded my IC, however was rejected, stating it wasnt signed. Update: Found the image - Submitted black and white version, crossed with "FOR INTERACTIVE BROKERS USE ONLY" on top left corner, front and back in a single image. Perhaps the signature behind is the one they want? This post has been edited by roarus: Jul 8 2019, 09:44 PM |

|

|

Jul 9 2019, 09:47 PM Jul 9 2019, 09:47 PM

Return to original view | Post

#28

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Jul 16 2019, 11:07 PM Jul 16 2019, 11:07 PM

Return to original view | Post

#29

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(chickenessence @ Jul 16 2019, 10:50 PM) Signature at the back? is that your signature or "ketua pengarah pendaftaran's ". Mine's the ketua pengarah pendaftaran's signature. Don't see why they need your handwritten signature, their online forms signature requirement is just you typing your name in a textfield.Anyway, i believe they wanted client's signature. |

|

|

Aug 11 2019, 05:01 PM Aug 11 2019, 05:01 PM

Return to original view | Post

#30

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Sumofwhich @ Aug 10 2019, 06:38 PM) Regarding boglehead 3-funds, are you investing in these 3 or other equivalent ETFs? The idea behind this is:Vanguard Total Stock Market Index Fund (VTSAX) Vanguard Total International Stock Index Fund (VTIAX) Vanguard Total Bond Market Fund (VBTLX) Vanguard Total Stock Market Index Fund (VTSAX) - USA equity (home equity) America's equity represents roughly 50% of the weighted world market*. Vanguard Total International Stock Index Fund (VTIAX) - Excluding USA equity (outside home equity) The other half of the equity pie: ex-USA market Vanguard Total Bond Market Fund (VBTLX) - Bonds/Fixed income (Government security and/or corporate investment grade) Treasury (US Gov bonds) or corporate bonds *Based on rough 9:1 ratio of developed:emerging market weightage, with US weighing at 60% of developed market Based on the basic building block: 1. Equity - Local For Malaysians, our home equity represents less than 0.01% of the weighted world market*. Holding 0% is a valid possibility. Choices - note: our local ETFs blow, so alternatively: i. Stocks If you have roughly 800k-900k to blow, you can buy all 30 shares from KLSE 30 and mimic their actual index weight or You can even buy equally top 4 or 5 of KLSE 30 since they represent 35%-40% weightage of the index ii. Unit trust (including fixed price Amanah Saham) I have some of both, and treat Amanah Saham as a separate no withdrawal till retired bucket. 2. Equity - International The big ocean outside Malaysia. Holding 100% equity weight in world index is a possibility. Choices: i. Unit trust ii. Foreign ETF I personally went with developed world index, I have enough (or too much I feel) emerging market exposure via my local stocks + PRS (asia pac ex japan). Personal punt - I also went with a little Singapore index, since I see Malaysia and Singapore as neighbouring residents of the same 'taman' but will always thrive/be the more successful of the two. 3. Fixed income Now this one where we have advantage, because pension is not mandatory in the US. Malaysians may treat EPF as this pie - conventional accounts have guaranteed 2.5% annual returns and the value does not shrink during downturn. Based on the above, one can also include Amanah Saham fixed price funds in the same category. Choices: i. EPF (self contribution up to 60k per calendar year) ii. FDs (do try to shoot for promo rates only) iii. Unit trust (including fixed price Amanah Saham) iv. Directly held Malaysian Government Security (MGS) v. Foreign ETF I hold Islamic bond fund unit trust with a mix of MGS and investment grade corporate bonds. I'll likely glide a chunk of my international equity towards international corporate bonds later nearer to my retirement. I treat EPF as a separate no withdrawal till retired bucket. tldr: Malaysians can probably just hold 1 world index fund via a foreign ETF like IWDA or VWRD and call it the day |

|

|

Aug 21 2019, 02:07 PM Aug 21 2019, 02:07 PM

Return to original view | Post

#31

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(TOS @ Aug 19 2019, 03:57 PM) Now I have a clearer view. For TradeStation Global the commission for USD denominated ticker is the equivalent of GBP1.50 or 0.12% whichever is higher.Regarding Captrader and Tradestation, I am fine with both brokers and the fees seem low. The thing is, I don't know how much is the commission charges for USD-denominated ETF on LSE and SIX? The brokers only give GBP and euros for trade commissions in LSE and SIX respectively. Does that mean that I need to pay the commissions in pounds or euros to buy USD-denominated UCITS? Thanks for the help everyone. For the past few buys I've been charged USD1.91 to buy an ETF via LSE. |

|

|

Aug 24 2019, 03:49 PM Aug 24 2019, 03:49 PM

Return to original view | Post

#32

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Kudo2012 @ Aug 24 2019, 12:03 PM) Base currency doesn't affect anything (to us Malaysians at least). It's more to reference your portfolio or report in your 'home currency'. But since MYR is not available, either USD or SGD will still look 'alien' to us anyways. You can change your base currency in account settings.You're free to fund and convert to other currency outside your selected base currency as well. |

|

|

Aug 24 2019, 09:16 PM Aug 24 2019, 09:16 PM

Return to original view | Post

#33

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Kudo2012 @ Aug 24 2019, 06:42 PM) I checked the bank account provided, the currency is in USD. This should give you give you the appropriate Citibank NA Singapore to transfer to for SGD:is there any method I can fund the 1st fund to their bank acc in SG? Wire Funds to Citibank N.A. 111 Wall Street New York 10005 United States ABA Routing Number 021000089 SWIFT/BIC Code CITIUS33XXX Bank Account Title & Address Interactive Brokers (U.K.) Limited Level 20 Heron Tower 110 Bishopsgate London EC2N 4AY Bank Account Number XXXXXXX https://www.interactivebrokers.com.au/sso/Login -> Transfer & Pay -> Transfer Funds -> Choose a New Deposit Method -> SGD -> Bank Wire QUOTE(Ramjade @ Aug 24 2019, 08:49 PM) Of course la good. But for those clearing fees is practically negligible. I'm not too sure if it applies to Interactive Brokers UK Ltd though: https://ibkr.info/node/2012Custodian. You can get like a CDS for overseas stock brokerage. Worried about what happen to your money? Read here. All answered in the link below. https://www.interactivebrokers.com/en/index.php?f=2334 No need to open both. Both account is owned by interactive broker. Makes no difference. Pick one. If you really want to split go with Charles schwab better. Cheaper than TD Ameritrade. For me I will am not worried about IBKR as 1) they are well capitalised 2) protected by FDIC (US insurance like our PIDM) In any case I'll err on assuming UK's FSCS with lower limits instead. This post has been edited by roarus: Aug 24 2019, 09:41 PM |

|

|

|

|

|

Aug 25 2019, 06:29 PM Aug 25 2019, 06:29 PM

Return to original view | Post

#34

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Zegoon681111 @ Aug 25 2019, 03:58 PM) Happy Sunday guys! I'm collecting IWDA (USD, LSE). It tracks ~1,600 stocks from developed countries in the world, of which about 60% comprises of S&P 500 companies (followed by Japan & UK).besides SXR8, any other funds that you guys can recommend to buy (or the one that you are currently holding) and hold for long term? Thanks guys? I benefit less if S&P 500 charges on for the next 3 decades until my retirement, but I'm still covered in the event it loses steam. I also benefit a little if ever an emerging (developing) country like Malaysia decides to finally 'emerge' into developed status. |

|

|

Aug 26 2019, 11:09 AM Aug 26 2019, 11:09 AM

Return to original view | Post

#35

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(chickenessence @ Aug 25 2019, 07:49 PM) Hi Roarus, It's the same underlying fund overall, just fund and buy in whichever currency you have/convenient for you.Is there any other ETF similar to IWDA, but in other currency like GBP or EUR? Or it is more advisable to stay with IWDA, in USD? I go with USD because: i. I fund via SG bank and convert ii. LSE having more volume iii. Live data from google finance QUOTE(rjb123 @ Aug 25 2019, 07:51 PM) https://www.ishares.com/uk/individual/en/pr...ts-etf-acc-fund It’s traded in different currencies too |

|

|

Aug 29 2019, 05:39 PM Aug 29 2019, 05:39 PM

Return to original view | Post

#36

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Kvasir @ Aug 29 2019, 04:55 PM) Greetings guys, For Interactive Brokers the $10,000 initial deposit condition has been removed. But there's min commission:I'm interested in starting long term investment in blue chip dividends. It is also my first time into this kind of stuff. I've googled and youtubed myriad of ways to get a start with low capital. (Foot in the door) I looked up RobinHood, M1 Finance, Ameritrade, Interactive Brokers. I think RobinHood and M1 Finance was easy to understand, but unfortunately its for US people only Ameritrade I'm looking into but the broker fees are stopping me as I don't have a good capital yet. Interactive Brokers I'm confused, if they still require the 10kUSD starting fee.(Contradicting info) I'm looking into Utrade now (UOB Kay Hian) and plan to visit their HQ in KL to setup a CDS account and get some understanding. ------------- Basically what my plan is to Buy and hold stocks for dividends over time in Dividend Aristocrats. Possibly for 25 years. I would prefer US markets. I need advice/ideas on how should I go about this. It would be nice to be able to trade on mobile phone but most of the apps are US only. Hope to hear from you all, Thank you AUM < 2,000: $20 per month AUM < 100,000: $10 per month AUM: cash + value of securities Min commission: Min trade examples:- i. if you don't do anything, you pay $10 ii. if you only deposit and convert currency @ $2, you pay $10 iii. if you make several currency conversion + trades worth totalling $12.5, you pay $12.5 So it all boils down to how often and how much you plan to invest each time, you can draw up an excel to compare between brokers. For dividend counters, I assume you know about withholding tax that applies for holding US securities. |

|

|

Aug 29 2019, 09:55 PM Aug 29 2019, 09:55 PM

Return to original view | Post

#37

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Kvasir @ Aug 29 2019, 05:51 PM) Withholding tax I understand, also need to fill up w-8ben-e right? When you open an account you'll fill up a form declaring which country tax payer you are and whether you're a considered a US person. Specifically, W8BEN is what you fill in when you declare yourself as a non resident, non US tax paying person residing outside of US.But how do they deduct? Direct from the CDS account? How do I pay for that tax? With that info your broker should withhold the right amount. |

|

|

Oct 6 2019, 09:40 PM Oct 6 2019, 09:40 PM

Return to original view | Post

#38

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(TOS @ Oct 6 2019, 08:35 PM) Ok, so I checked Tradestation global and it says I need to fulfill these conditions: It's part of their due diligence/cover-ass. Just say you have done that many trades, they don't ask for proof. The 2nd one does not apply to me though. So, how to open an account with them then? And for my case, can I just assume that I am a Malaysian opening an account although I have a HKID and will stay in HK for quite some time (won't stay for long at most 4-5 years). But I have enough HKD to convert into USD and it can be done easily here in HK. Maybe I shall open an account in Malaysia. Can someone share the process of opening an account at Tradestation Global in Malaysia and their experience? Thanks and much appreciated. From start to end expect about 3-5 days. Fill up the online form, and wait for them to verify 1 round before enabling document upload (mykad/proof of identity). Then after uploading another 1-2 days, you'll be able to login to customer portal and fund your account in whichever major convertible currency you prefer. |

|

|

Oct 25 2019, 01:30 PM Oct 25 2019, 01:30 PM

Return to original view | Post

#39

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(esyap @ Oct 25 2019, 01:24 PM) Huh, can open Singapore bank account via online? That will be good. Please share more info. Boss Thanks Have a look through this thread https://forum.lowyat.net/topic/1440794Your options: i. Maybank iSavvy - need to submit at local Maybank branch, comes with no annual fee debit card. Can do initial deposit with SGD bank draft or remittance service like Instarem ii. Cimb FastSaver - fully online, initial deposit you can bite the bank rate and transfer from CIMB Malaysia account or from your Maybank Singapore account if you plan to have both |

|

|

Oct 30 2019, 08:40 AM Oct 30 2019, 08:40 AM

Return to original view | Post

#40

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Oct 30 2019, 01:45 AM) dwRK, roarus, rjb123 any idea if we used US brokerage like IB but we did not buy/hold US stocks, are we subjected to >60k US estate tax? QUOTE(dwRK @ Oct 30 2019, 06:19 AM) Your account is with Tradestation Global... a UK company... introducing broker to IBKR UK... I'd assume it follows UK law not US... ^ That.AFAIK... for NRA IBKR US account, estate tax not applicable to non-US stock/etf, and $ deposits... Imho...teach your spouse/kids how to online like you... But in event you run into the nice problem of having a large enough account and transferring to IB LLC - non US domiciled securities are not subject to 60k estate tax. I believe directly held US treasuries are exempted as well |

| Change to: |  0.0791sec 0.0791sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 03:53 PM |