Hi all,

I'm a newbie into foreign investments and would like some advice and to confirm my understanding.

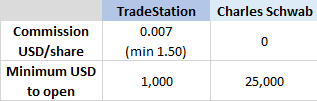

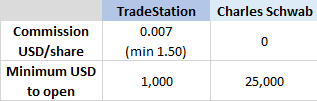

I'm currently looking into TradeStation and Charles Schwab.

From my understanding:

1. With a

Charles Schwab account, I can trade US stock with no commission fee?

If I buy 1 share of a USD 8.00 stock, I spend exactly USD 8.00?

2. With a

TradeStation account, what does "minimum per order of USD 1.50" mean?

Is it:

A) If I buy 1-214 shares, I pay a flat USD 1.50 for commission fee.

or

B) I MUST purchase at least 215 shares and be charged USD 1.50 for commission fee.

3. With a

Charles Schwab account, I can only trade US stock. With a

TradeStation account, I can trade stock in US, EU, UK, AU, HK, JP, SG etc.

4. Both

Charles Schwab and

TradeStation have 0 platform fees.

Please correct me if I'm wrong

1. No commission, but I think pay some cents for network/routing/exchange fee... tradestation also have to add on. Check fine print.

2. A

3. Charles Schwab got international brokering but expensive. Only US stocks no commission.

4. Yup

Oct 8 2019, 09:02 PM

Oct 8 2019, 09:02 PM

Quote

Quote

0.0225sec

0.0225sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled