QUOTE(theanine @ Sep 2 2020, 09:18 PM)

Thanks for the suggestions!

I heard about Stashaway but I think it is good for small amount. But for big amount, I would rather use a reputable broker or bank. I dislike Stashaway 1% commission and its a robo-advisor so its a relatively new thing to put a big amount into it.

I will think about TD though, looks like a solid choice.

Also, i believe TD charge 30% dividend right? How would it affect the return? Or is there a plan to reinvest the dividend so i don't get taxed.

Stashaway custodian is Saxo bank.

Endowus custodian is UOB Kay Hian.

So up to you to believe if they are safe or not.

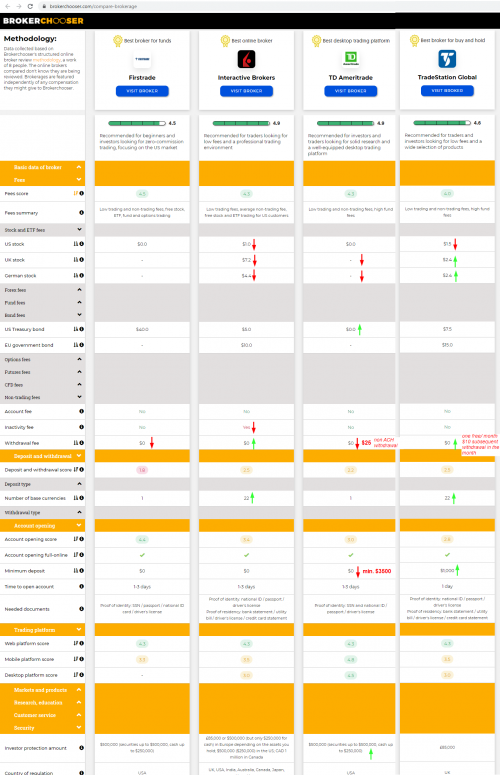

IB and TD are more or less the same. For me, I lean more towards IB cause IB is better than TD in every way except for the looks.

You cannot run away from 30% dividend tax unless you are no longer malaysian citizen. Whichever broker you choose you still get hit with the 30% dividend tax.

That's why majority of people don't invest in US for dividends. Can be done but not many people doing it. People go for capital appreciation cause no tax.

Even if reinvest, you will get slapped with 30% tax before you get to auto reinvest.

Three ways around it

1. Throw away your IC and become a citizen of another country with tax treaty with US and get taxed only 15%.

2. Buy ireland domiciled ETF/unit trust (you can DIY by buying off London Stock exchange, TD does not support LSE but IB does) or use Endowus to do it for you.

3. Don't bother about dividends in US and focus on capital appreciation.

This post has been edited by Ramjade: Sep 2 2020, 09:27 PM

Jul 4 2020, 12:50 PM

Jul 4 2020, 12:50 PM

Quote

Quote

0.0950sec

0.0950sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled