Greetings guys,

I'm interested in starting long term investment in blue chip dividends.

It is also my first time into this kind of stuff.

I've googled and youtubed myriad of ways to get a start with low capital. (Foot in the door)

I looked up RobinHood, M1 Finance, Ameritrade, Interactive Brokers.

I think RobinHood and M1 Finance was easy to understand, but unfortunately its for US people only

Ameritrade I'm looking into but the broker fees are stopping me as I don't have a good capital yet.

Interactive Brokers I'm confused, if they still require the 10kUSD starting fee.(Contradicting info)

I'm looking into Utrade now (UOB Kay Hian) and plan to visit their HQ in KL to setup a CDS account and get some understanding.

-------------

Basically what my plan is to Buy and hold stocks for dividends over time in Dividend Aristocrats. Possibly for 25 years.

I would prefer US markets.

I need advice/ideas on how should I go about this. It would be nice to be able to trade on mobile phone but most of the apps are US only.

Hope to hear from you all,

Thank you

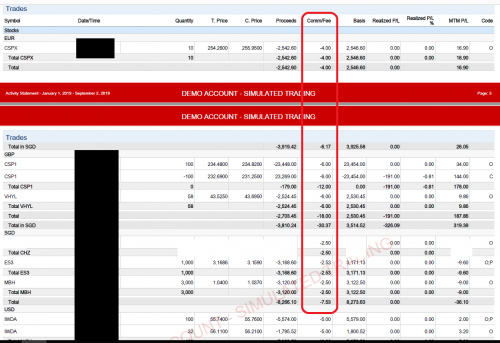

Just use whitelabels IB and you are all set to go. Good for those with small amount. Cost about USD2-3% transaction. Forex conversion fees is USD2/conversion.

first time trade with IB, may I know the meaning?

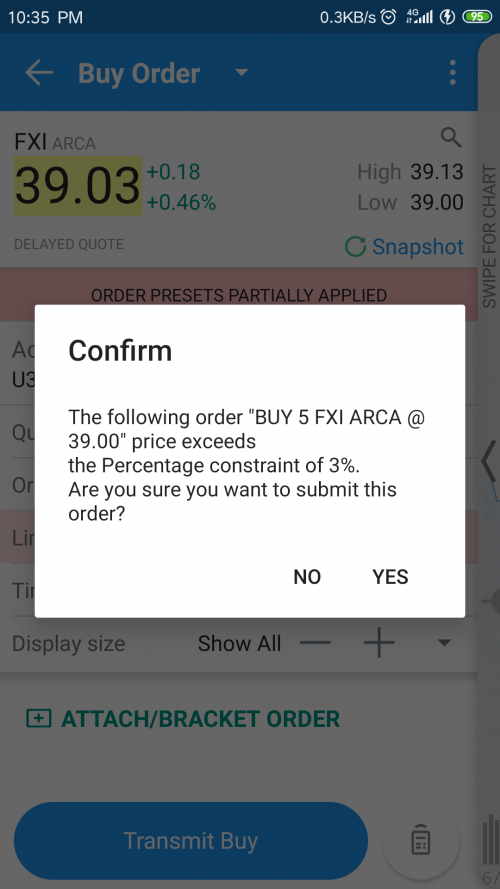

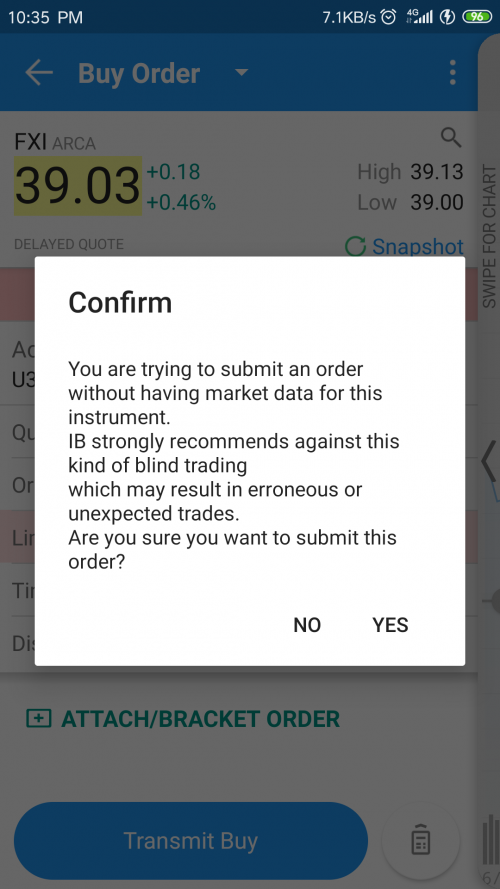

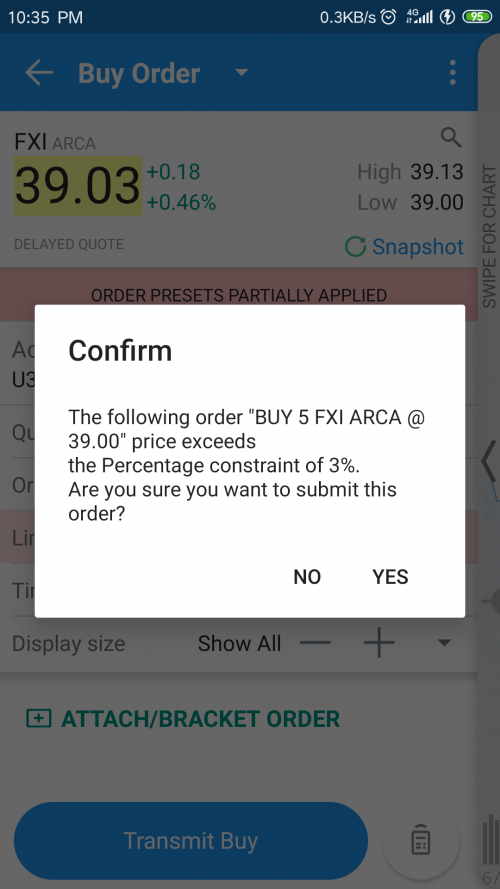

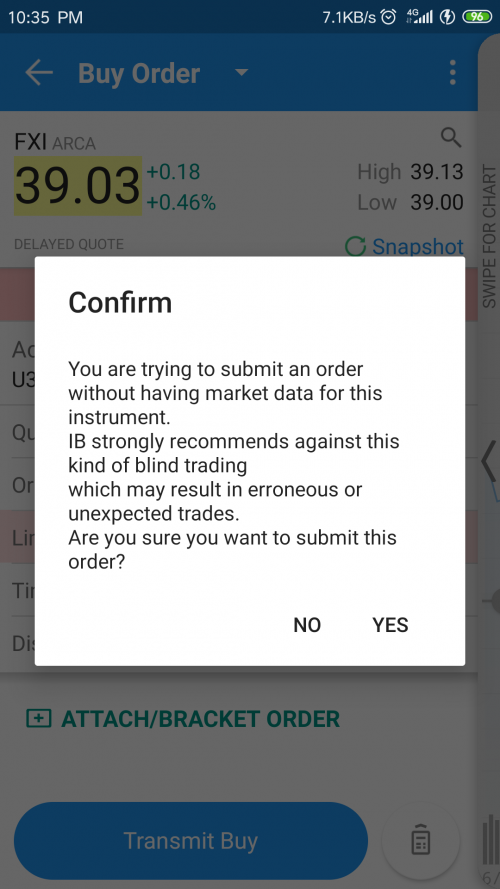

Select Yes to both.

Aug 21 2019, 01:50 PM

Aug 21 2019, 01:50 PM

Quote

Quote

0.1107sec

0.1107sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled