Outline ·

[ Standard ] ·

Linear+

Q&A on Stock Market V2, General Question On Stock Market

|

tryifelsecatch

|

Jul 15 2016, 02:44 PM Jul 15 2016, 02:44 PM

|

|

hi sifu, so i am interested in IPO that i see from my e-banking website. in order to purchase that, I need an CDS a/c.

does it matter which ADA i goes to open a new CDS a/c? if it matters how do we choose?

i look at RHB and it has this RHBInvest and RHBTradeSmart, which one is this to open a new CDS a/c in order to purchase IPO?

or if we walk in to ADA office to open CDS a/c a better option?

|

|

|

|

|

|

nlmj

|

Jul 15 2016, 06:55 PM Jul 15 2016, 06:55 PM

|

Getting Started

|

Hi, Instead of going through a broker, can I purchase share online by myself? What are the pros and cons doing this?

|

|

|

|

|

|

wil-i-am

|

Jul 15 2016, 10:21 PM Jul 15 2016, 10:21 PM

|

|

QUOTE(tryifelsecatch @ Jul 15 2016, 02:44 PM) hi sifu, so i am interested in IPO that i see from my e-banking website. in order to purchase that, I need an CDS a/c. does it matter which ADA i goes to open a new CDS a/c? if it matters how do we choose? i look at RHB and it has this RHBInvest and RHBTradeSmart, which one is this to open a new CDS a/c in order to purchase IPO? or if we walk in to ADA office to open CDS a/c a better option? A CDS will tag to your trading a/c Better choose d broker which offer competitive rates |

|

|

|

|

|

tryifelsecatch

|

Jul 17 2016, 11:42 PM Jul 17 2016, 11:42 PM

|

|

QUOTE(wil-i-am @ Jul 15 2016, 10:21 PM) A CDS will tag to your trading a/c Better choose d broker which offer competitive rates any tips/recommendation please? |

|

|

|

|

|

wil-i-am

|

Jul 18 2016, 10:45 AM Jul 18 2016, 10:45 AM

|

|

QUOTE(tryifelsecatch @ Jul 17 2016, 11:42 PM) any tips/recommendation please? Nope |

|

|

|

|

|

lavenzo

|

Jul 27 2016, 08:39 AM Jul 27 2016, 08:39 AM

|

Getting Started

|

hello, i am using M2u for trading. May i ask what is "sellable list"? It show all my share and when i select 1 of my share and key the quantity and click 'sent' but nothing happen. what is this for?

|

|

|

|

|

|

galaxynote259

|

Aug 28 2016, 02:36 PM Aug 28 2016, 02:36 PM

|

|

what is clearing fee?

cimb clicks trader clearing fee: As per Bursa Depository Charges, 0.03% (6% GST will be imposed to clearing fees)

|

|

|

|

|

|

wil-i-am

|

Aug 28 2016, 06:42 PM Aug 28 2016, 06:42 PM

|

|

QUOTE(galaxynote259 @ Aug 28 2016, 02:36 PM) what is clearing fee? cimb clicks trader clearing fee: As per Bursa Depository Charges, 0.03% (6% GST will be imposed to clearing fees) Fees charged by Bursa for its services |

|

|

|

|

|

wil-i-am

|

Aug 30 2016, 12:20 PM Aug 30 2016, 12:20 PM

|

|

Sudden pent up demand for M3tech-wa

|

|

|

|

|

|

galaxynote259

|

Sep 1 2016, 01:53 PM Sep 1 2016, 01:53 PM

|

|

QUOTE(wil-i-am @ Aug 28 2016, 06:42 PM) Fees charged by Bursa for its services Thanks man, when will this fee be charged? |

|

|

|

|

|

wil-i-am

|

Sep 1 2016, 06:45 PM Sep 1 2016, 06:45 PM

|

|

QUOTE(galaxynote259 @ Sep 1 2016, 01:53 PM) Thanks man, when will this fee be charged? Upon successful transactions |

|

|

|

|

|

captain_asia

|

Sep 9 2016, 10:07 PM Sep 9 2016, 10:07 PM

|

Getting Started

|

Hi guys, i am new here. I am on my second year degree and I am planning to learn more about the stock market. I have earned some money from my part time jobs during my school break. Instead of putting it in FD i planning to invest the money on somewhere else. From the previous comments i noticed that most people would recommend newbies to try on REIT first. Can someone here tell me the reason? Is it because it is lower-risk than stocks? Will i able to open a trading account if i am still a student? Or do i need a full time job first? Any advice and help would be much appreciated. Thanks

|

|

|

|

|

|

Dreamer09

|

Sep 12 2016, 01:46 PM Sep 12 2016, 01:46 PM

|

Getting Started

|

QUOTE(captain_asia @ Sep 9 2016, 10:07 PM) Hi guys, i am new here. I am on my second year degree and I am planning to learn more about the stock market. I have earned some money from my part time jobs during my school break. Instead of putting it in FD i planning to invest the money on somewhere else. From the previous comments i noticed that most people would recommend newbies to try on REIT first. Can someone here tell me the reason? Is it because it is lower-risk than stocks? Will i able to open a trading account if i am still a student? Or do i need a full time job first? Any advice and help would be much appreciated. Thanks Hi, people usually invest in REITS because it is categorised under defensive stocks. You're right on the part where REITS are typically lower risk than other sectors because it rewards shareholders with decent dividend yields over the years. I'm not sure about other countries, but REITS that are listed in Bursa Malaysia has a clause stating that 90% of their distributable income are paid as dividends to unit/shareholders. You can open an account as long as you are above 18 years of age. Just bring in you IC and a copy of bank statement and walk in to any brokerage houses will do. Best if you open a cash upfront account, not a margin account. |

|

|

|

|

|

NickyEng

|

Sep 13 2016, 05:09 PM Sep 13 2016, 05:09 PM

|

|

I'm a newbie in stock trading. I've study online for few basic terms and process as well as fee charges by different party, yet still a lot to learn. But there is one question still stuck in my head. Hopefully can get some answer from here as I can't find the answer via google search =.=

Q: If I have 10k shares and I decided to sell all today at price of RM 3 per share. I used M2U Stocks app for trading. I am wondering what's the different of selling 10k shares separately say 2k * 5 sell transaction VS selling 10k shares at ONCE 10k * 1 sell transaction?

Any difference or any pros & cons?

|

|

|

|

|

|

SUSfuzzy

|

Sep 13 2016, 08:34 PM Sep 13 2016, 08:34 PM

|

|

QUOTE(captain_asia @ Sep 9 2016, 10:07 PM) Hi guys, i am new here. I am on my second year degree and I am planning to learn more about the stock market. I have earned some money from my part time jobs during my school break. Instead of putting it in FD i planning to invest the money on somewhere else. From the previous comments i noticed that most people would recommend newbies to try on REIT first. Can someone here tell me the reason? Is it because it is lower-risk than stocks? Will i able to open a trading account if i am still a student? Or do i need a full time job first? Any advice and help would be much appreciated. Thanks Yep, it is lower in risk. REITs are generally passive, defensive and stable stock so while it generates you the 4-6% annually or so, you do not see much movement in terms of the price nor a massive amount of trades going on for it. Thus you can buy it and do not need to monitor it that often, thus being a passive stock. |

|

|

|

|

|

NickyEng

|

Sep 13 2016, 09:06 PM Sep 13 2016, 09:06 PM

|

|

QUOTE(NickyEng @ Sep 13 2016, 05:09 PM) I'm a newbie in stock trading. I've study online for few basic terms and process as well as fee charges by different party, yet still a lot to learn. But there is one question still stuck in my head. Hopefully can get some answer from here as I can't find the answer via google search =.= Q: If I have 10k shares and I decided to sell all today at price of RM 3 per share. I used M2U Stocks app for trading. I am wondering what's the different of selling 10k shares separately say 2k * 5 sell transaction VS selling 10k shares at ONCE 10k * 1 sell transaction? Any difference or any pros & cons? Anyone?  |

|

|

|

|

|

Suicidal Guy

|

Sep 13 2016, 10:58 PM Sep 13 2016, 10:58 PM

|

|

QUOTE(NickyEng @ Sep 13 2016, 09:06 PM) Charges will be the same for both. |

|

|

|

|

|

SUSfuzzy

|

Sep 14 2016, 10:09 AM Sep 14 2016, 10:09 AM

|

|

QUOTE(NickyEng @ Sep 13 2016, 09:06 PM) Anyone?  Unless your trade is being charged at a fixed amount (let's say RM20 per transaction), it wouldn't matter because trade charges are usually by a % of the price, so selling a 10k in 1 shot or 10 shots will still yield the same % .. |

|

|

|

|

|

NickyEng

|

Sep 14 2016, 02:41 PM Sep 14 2016, 02:41 PM

|

|

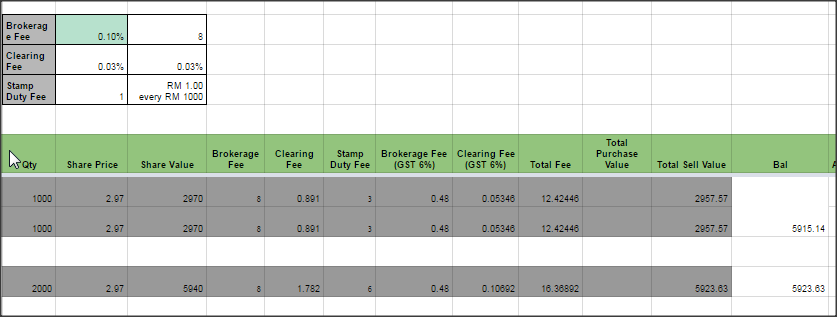

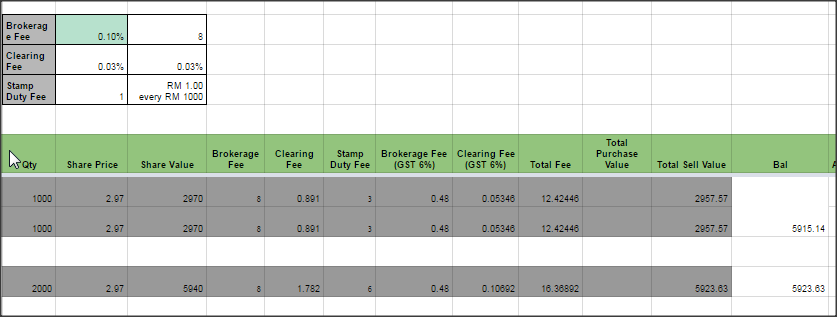

QUOTE(Suicidal Guy @ Sep 13 2016, 10:58 PM) Charges will be the same for both. If follow Maybank charges formula, there is a big different. Check below calculation:  But If i try to avoid extra charges per transaction, I'm afraid My selling Volume will NOT easily be matched because it is big volume & not many people buy big volume (Just Saying..) any advise? |

|

|

|

|

Jul 15 2016, 02:44 PM

Jul 15 2016, 02:44 PM

Quote

Quote

0.0280sec

0.0280sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled