QUOTE(romuluz777 @ Nov 4 2022, 09:23 AM)

Beware as they are operating co labs shared office open sharing spaces Nothing more than just bunch of speculators teaming up 🤦♀️

Gold Investment Corner V8, All About Gold

|

|

Dec 26 2022, 05:44 PM Dec 26 2022, 05:44 PM

Return to original view | Post

#1

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(romuluz777 @ Nov 4 2022, 09:23 AM) Beware as they are operating co labs shared office open sharing spaces Nothing more than just bunch of speculators teaming up 🤦♀️ |

|

|

|

|

|

Dec 29 2022, 06:50 AM Dec 29 2022, 06:50 AM

Return to original view | Post

#2

|

Senior Member

4,636 posts Joined: Jan 2003 |

|

|

|

Dec 30 2022, 06:54 AM Dec 30 2022, 06:54 AM

Return to original view | Post

#3

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Kopistall @ Dec 30 2022, 04:54 AM) Bro. I don't understand. Means per ounce or per kilo you're trying to say. How much is that per gram in ringgit. Thanks. Per oz as in USD Not point looking in RM or gm as it is not traded openly that way 🤦♀️ Just use the online converter if you want actual live prices |

|

|

Dec 31 2022, 05:19 AM Dec 31 2022, 05:19 AM

Return to original view | Post

#4

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Kopistall @ Dec 31 2022, 04:05 AM) You just need to check on GLD price then use the converter to price in RMAnything more than 5% in spread to RM forget about buying it as it is rip off Iinm gold shop like Poh Kong spread is 10-15% higher and it is even higher during festive season Btw, try this site for price indicator as it is has all the info you need https://www.livepriceofgold.com/malaysia-gold-price.html This post has been edited by xander2k8: Dec 31 2022, 05:29 AM |

|

|

Dec 31 2022, 06:27 PM Dec 31 2022, 06:27 PM

Return to original view | Post

#5

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Kopistall @ Dec 31 2022, 04:36 PM) Not really because gold is only for wealth preservation 🤦♀️If you’re buying gold because of war and tensions then you’re wrong as 2022 proven gold hasn’t not even increased The only thing has increased USD, Oil, Corn and Wheat |

|

|

Dec 31 2022, 07:50 PM Dec 31 2022, 07:50 PM

Return to original view | Post

#6

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Cubalagi @ Dec 31 2022, 06:45 PM) Since u said USD increased, GLD is priced in USD and it is slightly positive.(0.78%) for the year. Meaning gold has increased as much as USD. Gold increased slightly while USD basket increases by 7% outpacing gold ten times hence gold actually not increasing but stagnant 🤦♀️Not a bad performance considering 2022 is also the year of aggressive nterest rates hikes, which is a negative for gold. For 2023, if interest rate peaks (or declines) but geopolitical conflict remains or escalates, then I would expect an ever better year for gold. |

|

|

|

|

|

Jan 1 2023, 06:37 AM Jan 1 2023, 06:37 AM

Return to original view | Post

#7

|

Senior Member

4,636 posts Joined: Jan 2003 |

|

|

|

Jan 1 2023, 08:50 AM Jan 1 2023, 08:50 AM

Return to original view | Post

#8

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(prophetjul @ Jan 1 2023, 08:13 AM) 4+% interest Rate rise is recent. WE don't know what gold will do in 2023. Do you? Unless you are buying gold in USD and sold it off in RM then it is gain The 4.67% is from Jan to Dec 2022. DONE. But if your buying USD and sell it off to RM in cash it outperforms it 🤦♀️ by 0.7% This post has been edited by xander2k8: Jan 1 2023, 08:51 AM |

|

|

Jan 1 2023, 05:22 PM Jan 1 2023, 05:22 PM

Return to original view | Post

#9

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Aventador360 @ Jan 1 2023, 01:38 PM) Can anyone help to explain to me why Gold is pushing the envelope against many of the major currencies in the world even the AUD (Which is commodity backed) but it is not really rocking against the MYR? Is there a defacto peg or something? Or is it to do with the fact that malaysia is an oil exporter and there may be some link there? Thank you. Malaysia RM fundamentals itself causes the money to depreciate and with USD rate rises it is double whammy Generally gold only rallies on two things weaker USD and global macro uncertainties So if gold not rallying in Malaysia it means Malaysia current fundamentals is bad 🤦♀️ |

|

|

Jan 2 2023, 08:40 PM Jan 2 2023, 08:40 PM

Return to original view | Post

#10

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Cubalagi @ Jan 2 2023, 10:57 AM) There ia no such peg. Its just MYR has performed better in 2022 than the likes of JPY, GBP, EUR vs the USD. N u r correct, we being a commodity exporter has something to do with it. MYR depreciated by close 6% and it shows it is not better in 2022 🤦♀️Personal outlook is that gold should perform well when the Fed pauses, which is expected to be around the 2Q 2023. While SGD ended year barely unchanged QUOTE(honsiong @ Jan 2 2023, 12:56 PM) Buying gold for diversification = good, That is why gold is good for wealth preservation and it is balancing tool for diversification across asset classes 👏buying gold in hope to outperform all other assets = not good You cant win it all, but you can diversify enough to sleep better. |

|

|

Jan 8 2023, 05:15 PM Jan 8 2023, 05:15 PM

Return to original view | Post

#11

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Jan 8 2023, 03:38 PM) This is totally sums it up all 🤦♀️Only thing why gold went up in Malaysia because of the BNM weak and indecisive in increasing OPR They should instead of use the model of MAS SGD policy by jawboning the currency rather than rely of OPR but unfortunately our BNM mindset is still weak on policy and slow to action |

|

|

Jan 25 2023, 09:16 PM Jan 25 2023, 09:16 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(Unkerpanjang @ Jan 25 2023, 08:13 PM) Hahaha, most frightening wud be a hockey stick pattern....(once they start launching the hypersonic missiles) No need to wait hypersonic as the tanks would be coming soon and spring offensive will be starting to reclaim back territories from the Russians 🤦♀️As us Seniors have repeated till ad nauseum,....where possible, accumulate some physical gold. Expect gold to be trading sideways till Spring or debt default drama whichever comes 1st |

|

|

Jan 26 2023, 03:39 PM Jan 26 2023, 03:39 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(persona93 @ Jan 26 2023, 12:06 PM) thanks for your advice sir, yeah it's just 10% but can save up to RM3k, which maybe can tambah to the chain so that it'll look prettier When it comes to wedding spending a bit on gold jewellery worth it rather than worrying the price Unless you planning to get married again in the future 😂 |

|

|

|

|

|

Feb 9 2023, 06:26 PM Feb 9 2023, 06:26 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(James.L1M @ Feb 9 2023, 05:16 PM) Not at the current level 🤦♀️Already boom and now wait for it to drop James.L1M liked this post

|

|

|

Feb 14 2023, 03:35 AM Feb 14 2023, 03:35 AM

Return to original view | IPv6 | Post

#15

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(James.L1M @ Feb 13 2023, 05:22 PM) Bottom was during Oct at 1640 and then went up to 1800 by Nov with a slight bump before Santa Clause rally until 1940 by 1st week of Jan We are now trading sideways at 1860 atm but resistance downside at 1780 As I trade mostly in GLD anything below 166 it is buy signal for trade on bad news but I doubt it will hit that this year as 170 seems holding strong support with the macro news for the year unless a miracle changes with massive drip in inflation worldwide James.L1M liked this post

|

|

|

Feb 14 2023, 03:11 PM Feb 14 2023, 03:11 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(James.L1M @ Feb 14 2023, 11:37 AM) Good to know! You dream to big for GLD at 150 only time it breaches that was during Covid in March 2020 and since it is barely and holding up at 151 during Oct 🤦♀️GLD is an excellent alternative with no overnight fees, etc. Will consider going in if GLD touches 150 based on a weekly chart. As proven last year, gold as a hedge against inflation was less than stellar last year but I suppose it did an okay job as a store of value. For 2022 cash (i.e. the USD) was indeed king but not sure if we will see something similar for 2023 going forward. Might be worthwhile taking some positions in gold/GLD for the medium term. Like I said earlier anything below 166 is a buy signal for the upside while you can never time the bottom to 150 unless there is no more war, natural disaster or economic crisis in the world 🤦♀️ You buy GLD if you go no where to store your cash while not generating at least 3% pa and while USD on the downtrend James.L1M liked this post

|

|

|

Feb 15 2023, 03:38 PM Feb 15 2023, 03:38 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(James.L1M @ Feb 15 2023, 10:32 AM) Agreed GLD at 150 is rather ambitious and greedy. Will definitely take a black swan event to get there. Shall consider GLD at 166. Gold downside now rather low better take middle ground and the upside chances is higher Difficult for GLD now to break to 190 unless more bad news being thrown in |

|

|

Feb 16 2023, 12:05 PM Feb 16 2023, 12:05 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

4,636 posts Joined: Jan 2003 |

QUOTE(James.L1M @ Feb 16 2023, 10:47 AM) And another leg down tomorrow we back at square one for the year as GLD is only up by less than 1% this year I expect to hit my target by March 👏 and the USD will start roaring again James.L1M liked this post

|

|

|

Mar 18 2023, 08:40 AM Mar 18 2023, 08:40 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,636 posts Joined: Jan 2003 |

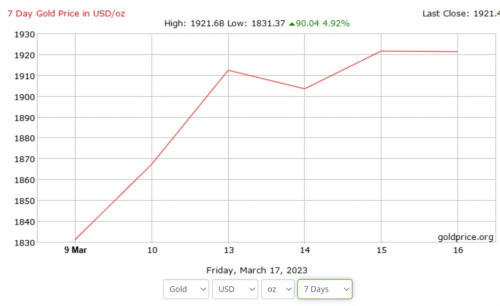

QUOTE(Unkerpanjang @ Mar 18 2023, 07:29 AM) Bro, many thanks for reviving this thread, much respects. Confirm raise 25bps as it is going long period in between stagflation and inflation Mari, Mari, Unker mau dengar....whats is Sifu n Senior opinions, on current situation. Are we facing Inflation or Currency Debasement? Worldwide oil price drop, char koay teow price maintain, loss of jobs, vs. precious metal up, stocks up, crypto up, Fed still expect to raise rates?   QUOTE(Cubalagi @ Mar 18 2023, 08:00 AM) It will break up till 2020 but difficult to go upwards of 2050QUOTE(prophetjul @ Mar 18 2023, 08:06 AM) Yes. Expect it to go past 10k with the depreciation of RM 🤦♀️Last March high was $1,998.18 Just a few $ more. But in MYR, it is at historical high Expect gold ti be approx MYR9,000 on Monday.  QUOTE(Cubalagi @ Mar 18 2023, 08:23 AM) It breached 2k last year. Intraday high on 8 March 2022 was USD2070 Difficult to hit past 2020 as will trade sideways between 1940 to 2020 on macroeconomic data newsBack in 2020, 8 August, intraday high was USD2075, which is still.the historical record high. But yeah in MYR, Gold already at historical high. |

|

|

Mar 20 2023, 07:25 PM Mar 20 2023, 07:25 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,636 posts Joined: Jan 2003 |

|

| Change to: |  0.0259sec 0.0259sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 10:49 AM |