QUOTE(tweakity @ Sep 19 2021, 02:59 PM)

Hi, Maybank gold account are we referring to MAYBANK ISLAMIC GOLD ACCOUNT-I?

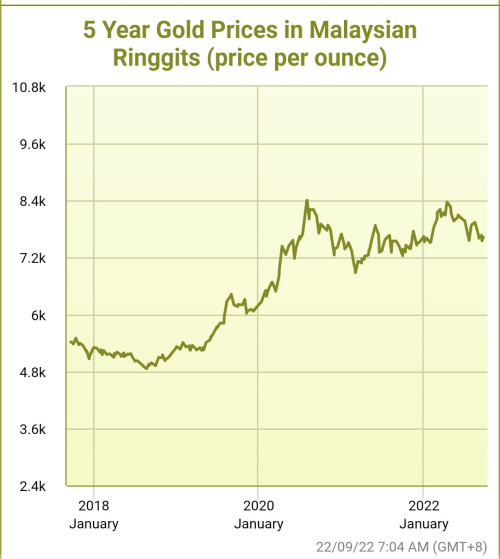

I'm looking to DCA into gold as well

There r 2. I chose the normal gold acc. With silver dropping below $24 recently, n gold/silver ratio, all time low....getting wife, to open silver too.I'm looking to DCA into gold as well

Me theenks, good to park some money there. Problem wt Maybank, need to schedule appt...Oct calander already all taken up.

Sep 19 2021, 03:49 PM

Sep 19 2021, 03:49 PM

Quote

Quote

0.0398sec

0.0398sec

1.39

1.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled