Gold Investment Corner V8, All About Gold

|

|

May 24 2020, 12:34 PM May 24 2020, 12:34 PM

Return to original view | Post

#21

|

Senior Member

1,232 posts Joined: Mar 2019 |

[/quote] Today being an off day cum CB, stay at home past time. Quick update on mid year progress. Due to gold price appreciation n recent accumulation of 1x100 grams pamp n 2x5 grams coins, I finally surpassed the Sgd$210K collection worth....although if to sell now, will realize much lower returns. Consider them to be inflation hedge against our weakening Ringgit/Spore fiat currency. However, too lazy to organize full collection. This post has been edited by Unkerpanjang: May 25 2020, 05:04 PM |

|

|

|

|

|

May 25 2020, 07:38 AM May 25 2020, 07:38 AM

Return to original view | Post

#22

|

Senior Member

1,232 posts Joined: Mar 2019 |

Delete

This post has been edited by Unkerpanjang: May 31 2020, 03:28 PM |

|

|

May 25 2020, 08:26 PM May 25 2020, 08:26 PM

Return to original view | Post

#23

|

Senior Member

1,232 posts Joined: Mar 2019 |

[quote=Unkerpanjang,May 25 2020, 07:38 AM]

what about silver? do you stack/collect them? [/quote] Seems genuine question. Gold is 1.84x higher density than silver. Also, gold to silver ratio is now 1:100+ If you decide to buy 1x100 grams gold, you can buy 100x100+ grams silver. I will need > 184X (density ratio x price ratio) additional space to store silver. Storage becomes a major consideration. Transporting becomes a problem. Safe hiding becomes impossible. In short 'No'. [/quote] Correction... |

|

|

May 31 2020, 02:29 PM May 31 2020, 02:29 PM

Return to original view | Post

#24

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(rhodon @ May 31 2020, 01:25 PM) bought 15g paper gold on last 9 years for my first investment. Average around RM160/g. once bought it the spot gold start drop from around USD1900 till today back to USD1730. now not sure want to sell it or just hold it since already 9 years. any advice? You bought at rm160/g.... It's now rm249/g.In yr msg, why u need to mention usd? So, seriously, u now stay in USA? If u, no need to pay high interest % loan, etc. Just hold on lah. Our rm will continue to weaken, unemployment, saraan hidup, weak oil price, food inflation, corruption, we revisit your question on gold price after 6 months. This post has been edited by Unkerpanjang: May 31 2020, 03:06 PM |

|

|

May 31 2020, 07:21 PM May 31 2020, 07:21 PM

Return to original view | Post

#25

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

May 31 2020, 08:09 PM May 31 2020, 08:09 PM

Return to original view | Post

#26

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(rhodon @ May 31 2020, 07:38 PM) I mention usd because i used to watch the spot gold to find out whether gold price up or down. Looks like your gold investment made annual avg 3.7% gains over last 9 years. You went thru the lows, n now uptrend back.i buying paper gold, if want to know the selling price need to login bank account to click several things to check so i used to watch the spot gold. that day check back now selling around rm232/g. i bought on last 9 years, now only think of it. But now with kwsp, FD, Asnb, etc dividend yield going downtrend. Most P2P loans lost principal. U qualify ASB? What other investment choice u got? Unless, u stock picking expert. But gold n stock investment are 2 different asset allocation. Cannot inter mix. Curious to understand your golden decision. If doing a poll? Do u think MY economy will improve, worsen or limp along for next 6 months. Your answer will help me validate my own data points. This post has been edited by Unkerpanjang: May 31 2020, 08:13 PM |

|

|

|

|

|

Jun 8 2020, 11:03 AM Jun 8 2020, 11:03 AM

Return to original view | Post

#27

|

Senior Member

1,232 posts Joined: Mar 2019 |

Sigh, give free advice yet people get offended.

Likely, truth hurts. Must go read up on 'The angry man vs Buddha.' For those aspiring RM decamillionaires, once the safe n liquid bedrock investments of Kwsp, Asnb n FD >RM5M, while continue to be gainfully employed, then other investments are just divided to safe haven (I like physical gold n Sgd dollars), hobby (art n numismatics), investing for Income in dividend paying stocks, speculative n others. Anyone can challenge me, but I don't give a damn as I know I'm sleeping peacefully with a whole lot of net worth n a career I enjoy doing till time to go. As for price of physical gold, over long periods of time, it should go up in sympathy with MAL inflation. As long as RM600k physical gold holdings is << 10% of investments, why worry of a 20-30% gold price fluctuations... Its just 3% impact on networth. The annual passive income from bedrock investments (risk free @ 4.5% dividends) will cover any gaps/downside + allow buy more physical gold during dips. The worrying trend I observe, is some forumers mixing asset allocations, selling asnb to buy stocks, treating gold like stocks - jumping in n out of gold investments, etc. This post has been edited by Unkerpanjang: Jun 8 2020, 11:16 AM |

|

|

Jun 10 2020, 07:10 AM Jun 10 2020, 07:10 AM

Return to original view | Post

#28

|

Senior Member

1,232 posts Joined: Mar 2019 |

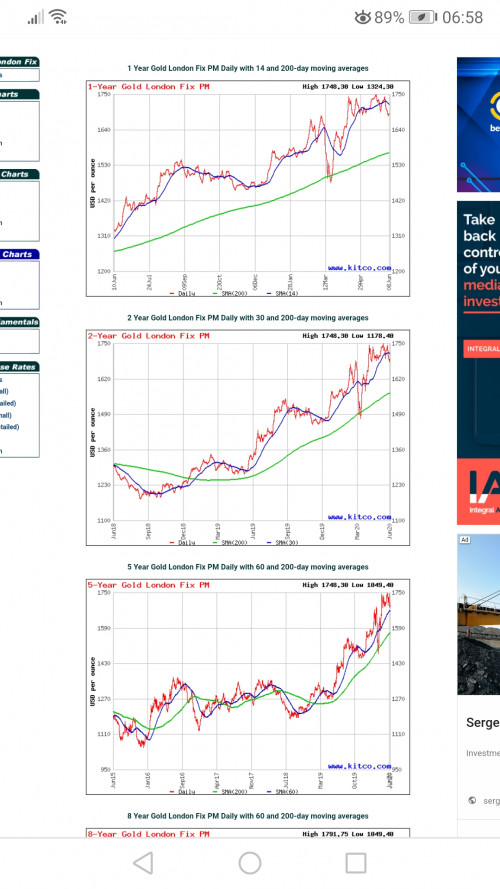

QUOTE(WhitE LighteR @ Jun 6 2020, 04:39 PM) Only you know your own financial affordability, investment horizon n risk tolerance. If you can afford 10% in hard asset, why not? If you are a stock picking expert, why invest in gold? If you are inadequately funding kwsp, why even bother? If you are poor in mindset, why not use whatever money to invest in knowledge? Sorry to digress from the question.... How to know gold price trend? No diff from stocks, prices are all linked to TA, macro economics and/or geopolitics.  This post has been edited by Unkerpanjang: Jun 10 2020, 09:48 AM |

|

|

Jun 10 2020, 10:59 AM Jun 10 2020, 10:59 AM

Return to original view | Post

#29

|

Senior Member

1,232 posts Joined: Mar 2019 |

[quote=Unkerpanjang,Jun 10 2020, 07:10 AM]

Sorry to digress from the question.... How to know gold price trend? No diff from stocks, prices are all linked to TA, macro economics and/or geopolitics. --------------- With the above in mind. So, let's debate.... My thoughts. China, India and Russia are top buyers of physical gold. Oil price is down. Russia exports lots of oil, but lower revenue. India economy is cyclical n stalling because of covid. China is using reserves to prop economy n trade war. Who has spare cash to buy physical gold? Also, the big hedge funds still weak allocation in gold stocks, physical, etc, approx 0.5%, vs mean of 2%. On the flip side, have miners started going back to work n has gold transportation resumed? I do see the gold traders have ready stocks to sell now. Were they artificially creating supply shorage, (hoarding gold) couple of months back? My last purchase was $237/gram. I think it'll continue to stabilise ard $220-240/gram. Quite worrisome... But, stay pragmatic. This post has been edited by Unkerpanjang: Jun 10 2020, 03:09 PM |

|

|

Jun 10 2020, 06:54 PM Jun 10 2020, 06:54 PM

Return to original view | Post

#30

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(GrumpyCat @ Jun 10 2020, 05:53 PM) I once sold to a local jeweller (artisan working from home), at close to market price. Recommended by a close relative to be very reliable n safe transaction...in short, her "foster-brother".(Needed cash to fund my niece to UK for her studies. She a chartered accountant now. So u can imagine how long ago this story). Drove to the almost unassuming building, the sides walls with paint peeling off,... except that it had cctv directed at the walkway n heavy grilled entrance. Introduced myself, as so-n-so relative, the uncle greeted me was bald, and shirtless with tattoo on his whole body. Was invited inside, walked past a narrow alse of old furniture's n junk. Inside in office, the wall safe, at that time, never seen so much cash kept at home. He didn't care 22K, 20K, Thai gold all one price. Hahaha, got a free tour upstairs, all the workers making gold jewellery. Totally, different world! So, with my 1 time experience. I can only suggest, same trick - go find such an uncle in your home state. Oh one last thing,... Pls be prepared. No Receipt! To prove to your wife on price. This post has been edited by Unkerpanjang: Jun 10 2020, 07:07 PM |

|

|

Jun 10 2020, 08:56 PM Jun 10 2020, 08:56 PM

Return to original view | Post

#31

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(WhitE LighteR @ Jun 10 2020, 08:28 PM) wow. interesting story. My relative, she married to big time 4D xxxxxxx. i wonder why the uncle willing to take from people like that if its so close to market price. Uncle buy gold from light n dark side of force. In summary,... Very likely Uncle just give face my relative. Very likely my relative just doing me a favor. Very likely, karma help those, who is unconditionally helping others. My niece now paying forward this good karma, to her relatives. Needless to say, my children gets her top kind gifts n thoughts. |

|

|

Jun 12 2020, 09:28 AM Jun 12 2020, 09:28 AM

Return to original view | Post

#32

|

Senior Member

1,232 posts Joined: Mar 2019 |

[quote=smokymcpot,Jun 12 2020, 08:20 AM]

@smokymcpot If you were to ask an accomplished engineer 'what's the top 5 densest element in the world'. You might get the answer... silver, gold, osmium, etc. Hahaha. But, yet my answer would include... Sadly, an uninspired, under-developed n untrained potential of a human-mind. This post has been edited by Unkerpanjang: Jun 12 2020, 09:50 AM |

|

|

Jun 12 2020, 03:38 PM Jun 12 2020, 03:38 PM

Return to original view | Post

#33

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

|

|

|

Jun 12 2020, 06:49 PM Jun 12 2020, 06:49 PM

Return to original view | Post

#34

|

Senior Member

1,232 posts Joined: Mar 2019 |

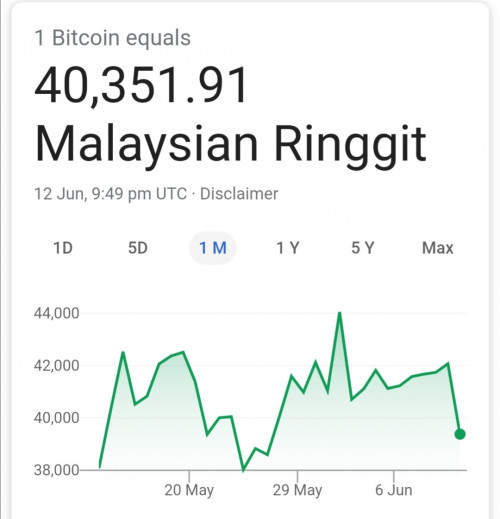

Only the Unker n Dinosaur generations invest inphysical gold.

We are 100% into Bitcoin!!!!! |

|

|

Jun 13 2020, 05:54 AM Jun 13 2020, 05:54 AM

Return to original view | Post

#35

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Jun 15 2020, 01:03 PM Jun 15 2020, 01:03 PM

Return to original view | Post

#36

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Jun 18 2020, 12:25 PM Jun 18 2020, 12:25 PM

Return to original view | Post

#37

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Jun 20 2020, 06:38 AM Jun 20 2020, 06:38 AM

Return to original view | Post

#38

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Jun 21 2020, 10:23 AM Jun 21 2020, 10:23 AM

Return to original view | Post

#39

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Jun 23 2020, 06:26 AM Jun 23 2020, 06:26 AM

Return to original view | Post

#40

|

Senior Member

1,232 posts Joined: Mar 2019 |

[quote=Unkerpanjang,Jun 21 2020, 10:23 AM]

Got someone to confirm. No black n white store policy...nor stated on receipt. Apparently, poh Kong goldsmith buyback for 20k jewellery is 30% discount, while for Swiss pamp bar is 6% discount gold price. Again, this is up yo their fancy, can change unilaterally. |

| Change to: |  0.0225sec 0.0225sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 07:35 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote