QUOTE(j.passing.by @ Jul 17 2014, 02:55 PM)

as long as both parties have facts & logic lar - not BS that can't hold water statistically / factually

This post has been edited by wongmunkeong: Jul 17 2014, 02:59 PM

Fundsupermart.com v6, Manage your own unit trust portfolio

|

|

Jul 17 2014, 02:58 PM Jul 17 2014, 02:58 PM

Return to original view | Post

#41

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(j.passing.by @ Jul 17 2014, 02:55 PM) as long as both parties have facts & logic lar - not BS that can't hold water statistically / factually This post has been edited by wongmunkeong: Jul 17 2014, 02:59 PM |

|

|

|

|

|

Jul 21 2014, 05:18 PM Jul 21 2014, 05:18 PM

Return to original view | Post

#42

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(kimyee73 @ Jul 21 2014, 03:53 PM) As usual I'm late to the discussion again but just to share about rich or poor In USD summore too right? Definition of rich from How to Get Rich by Felix Dennis $2M-$4M - The comfortable poor $4M-$10M - The comfortably off $10M-$30M - The comfortably wealthy $30M-$80M - The lesser rich $80M-$150M - The comfortably rich $150M-$200M - The rich $200M-$400M - The seriously rich $400M-$800M - The truly rich $800M-$2B - The filthy rich $2B - infinity - The super rich So, what that made of us below $2M? The truly poor? |

|

|

Jul 24 2014, 11:14 AM Jul 24 2014, 11:14 AM

Return to original view | Post

#43

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

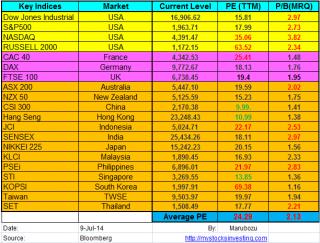

QUOTE(Pink Spider @ Jul 24 2014, 10:03 AM) er.. long time no do mutual funds liao (nearly 6 mths) bro as:a. EPF --> CIMBC25 & CIMBA40 b. Cash --> Direct to ETFs & options "trading biz" via US exchanges What i did previous 6+ months for yr reference (yr mileage & reasoning may vary): c. Reduced / sold off MY funds $xxK - i'm holding way too much % in MY equities + too "low value" to me Too much % in MY = more than 20%, aiming for about 5% to 10% max in MY equities (including REITs, properties, solar FiT, etc. d. Used the $ from (c.) + cash (% held hit forced re-allocation) to get into ETFs directly + fund options "trading biz" Since markets are frothy to me: + i was just trading options weeklies & monthlies mostly (no long term long - thus managing risk of kaboom) + buying / long ETFs of HK & China (specific ETF) + ASEAN, BRICs (as a basket ETF) - low-ish average market P/E. For U, since i'm unsure holistically where & how much% U are holding/planned, generally i'd suggest: e. go buy lelongs or value available, dont chase things that are already up & "expensive" eg1. if additional $100 - put $67 for lelongs/value & $33 into whatever DCA/VCA program still running eg2. IF yr asset & sub-asset allocation is pointing / showing U that U need to reduce cash (ie. buy something) / bonds, as per above eg1 eg 3. IF no reason to reduce cash/bonds - then need to rebalance regional? eg too heavy on MY? (total investment equities of funds, stocks, reits, etc) IF yes, then reduce and move to more lelong stuff like HK or China This may help - er.. credit to the website i snapshot it from (unfortunately i can't recall where from - some of the things i pickup daily here/there)

Just sharing |

|

|

Jul 24 2014, 03:12 PM Jul 24 2014, 03:12 PM

Return to original view | Post

#44

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Jul 24 2014, 03:03 PM) i be thinking - matters not whip-saws, as long as long term up and CAGR after 5 years or more >=10%pa eg Prudential (now EastSpring) SmallCap Fund - earlier years.. whoa.. now like WHOA! (CAGR 17%pa to 18%pa) Bought lump sum 3 times and sat zzz on it (EPF mar) since 2004+/- Note: AssUming $ in there not needed for 10 to 20 years Just thinking |

|

|

Jul 24 2014, 03:14 PM Jul 24 2014, 03:14 PM

Return to original view | Post

#45

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Jul 24 2014, 03:13 PM) There was a period of time when it keeps flying and flying and flying...that was when we christened it "the Ponzi fund" and that was the best time to buy (when slumped enough and long enough to be cursed) Then everyone also wanna jump on board... Then comes a slump in performance, when ppl who jumped in AFTER the spectacular period like David83 started cursing it |

|

|

Jul 27 2014, 10:27 AM Jul 27 2014, 10:27 AM

Return to original view | Post

#46

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

|

|

|

Jul 27 2014, 12:19 PM Jul 27 2014, 12:19 PM

Return to original view | Post

#47

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(wodenus @ Jul 27 2014, 12:01 PM) Yea if you sell and move to any other fund house at 0% SC, you don't lose anything, but you can gain from the higher growth or more foreign funds options well those 2 were my reasons (BRICs + 0% SC "transfer over" from PM) anyways poor folks like me gotta finds ways & means to move small steps forwards mar |

|

|

Jul 30 2014, 08:20 AM Jul 30 2014, 08:20 AM

Return to original view | Post

#48

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

Wah article on FSM DIY in Personal Money magazine!

Perhaps direct newbies there if Q on "can trust or not ar FSM?" This post has been edited by wongmunkeong: Jul 30 2014, 09:27 AM |

|

|

Jul 30 2014, 09:37 AM Jul 30 2014, 09:37 AM

Return to original view | Post

#49

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(cybermaster98 @ Jul 30 2014, 09:30 AM) Despite me making the cash transfer through Maybank2U last Thurs at 4.22pm, my order is still 'processing' now. Can anybody shed any light? Its frustrating for the order to be taking so long. Just went through yr posts on this - what funds did U purchase?Personal experience: For foreign funds that consist of several countries like BRICs and Developed markets, i waited on average 3 to 4 working days. Probably due to the need to derive NAV for the fund from: a. Consolidation of all those countries' stock value b. Some of those countries weekend/public holiday c. MY public holiday/weekend |

|

|

Jul 30 2014, 03:42 PM Jul 30 2014, 03:42 PM

Return to original view | Post

#50

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(David83 @ Jul 30 2014, 03:22 PM) Possible but not sure if FSM accepts it. They're currently transfer in from direct investment bank channel. Yup - just like when i tried EastSpring fund --> FSM EastSpring same fund, was told tough as need agent blah blah to sign-off & agree. Right - like as if agent will agree to me ripping her free yearly rice bowl from herBut since eUT is another competing distributor. Unlike if PubMut --> FSM distributed funds, which PubMut is NOT representated and it is literally a sell/redeem from PubMut, then Buy from FSM Tried both the above |

|

|

Jul 31 2014, 11:43 AM Jul 31 2014, 11:43 AM

Return to original view | Post

#51

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Jul 31 2014, 11:25 AM) ceh - i know HOW it will end too - cosmic event of either the Sun going supernova, black hole following or huge asteroid collision sorry mods - off topic. anyhow - hey, there's fear in the market now http://money.cnn.com/data/fear-and-greed/ finally - not just seeing the link above but personally seen in US index options, more / easier to get premium for sellers (due to fear) than past 2 months. sharpen your spears for hunting |

|

|

Aug 1 2014, 07:27 AM Aug 1 2014, 07:27 AM

Return to original view | Post

#52

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(wodenus @ Jul 31 2014, 12:07 PM) That fear not reflected in market indices & prices yet mar.. UNTIL last night. S&P -39 or nearly -2% in one day Fear at Extreme now http://money.cnn.com/data/fear-and-greed/ |

|

|

Aug 1 2014, 12:50 PM Aug 1 2014, 12:50 PM

Return to original view | Post

#53

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

|

|

|

Aug 8 2014, 11:14 AM Aug 8 2014, 11:14 AM

Return to original view | Post

#54

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Aug 8 2014, 02:03 PM Aug 8 2014, 02:03 PM

Return to original view | Post

#55

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Aug 8 2014, 02:13 PM Aug 8 2014, 02:13 PM

Return to original view | Post

#56

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Aug 8 2014, 02:04 PM) Personally?Trading: I'm selling... options on the fear extreme That's the thing - fear is extreme BUT not much blood. Like those "suspense horror" show instead of "Friday the 13" splatter fest Investments: Sitting non-pretty for real blood bath. Currently like pin-pricked blood letting only lar. I want to see: at least 15%-20% before i go "fish shooting - DefCon level 1" at least 30%-40% before i go "fish bombing - DefCon level 2" at least 50% before i go "thermonuclear - DefCon level 3" This post has been edited by wongmunkeong: Aug 8 2014, 02:15 PM |

|

|

Aug 8 2014, 02:19 PM Aug 8 2014, 02:19 PM

Return to original view | Post

#57

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Aug 8 2014, 02:15 PM) IMHOBest time to be a contrarian isn't when there's fire burning and ppl are still running out of the building. It's after the building collapsed and most ppl are out. Sounds familiar with value-investing too right? AFTER the fire & death (ie. no predictions, can see it already happened) Thus before that - do & execute "normal" plans. No DefCon biz |

|

|

Aug 8 2014, 02:24 PM Aug 8 2014, 02:24 PM

Return to original view | Post

#58

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Aug 8 2014, 02:22 PM) oh - ceh.Normal monthly or quarterly thing izzit? Just buy what's of more value lor - look http://markets.on.nytimes.com/research/mar...orldmarkets.asp and pick a fund which hits 2 to 3 of those lower ones la U know which liao ma based on that Excel snapshot i shared from .. gawdknows which website i saw it from |

|

Topic ClosedOptions

|

| Change to: |  0.0628sec 0.0628sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 09:14 AM |