QUOTE(Smurfs @ Sep 13 2014, 08:56 AM)

Which One?M Reits Version 6, Malaysia Real Estate Investment Trust

M Reits Version 6, Malaysia Real Estate Investment Trust

|

|

Sep 13 2014, 01:15 PM Sep 13 2014, 01:15 PM

Return to original view | Post

#101

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

|

|

|

Sep 17 2014, 09:46 AM Sep 17 2014, 09:46 AM

Return to original view | Post

#102

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Sep 17 2014, 10:33 AM Sep 17 2014, 10:33 AM

Return to original view | Post

#103

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(Pink Spider @ Sep 17 2014, 09:48 AM) Pink Gor,I not to compare but sharing mine opinion Indeed Sunway reit are not pure mall Reits but - their hotel Gross Revenue = net property income, doesnt hv much maintenance cost. Smemore their hotel segment is juz smaller portion 30% of SunReits. If you concern about the Hotel jeopardize SUNReit income - we can try to see their Business model for Sunway Hotel. they give complement •Complimentary entry to Sunway Lagoon theme park main extraction for tourism. 2ndly their Sunway Lagoon also contribute their Hotel segnment by organizing Concert event. The reason happening at Sunway lagoon. This post has been edited by felixmask: Sep 17 2014, 10:34 AM Attached thumbnail(s)

|

|

|

Sep 17 2014, 12:44 PM Sep 17 2014, 12:44 PM

Return to original view | Post

#104

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Sep 17 2014, 12:46 PM Sep 17 2014, 12:46 PM

Return to original view | Post

#105

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Sep 17 2014, 04:41 PM Sep 17 2014, 04:41 PM

Return to original view | Post

#106

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(nightzstar @ Sep 17 2014, 04:21 PM) u also notice..now rm1.30 , but mine the listing is rm1.37..waiting for Euro QE ..see got effect or not. I also plan to sell above rm1.37 when the yield range 4% This post has been edited by felixmask: Sep 17 2014, 04:41 PM |

|

|

|

|

|

Sep 17 2014, 05:14 PM Sep 17 2014, 05:14 PM

Return to original view | Post

#107

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(felixmask @ Sep 17 2014, 04:41 PM) u also notice..now rm1.30 , but mine the listing is rm1.37 jus started..waiting for Euro QE ..see got effect or not. I also plan to sell above rm1.37 when the yield range 4% http://www.bloomberg.com/news/2014-09-16/c...uro-credit.html |

|

|

Sep 19 2014, 06:45 PM Sep 19 2014, 06:45 PM

Return to original view | Post

#108

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Sep 25 2014, 09:42 AM Sep 25 2014, 09:42 AM

Return to original view | Post

#109

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(AVFAN @ Sep 24 2014, 07:00 PM) yep, looking good. Juz mine thought uoa, axis, sunreit, ytl, igb, now pav... all up only amanahraya managed to stay at 89 sen! most reit pirces moving up now... maybe expectation bnm will not raise rates for a long time...? BNM OPR not effect to REITS..as Reit able to using fix interest rate like SUNREIT; If look back OPR raised in 2011 also no impacted to Reit Main concern still at MGS 10 yield - tandem to US -Treasury Bill 10yield. This post has been edited by felixmask: Sep 25 2014, 09:43 AM |

|

|

Sep 25 2014, 01:06 PM Sep 25 2014, 01:06 PM

Return to original view | Post

#110

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Sep 25 2014, 01:26 PM Sep 25 2014, 01:26 PM

Return to original view | Post

#111

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(nexona88 @ Sep 25 2014, 01:11 PM) so I just Reg free there & key-in all the info. the website can calculate clearly, so don't make me confusing money go inside your pocket..dont need waste time or dilema calc profit buying stock.» Click to show Spoiler - click again to hide... « This post has been edited by felixmask: Sep 25 2014, 01:29 PM |

|

|

Sep 25 2014, 06:24 PM Sep 25 2014, 06:24 PM

Return to original view | Post

#112

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(AVFAN @ Sep 25 2014, 05:57 PM) this is trading ler...! i know one person trading reits;i always fail with this strategy - everytime i did that, the price either stays above buy price or below sell price for a long time... so, i stopped doing that. either sell all or sell nothing. Hope this can help; http://www.wealth-trade.blogspot.hk/ |

|

|

Sep 28 2014, 10:37 PM Sep 28 2014, 10:37 PM

Return to original view | Post

#113

|

Senior Member

6,356 posts Joined: Aug 2008 |

from DALI

» Click to show Spoiler - click again to hide... « I do google search ; article mention QE will end at October 2014; during Fed October or Dec meeting http://en.wikipedia.org/wiki/History_of_Fe...mmittee_actions http://www.forbes.com/sites/samanthasharf/...sset-purchases/ This post has been edited by felixmask: Sep 28 2014, 10:39 PM |

|

|

|

|

|

Sep 30 2014, 10:04 AM Sep 30 2014, 10:04 AM

Return to original view | Post

#114

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Oct 2 2014, 10:11 AM Oct 2 2014, 10:11 AM

Return to original view | Post

#115

|

Senior Member

6,356 posts Joined: Aug 2008 |

Maybank IB view on US FOMC(Fed Meeting)

Attached File(s)  Econs_US_FOMC_20140918_MKE.pdf ( 452.46k )

Number of downloads: 37

Econs_US_FOMC_20140918_MKE.pdf ( 452.46k )

Number of downloads: 37 |

|

|

Oct 2 2014, 01:50 PM Oct 2 2014, 01:50 PM

Return to original view | Post

#116

|

Senior Member

6,356 posts Joined: Aug 2008 |

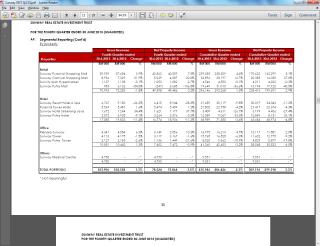

from KENAGA - MREITs - 2QCY14 Inline, Door Still Open For European

Attached File(s)  MREITs___2QCY14_Inline__Door_Still_Open_For_European_BY_KENAGA.pdf ( 648.24k )

Number of downloads: 74

MREITs___2QCY14_Inline__Door_Still_Open_For_European_BY_KENAGA.pdf ( 648.24k )

Number of downloads: 74 |

|

|

Oct 3 2014, 01:00 PM Oct 3 2014, 01:00 PM

Return to original view | Post

#117

|

Senior Member

6,356 posts Joined: Aug 2008 |

President of the St. Louis Federal Reserve Bank highlight

http://www.reuters.com/article/2014/10/03/...N0HS01O20141003 » Click to show Spoiler - click again to hide... « US want to end QE - increase their interest rate but Euro only start their New QE effect reduce their interest. ECB targets bundled-debt market to boost economy http://www.reuters.com/article/2014/10/02/...N0HR0SH20141002 » Click to show Spoiler - click again to hide... « This post has been edited by felixmask: Oct 3 2014, 01:20 PM |

|

|

Oct 7 2014, 05:31 PM Oct 7 2014, 05:31 PM

Return to original view | Post

#118

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Oct 8 2014, 09:00 AM Oct 8 2014, 09:00 AM

Return to original view | Post

#119

|

Senior Member

6,356 posts Joined: Aug 2008 |

http://www.iras.gov.sg/irasHome/page04.aspx?id=6676

GST in Singapore The Investors 32. An investor is entitled to receive income distributions from the REITs invested. The income distribution in the form of dividend is not subject to GST. When the REIT units are traded in Bursa Malaysia, the buying and selling of REIT units is also an exempt supply and is not subject to GST. However, any brokerage commission or clearing fee on the buying and selling of the REITs is subject to GST at a standard rate. The investor is not entitled to claim the GST incurred on the buying and selling of the REITs since it is an exempt supply. This post has been edited by felixmask: Oct 8 2014, 09:05 AM Attached File(s)  GST_FundManagement.pdf ( 347.8k )

Number of downloads: 9

GST_FundManagement.pdf ( 347.8k )

Number of downloads: 9 |

|

|

Oct 14 2014, 08:42 AM Oct 14 2014, 08:42 AM

Return to original view | Post

#120

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0258sec 0.0258sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 09:40 AM |