QUOTE(yklooi @ Nov 4 2013, 10:43 AM)

reason for < 10 yrs may includes; maybe needed to cash out, switch to other asset class, moves to other more "performing" bond fund which is not from the same fund house, etc

Fundsupermart.com v5, Manage your own unit trust portfolio

|

|

Nov 4 2013, 10:44 AM Nov 4 2013, 10:44 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(yklooi @ Nov 4 2013, 10:43 AM) reason for < 10 yrs may includes; maybe needed to cash out, switch to other asset class, moves to other more "performing" bond fund which is not from the same fund house, etc |

|

|

|

|

|

Nov 4 2013, 10:54 AM Nov 4 2013, 10:54 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 4 2013, 11:30 AM Nov 4 2013, 11:30 AM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 10:43 AM) reason for < 10 yrs may includes; maybe needed to cash out, switch to other asset class, moves to other more "performing" bond fund which is not from the same fund house, etc As for your time horizon of < 10 years, then you may want to consider a bond fund that invest in short to intermediate term bonds, since consensus are, that we are in a "rising interest rate environment " (I cannot predict the future, by the way "You'll want to match your fund investments with your time horizons. For principal you might need over the next one to four years, choose short-term bond funds. Money you don't need right away, consider intermediate-term funds. Save longer-term funds only for money you won't be needing for a long time (or avoid them altogether if you'd prefer to avoid the volatility if rates rise)." - Rob Williams, Director of Income Planning, Schwab Center for Financial Research Read more here--> Choosing bond funds by duration and your investment horizon |

|

|

Nov 4 2013, 11:40 AM Nov 4 2013, 11:40 AM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(Pink Spider @ Nov 4 2013, 10:43 AM) Depends really, if Yes, you do make sense for really short term holding. We must do the math to find the optimum holding period to give the bang for the buck.(i) your holding period is not that long (ii) you sell a bond fund to raise cash i.e. not doing intra switching, later buy back into bond fund be it the same fund or different fund Then platform fee would be better than sales charge. |

|

|

Nov 4 2013, 11:42 AM Nov 4 2013, 11:42 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(creativ @ Nov 4 2013, 11:40 AM) Yes, you do make sense for really short term holding. We must do the math to find the optimum holding period to give the bang for the buck. To add, not too many funds that can consistently outperform for that many years, cos fund managers come and go.U may hold ABC Income Fund for x no. of years, then u switch to XYZ Bond Fund that is managed by a different fund house. In that case, u will incur fresh new sales charges (if u invest thru other platforms). |

|

|

Nov 4 2013, 11:59 AM Nov 4 2013, 11:59 AM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(Pink Spider @ Nov 4 2013, 11:42 AM) U may hold ABC Income Fund for x no. of years, then u switch to XYZ Bond Fund that is managed by a different fund house. In that case, u will incur fresh new sales charges (if u invest thru other platforms). Yup, do the math according to our own situation to see if it's worth it or not. |

|

|

|

|

|

Nov 4 2013, 12:02 PM Nov 4 2013, 12:02 PM

|

Junior Member

218 posts Joined: May 2008 |

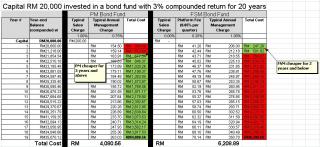

QUOTE(Pink Spider @ Nov 4 2013, 10:43 AM) Depends really, if This is the calculation for the optimum holding period of bond fund in FSM(i) your holding period is not that long (ii) you sell a bond fund to raise cash i.e. not doing intra switching, later buy back into bond fund be it the same fund or different fund Then platform fee would be better than sales charge. It is only cheaper if holding is 2 years and below for FSM.

|

|

|

Nov 4 2013, 12:04 PM Nov 4 2013, 12:04 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(creativ @ Nov 4 2013, 11:40 AM) Yes, you do make sense for really short term holding. We must do the math to find the optimum holding period to give the bang for the buck. that does just justify between holding just term bonds and long terms bonds for risk/asset class holdings, BUT does not have the answer to my post asking is FSM bond funds more expensive when holds < 10 years when compared to the providers you used to compared FSM with for a period of 20 years?you mentioned "No matter how many years your time horizon is, any fees or charges on your investment is not good, so go for the lower one." i would go for the one that can provide me a better expected ROI at a risk appetite that are comparable....no use of saving 1 ~ 2% mgmt fees when the ROI is not performing when compared to the mkt benchmarks or peers. |

|

|

Nov 4 2013, 12:07 PM Nov 4 2013, 12:07 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 12:04 PM) that does just justify between holding just term bonds and long terms bonds for risk/asset class holdings, BUT does not have the answer to my post asking is FSM bond funds more expensive when holds < 10 years when compared to the providers you used to compared FSM with for a period of 20 years? Dude, I hope my previous post answers your question. you mentioned "No matter how many years your time horizon is, any fees or charges on your investment is not good, so go for the lower one." i would go for the one that can provide me a better expected ROI at a risk appetite that are comparable....no use of saving 1 ~ 2% mgmt fees when the ROI is not performing when compared to the mkt benchmarks or peers. |

|

|

Nov 4 2013, 12:12 PM Nov 4 2013, 12:12 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 4 2013, 12:18 PM Nov 4 2013, 12:18 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 12:04 PM) i would go for the one that can provide me a better expected ROI at a risk appetite that are comparable....no use of saving 1 ~ 2% mgmt fees when the ROI is not performing when compared to the mkt benchmarks or peers. Yes of course (-) High Risk, High Potential returns (vice-versa) (-) Past Performance is No Guarantee of Future Results |

|

|

Nov 4 2013, 12:26 PM Nov 4 2013, 12:26 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(creativ @ Nov 4 2013, 12:07 PM) that just made a good comparision of "saving" between funds with different in annual Mgmt fees" but does not means correct to generalizewhat is posted as "FSM is more expensive!"...by you at page 6 post 119 i believes FSM do have some bonds funds with better (or less) Annual Mgmt fees. than 0.75% (ex AmIncome, KAF, RHB Is inc) Public Mutual Enchanced bond fund is also 1%? This post has been edited by yklooi: Nov 4 2013, 12:39 PM |

|

|

Nov 4 2013, 12:27 PM Nov 4 2013, 12:27 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(creativ @ Nov 4 2013, 12:18 PM) Yes of course so, NEVER selects funds solely based on mgmt fees alone.(-) High Risk, High Potential returns (vice-versa) (-) Past Performance is No Guarantee of Future Results so is posting of "No matter how many years your time horizon is, any fees or charges on your investment is not good, so go for the lower one" is WRONG to be the sole basis of selections.. This post has been edited by yklooi: Nov 4 2013, 12:31 PM |

|

|

|

|

|

Nov 4 2013, 12:41 PM Nov 4 2013, 12:41 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 12:27 PM) so, NEVER selects funds solely based on mgmt fees alone. Ok ok.. I thought people here are mostly experience investors... It looks like I must word them correctly like a legal document so is posting of "No matter how many years your time horizon is, any fees or charges on your investment is not good, so go for the lower one" is WRONG to be the sole basis of selections.. "Assuming risk is the same, no matter how many years your time horizon is, any fees or charges on your investment is not good, so go for the lower one" QUOTE(yklooi @ Nov 4 2013, 12:26 PM) i believes FSM do have some bonds funds with better (or less) Annual Mgmt fees. than 0.75% (ex AmIncome, KAF, RHB Is inc) Also, in my calculation spread sheet, you will see the word "typical" as in "typical management fees"Public Mutual Enchanced bond fund is also 1%? Btw, Public Enhanced Bond fund has equity exposure, I think that's why they are charging higher. This post has been edited by creativ: Nov 4 2013, 12:46 PM |

|

|

Nov 4 2013, 12:46 PM Nov 4 2013, 12:46 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(creativ @ Nov 4 2013, 12:41 PM) Also, in my calculation spread sheet, you will see the word "typical" as in "typical management fees" but using the phrase ""FSM is more expensive!"...by you at page 6 post 119 ? to sum it up "Btw, Public Enhanced Bond fund has equity exposure, I think that's why they are charging higher".....so is i think other funds in FSM also has that exposure too. This post has been edited by yklooi: Nov 4 2013, 12:49 PM |

|

|

Nov 4 2013, 01:03 PM Nov 4 2013, 01:03 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 12:46 PM) but using the phrase ""FSM is more expensive!"...by you at page 6 post 119 ? to sum it up Not sure, must check the FSM fund fact sheet to compare (apple-to -apple) the Investment Strategy of the bond fund you're buying."Btw, Public Enhanced Bond fund has equity exposure, I think that's why they are charging higher".....so is i think other funds in FSM also has that exposure too. |

|

|

Nov 4 2013, 01:08 PM Nov 4 2013, 01:08 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(creativ @ Nov 4 2013, 01:03 PM) Not sure, must check the FSM fund fact sheet to compare (apple-to -apple) the Investment Strategy of the bond fund you're buying. so, NEVER selects funds solely based on mgmt fees alone.to be honest, your chart did shows a good comparison of "loses" from the Mgmt fees....that exclude "all other fees" you did that for hobby or for your profession use? |

|

|

Nov 4 2013, 01:20 PM Nov 4 2013, 01:20 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yklooi @ Nov 4 2013, 01:08 PM) so, NEVER selects funds solely based on mgmt fees alone. I am not working for PM nor FSM. I am just an investor who is planning for retirement using asset allocation strategy.to be honest, your chart did shows a good comparison of "loses" from the Mgmt fees....that exclude "all other fees" you did that for hobby or for your profession use? Well, if you would be kind enough to come up the calculation to include those fees that rather than picking on me, it would definitely help a lot of forumers here. My future depends on it... can't say hobby too... because hobby is what we do during our past time. Can't say profession too, because I'm not working in the financial or investment industry This post has been edited by creativ: Nov 4 2013, 01:25 PM |

|

|

Nov 4 2013, 01:32 PM Nov 4 2013, 01:32 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

creativ sounds like a PM agent

Anyway, I don't look at the annual management fee if the past historical performance shows solid returns |

|

|

Nov 4 2013, 01:48 PM Nov 4 2013, 01:48 PM

|

Junior Member

218 posts Joined: May 2008 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0297sec 0.0297sec

0.54 0.54

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 02:16 PM |