hm.. i'll play the devil / bad cop here

1. There seems to be some missing costs in your monthly expenses - eg. obvious one being rental (room or entire apartment/house)

Must be realistic to plan cash flow ahead consistently

eg. even if staying with parents please factor in IF U are by yourself - how much will it cost U?

2. When should one start thinking of buying own home?

Any time - to build-up savings, income, etc in preparation to execute

When should one buy is another question +where +how much.

3. Rule of thumb - your housing cost (mortgage+cukai taksiran+cukai tanah+maintenance+etc.) should NOT be more than 30% of your net income (active income +passive income if U choose so).

Reason - the lower the %, the less of a pain it is to own it +more flexibility in investments.

Note - a home is a cost, not an investment. Yes, it's considered an asset but an asset that sucks up cash flow unless U sell it and hope for profit. Investment properties are different animals.

4. Personal opinions on your action plan:

- Place 30k into OCBC 360 (4.1% p.a.) (emergency fund for family, need to be liquid)

Good - never touch this unless emergency.

And NO, your parents unable to pay their personal loan isnt an emergency. Personal loans and the likes are unsecured loans and choy choy if anything happens to debtors of unsecured loans, banks try to go after what's left of debtors' estate. Sorry for being obvious & fatalistic here ya

- Remaining 15k for investment (ASNB ASM1 ASM2, unit trust, ETF StashAway, Stock)

U better have some sort of equity asset sub-allocation plan & execution here.

ie. dont "all-in" into one-hand like 1 ETF or 1 Stock.

- Each month allocate 2k into investment, 1k into saving (FD/OCBC360)

increasing your emergency buffer until?

gotta re-direct the cash into investing after U reach your emergency buffer goals else U'll never win the game playing defence only. Playing good defence is good but offence is needed too to score goals and win.

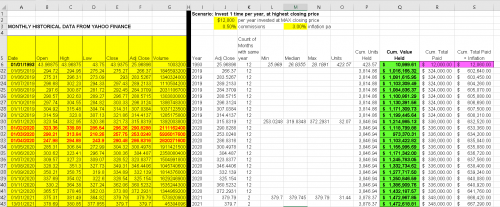

- 6k-8k per year into EPF (ultimate aim is to have ~600-700k in EPF when I'm around 55 years old, by compounding I hope this is doable...)

EPF, assuming i am self-employed (freelance, no employer EPF right?), i'd treat EPF as my bonds / Fixed income portion of asset allocation & i'd also go for the max tax-relief $4K pa or more (assuming it meets my asset allocation %).

Whether or not it'll hit 600K-700k when 55, can simulate easily with a spreadsheet. Just assume 5%pa or 4%pa returns to be prudent, even though averaging about 5.5%pa

Hope the above helps in clarifying your thoughts/plans a bit without being too much of a bast*rd/hard knock

I'd suggest not lumping up all problems and trying to solve everything in one shot/plan - ie. noticed i didnt bother stating possible solutions about your parents' home loan and stuff?

Plan A first, things that U can control / foresee enough

Then adjust Plan A for parents' stuff and see if can do Plan B - coz U can't control others +others may not want you being nosy/your help.

QUOTE(Kitsune Udon @ Aug 8 2019, 03:00 AM)

Seeking for some financial and maybe even life advice here.

Age 30, single, been working freelance programmer for 2 years, around 48-60k p.a., so that's around 4-5k per month.

Each month save around 3k, currently has ~45k in saving account.

45k saving is not solely for me but also for my parents, because:

- Their house still on loan (~70k), and also a car (but only left 3k installment to go)

- Just found out recently parents has personal loan ~50k from bank as well (borrowed for money game/stock/investment which I think they lost all...)

- Slow income and it's getting worse, retiring soon, ~2k per month which barely covers live expenses + debt repayment

- No EPF and savings AFAIK

For my side, cleared my PTPTN last year so I don't have any debt for now, my monthly expenses:

- Insurance RM320

- Utilities bill ~RM200 (water, electricity, internet, mobile)

- Travel ~RM150 (petrol, touch n go)

- Food ~RM150

- Misc ~RM200 (parents, personal expenses, etc)

I'm afraid they might not be able to clear their debt properly so I've been living frugally to save up to a amount I feel more relief.

For now I feel more 'safe' to have 45k saving, and thinking to start doing some investment with 3k gross income I can do every month.

I've 0 experience in investment and money management, only lately I've started to read and trying to learn in this sub-forum.

Currently my action plan:

- Place 30k into OCBC 360 (4.1% p.a.) (emergency fund for family, need to be liquid)

- Remaining 15k for investment (ASNB ASM1 ASM2, unit trust, ETF StashAway, Stock)

- Each month allocate 2k into investment, 1k into saving (FD/OCBC360)

- 6k-8k per year into EPF (ultimate aim is to have ~600-700k in EPF when I'm around 55 years old, by compounding I hope this is doable...)

I need some enlightenment on:

- How likely is this financial situation allow me to purchase a property?

- Is my action plan make sense? Too risky/'out-of-mind'/nonsense/full of hole?

- What can I do to improve my situation/income? I'm trying hard to increase my income but I'm not so confident that I can increase it a lot.

Honestly I don't feel good with this situation especially seeing many of my friends has already secured a property (be it PAMA or self effort).

Hopefully I can get some advice here be it harsh or soft.

Oct 16 2018, 08:40 PM

Oct 16 2018, 08:40 PM

Quote

Quote

0.1059sec

0.1059sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled