QUOTE(BoomChaCha @ Oct 20 2013, 06:04 PM)

I have a relative passed away without a will prepared, and none of his family members knew where he kept the money.

For me, I do not want to see this happens to my family members.

Fixed Deposit Rates in Malaysia V5

|

|

Oct 20 2013, 09:40 PM Oct 20 2013, 09:40 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Oct 20 2013, 06:04 PM) I have a relative passed away without a will prepared, and none of his family members knew where he kept the money. For me, I do not want to see this happens to my family members. |

|

|

|

|

|

Oct 20 2013, 09:48 PM Oct 20 2013, 09:48 PM

|

Junior Member

162 posts Joined: Jun 2012 |

MBB offers 3mths FD average out 3.27% with fresh fund

|

|

|

Oct 20 2013, 11:13 PM Oct 20 2013, 11:13 PM

|

Senior Member

2,503 posts Joined: Jan 2003 From: http://davis-online-store.com |

|

|

|

Oct 21 2013, 08:27 PM Oct 21 2013, 08:27 PM

|

Junior Member

162 posts Joined: Jun 2012 |

I was offered when I was in maybank doin some transaction.. Valid till mid of not if I'm nt wrong

|

|

|

Oct 21 2013, 11:06 PM Oct 21 2013, 11:06 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(Gen-X @ Oct 20 2013, 08:09 PM) Prepaid mobile phone also not safe. It requires IC info to register the starter pack. QUOTE(bbgoat @ Oct 20 2013, 09:40 PM) I kept my will with a list of my assets including FD, bank accts, EPF/CPF, foreign brokerage acct together. So hopefully, all is not lost when I say bye bye whether in a rush or not. I do the same way except a will.I write down all my money info like FDs, saving accounts, ATM passwords on a book. On the book front cover, I write down: All my money. So my family members will find it when I am no longer here. On my post #390, I mentioned about my relative who passed away suddenly, I suggested his family members to check all his bank accounts to see if any money there. But I do not know if they are doing it or not? And it is also important to get the FDs joint account with your family members, better to make all of them either one to sign. and of course you keep the FD certs. And also keep at least 3 valid saving accounts (from 3 different banks) with joint account with your family members, and also make them either one to sign. You keep the saving books. QUOTE(Rich_Lim @ Oct 21 2013, 08:27 PM) Maybe this May Bank FD promo is no longer available:(1) FD/IFD-i Malaysia Day Campaign - Maybank www.maybank2u.com.my › Home › Promotions › Accounts & Banking This Fixed Deposit campaign will commence from 1 September until 30 September 2013, or upon reaching the ... 1st Month, 3.10% p.a., 3.27% p.a., 3.05% p.a.. (2) http://jimatcermat.my/promosi-deposit-teta...september-2013/ This post has been edited by BoomChaCha: Oct 22 2013, 05:28 AM |

|

|

Oct 22 2013, 10:05 AM Oct 22 2013, 10:05 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

dunno if anyone just posted but here's wat i got at uob:

board rate is only 2.9x-3.10% but... alto officially they say fresh funds, yr deposit at expiry, the teller will want to renew for you, no need to take out and go back. my last 3.65% 9 mths pa at maturity, renewed at 3.55% for 12 mths. amt need to be >100k. no frills, no casa required. if withdrawal, banker's cheque cost is rm2.15. one thing this week, uob started a new it system, new acc nos, etc - quite a mess in terms of q and waiting time. This post has been edited by AVFAN: Oct 22 2013, 10:06 AM |

|

|

|

|

|

Oct 22 2013, 10:13 AM Oct 22 2013, 10:13 AM

|

Senior Member

1,624 posts Joined: Apr 2011 |

QUOTE(AVFAN @ Oct 22 2013, 10:05 AM) dunno if anyone just posted but here's wat i got at uob: I opened a new FD on 17th Oct with 3.65% rate for 12 months. board rate is only 2.9x-3.10% but... alto officially they say fresh funds, yr deposit at expiry, the teller will want to renew for you, no need to take out and go back. my last 3.65% 9 mths pa at maturity, renewed at 3.55% for 12 mths. amt need to be >100k. no frills, no casa required. if withdrawal, banker's cheque cost is rm2.15. one thing this week, uob started a new it system, new acc nos, etc - quite a mess in terms of q and waiting time. 3.65% fresh fund versus 3.55% existing fund Difference is 100 interest for rm100k FD. Thus 2.15 banker cheque cost is negligible...IBG may be cheaper.. |

|

|

Oct 22 2013, 10:34 AM Oct 22 2013, 10:34 AM

|

All Stars

24,456 posts Joined: Nov 2010 |

QUOTE(gsc @ Oct 22 2013, 10:13 AM) I opened a new FD on 17th Oct with 3.65% rate for 12 months. true...3.65% fresh fund versus 3.55% existing fund Difference is 100 interest for rm100k FD. Thus 2.15 banker cheque cost is negligible...IBG may be cheaper.. only that i will lose a couple of days in transit for the money to clear in other bank, then go back. yr way wud get a bit more if dun mind the hassle and driving, parking, waiting... |

|

|

Oct 22 2013, 11:25 AM Oct 22 2013, 11:25 AM

|

Senior Member

1,624 posts Joined: Apr 2011 |

QUOTE(AVFAN @ Oct 22 2013, 10:34 AM) true... Just bring along your personal cheque ( bank X ) renew on the spot to fulfill the fresh fund criteria and instruct the bank to IBG or Rentas the matured FD fund to Bank X in the morning.only that i will lose a couple of days in transit for the money to clear in other bank, then go back. yr way wud get a bit more if dun mind the hassle and driving, parking, waiting... This is what I have been doing. |

|

|

Oct 22 2013, 11:27 AM Oct 22 2013, 11:27 AM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(AVFAN @ Oct 22 2013, 10:05 AM) dunno if anyone just posted but here's wat i got at uob: yah, nowadays UOB willing to offer "promo" rate for old funds. I did post earlier that for old funds, their 3 months offer pretty good because no need to deposit into CASA unlike current 3 months promo.board rate is only 2.9x-3.10% but... alto officially they say fresh funds, yr deposit at expiry, the teller will want to renew for you, no need to take out and go back. my last 3.65% 9 mths pa at maturity, renewed at 3.55% for 12 mths. amt need to be >100k. no frills, no casa required. if withdrawal, banker's cheque cost is rm2.15. one thing this week, uob started a new it system, new acc nos, etc - quite a mess in terms of q and waiting time. And like you said, save the hassle of doing transfer here and there. QUOTE(gsc @ Oct 22 2013, 10:13 AM) I opened a new FD on 17th Oct with 3.65% rate for 12 months. Definitely AVFAN would have consider that but I bet AVFAN's time is worth more than RM100 per hour.3.65% fresh fund versus 3.55% existing fund Difference is 100 interest for rm100k FD. Thus 2.15 banker cheque cost is negligible...IBG may be cheaper.. |

|

|

Oct 22 2013, 12:20 PM Oct 22 2013, 12:20 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(gsc @ Oct 22 2013, 10:13 AM) I opened a new FD on 17th Oct with 3.65% rate for 12 months. UOB offered you extra 0.05% (from 3.6% to 3.65%) for 12 months?3.65% fresh fund versus 3.55% existing fund Difference is 100 interest for rm100k FD. Thus 2.15 banker cheque cost is negligible...IBG may be cheaper.. And no need to sign-up a new saving account? |

|

|

Oct 22 2013, 01:59 PM Oct 22 2013, 01:59 PM

|

All Stars

24,456 posts Joined: Nov 2010 |

QUOTE(Gen-X @ Oct 22 2013, 11:27 AM) And like you said, save the hassle of doing transfer here and there. becos of the switch to new a it system yesterday, q time was 3 hrs, another 1 hr to sit at counter to redeem and renew. total 4 hrs.Definitely AVFAN would have consider that but I bet AVFAN's time is worth more than RM100 per hour. some customers just left. i was ready to withdraw all and never return to uob as i had always found them slow. 1st visit was 1hr wait, second time, 1.5 hr, this 3rd time, 4 hrs... but since there isn't much better elsewhere available at this time, i accepted the 3.55% renewal but at a reduced amount. i have only made deposits with cimb, pbb, hlb and uob. uob waiting time is by far the worst of the whole lot. all other banks take 30min or less. and yes, 1hr is too long for me!! |

|

|

Oct 22 2013, 02:21 PM Oct 22 2013, 02:21 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(AVFAN @ Oct 22 2013, 01:59 PM) becos of the switch to new a it system yesterday, q time was 3 hrs, another 1 hr to sit at counter to redeem and renew. total 4 hrs. UOB said: For existing UOB FDs that have not matured can still use the FD certs until the maturity date.some customers just left. i was ready to withdraw all and never return to uob as i had always found them slow. 1st visit was 1hr wait, second time, 1.5 hr, this 3rd time, 4 hrs... but since there isn't much better elsewhere available at this time, i accepted the 3.55% renewal but at a reduced amount. i have only made deposits with cimb, pbb, hlb and uob. uob waiting time is by far the worst of the whole lot. all other banks take 30min or less. and yes, 1hr is too long for me!! All FD depositors should receive a letter with a new FD account number on it for future or current use. |

|

|

|

|

|

Oct 22 2013, 03:25 PM Oct 22 2013, 03:25 PM

|

Senior Member

1,264 posts Joined: Aug 2009 |

http://www.rhb.com.my/whats_new/deposits/g...-horse-fortune/

Anyone interested with this? Newly launched. |

|

|

Oct 22 2013, 05:03 PM Oct 22 2013, 05:03 PM

|

|

Staff

2,797 posts Joined: Nov 2007 From: On the beach |

QUOTE(pinksapphire @ Oct 22 2013, 03:25 PM) http://www.rhb.com.my/whats_new/deposits/g...-horse-fortune/ Need to have 50k in CASA then only can put additional 50k into FD for the promo rate. From their website, their CASA interest rate not that attractive. Any ideas?Anyone interested with this? Newly launched. Looking for other 3 months FD promo, guess UOB still the most straight forward. |

|

|

Oct 22 2013, 05:49 PM Oct 22 2013, 05:49 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Oct 21 2013, 11:06 PM) I do the same way except a will. |

|

|

Oct 22 2013, 10:22 PM Oct 22 2013, 10:22 PM

|

Senior Member

1,624 posts Joined: Apr 2011 |

|

|

|

Oct 22 2013, 11:45 PM Oct 22 2013, 11:45 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

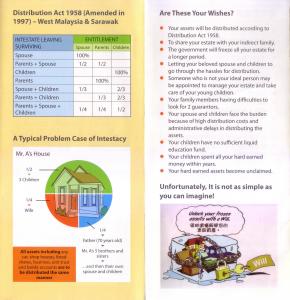

QUOTE(bbgoat @ Oct 22 2013, 05:49 PM) For a person who is a PB customer of various banks, it is better for you to have a will. You don't want the standard distribution of your assets by law, do you ? Not various banks lah.. We can prepare a will by ourselves, but just need 2 witnesses on the will. We can always change the will, only the latest will will be honored by laws. Yes, I will make one soon. The terrible situation without a will --->

QUOTE(gsc @ Oct 22 2013, 10:22 PM) QUOTE(pinksapphire @ Oct 22 2013, 03:25 PM) http://www.rhb.com.my/whats_new/deposits/g...-horse-fortune/ This FD promo is not so attractive la... Thanks for the update.. Anyone interested with this? Newly launched. The previous RHB 1 year FD promo at 3.78% is much better. I just received my first monthly interest in my Islamic saving account. This post has been edited by BoomChaCha: Oct 22 2013, 11:50 PM |

|

|

Oct 23 2013, 12:01 AM Oct 23 2013, 12:01 AM

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

Oct 23 2013, 12:56 AM Oct 23 2013, 12:56 AM

|

Junior Member

315 posts Joined: Jun 2008 |

QUOTE(munkeyflo @ Oct 22 2013, 05:03 PM) Need to have 50k in CASA then only can put additional 50k into FD for the promo rate. From their website, their CASA interest rate not that attractive. Any ideas? I thought that CIMB offer best FD for 3 months, at 3.05%? I am using this one cause convenient.Looking for other 3 months FD promo, guess UOB still the most straight forward. |

|

Topic ClosedOptions

|

| Change to: |  0.0341sec 0.0341sec

0.28 0.28

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 01:30 AM |