QUOTE(PlayMaker` @ Jul 3 2013, 05:08 PM)

STOCK MARKET DISCUSSION V133, Bear coming?

STOCK MARKET DISCUSSION V133, Bear coming?

|

|

Jul 3 2013, 05:57 PM Jul 3 2013, 05:57 PM

Return to original view | Post

#61

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

|

|

|

Jul 3 2013, 05:58 PM Jul 3 2013, 05:58 PM

Return to original view | Post

#62

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 3 2013, 09:43 PM Jul 3 2013, 09:43 PM

Return to original view | Post

#63

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 3 2013, 09:44 PM Jul 3 2013, 09:44 PM

Return to original view | Post

#64

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 4 2013, 04:39 PM Jul 4 2013, 04:39 PM

Return to original view | Post

#65

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

oh boy. don't tell me whole year 2013 is a bullish year.

2014 super bull. 2015 sideline 2016 kaboom bubble burst year. This post has been edited by yok70: Jul 4 2013, 04:40 PM |

|

|

Jul 4 2013, 04:41 PM Jul 4 2013, 04:41 PM

Return to original view | Post

#66

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

i like gab below 16.00

|

|

|

|

|

|

Jul 4 2013, 04:56 PM Jul 4 2013, 04:56 PM

Return to original view | Post

#67

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(PlayMaker` @ Jul 4 2013, 04:48 PM) maybe it is good for you but not to those ppl who having losses at this moment we have to train ourselves to think rationally on investment, no other choice. reality is reality, cannot change one. ie. i have to accept my heavy REIT holdings for current weak sentiment on REITs. Not helpful to be moody on investment. Just keep them if feel comfortable with their future, or sell them if losing confidence. As for myself, I am keeping my REITs mostly untouched. Just playing some trading on them since lately very volatile, good for trading REITs. P/S: i'm not a GAB shareholder tax hike is the key sentiment now for sin stocks. if announce no hike, price may back to previous high fast. if hike, further down....or, "buy on news" also may happen. This post has been edited by yok70: Jul 4 2013, 04:56 PM |

|

|

Jul 4 2013, 05:03 PM Jul 4 2013, 05:03 PM

Return to original view | Post

#68

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(panasonic88 @ Jul 4 2013, 04:57 PM) ya. yield around 4.8% now. lucky i sold about 30% of my cmmt at 1.9x. however, not sure how long the "S-REIT sentiment" would hunt M-REIT. I think it's very hard for M-REIt to go as great as S-REIT to yield 6-7%. I am seeing max downside potential is another 10%. I got trade a bit lately, making few % fast gain. This post has been edited by yok70: Jul 4 2013, 05:04 PM |

|

|

Jul 4 2013, 05:08 PM Jul 4 2013, 05:08 PM

Return to original view | Post

#69

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Hard to resist China/HK stocks getting cheaper and cheaper as compare with Bursa's stubborn sidelines.

Today shot my first batch of Tongda, catching another falling knife. Giordano and Stelux falling knife turns out pretty ok so far. This post has been edited by yok70: Jul 4 2013, 05:09 PM |

|

|

Jul 4 2013, 06:05 PM Jul 4 2013, 06:05 PM

Return to original view | Post

#70

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(gark @ Jul 4 2013, 05:12 PM) Psst... china malls offering free rent to retailers due to over supply and lowering medium class consumption... Not scare. The basic principle is, competition is healthy to keep the winners and dismiss the losers. After this consolidation period, winners become stronger as they makan losers territory. So the million dollar question is how to pick potential winners. Not scared ah? The stocks I have been monitoring had corrected about 18-25%. I'm willing to average down for another 20%. That would mean they fall 40-50%. I don't think China economy can slow down 50%. |

|

|

Jul 4 2013, 06:24 PM Jul 4 2013, 06:24 PM

Return to original view | Post

#71

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

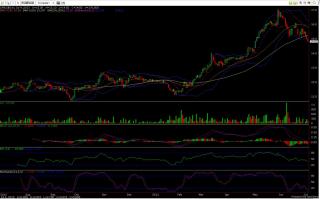

I think Carlsberg had slightly broken below the immediate support today. If the support at this level stays strong in 7 days or so, perhaps it's the short term support for it. However, if it continues to move downwards (even slightly downwards) in next 5-10 days, further downside may happened.

13.20-13.50 may see stronger support on both TA and fundamental concern. By then, RSI may hit around 20 (vs current 38.5) which may see more bottom hunting buyers. Just my view. Attached thumbnail(s)

|

|

|

Jul 4 2013, 06:39 PM Jul 4 2013, 06:39 PM

Return to original view | Post

#72

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(gark @ Jul 4 2013, 06:17 PM) Latest report up today, shadow banking crisis which trigger the 12% OPR couple of weeks ago... expected NPL of Chinese banks to report 40% once POBC ask all the banks to declare all their shadow banking. Most of the issue was affecting small banks. Large banks are not as affected, some even may profit more through inter-banks loan rate hike as the big banks are the credit supplier. It's a consolidating process for small banks, M&A is expecting for the next few years that will make China finance system stronger. China still has very strong cash power, so the crisis condition is controllable by the government. It's just about the tolerate plan of the government regarding the slow down.Shadow banking is 'illegal' money lending to state corporations behind the scenes by Chinese banks... usually not recorded in the books more like a float. If really like that... jialat loh. The growth of middle class will be continue non-stop ahead as infrastructure are building up in 2nd/3rd tier cities. This middle class is the growth engine of China, not the current loan heavy businessman. Bad businesses may bankrupt, but well managed businesses will overtake their market shares and become even stronger based on the middle class population growth. And I like the recent outcome that China is moving from manufacturing to service slowly. This is good as service can create sustainable high value chain, just imagine HK and Singapore. Please correct me if I was wrong. Just some thoughts. Of course, the severity of this transitional risk is hard to predict. So it's now a high risk high gain/loss situation. It's always like that. Low risk comes low gain/loss. What to do. China large banks are trading at PE 4-5x and pbv 0.8-0.9x. That's damn attractive! However, I still hesitate to buy in at this point. I will wait for their upcoming qtr report to see how's the earning first. The 3 stocks I bought (giordano, stelux and tongda) all have international exposure, not just china. So, it's more defensive in a way. This post has been edited by yok70: Jul 4 2013, 06:48 PM |

|

|

Jul 4 2013, 07:44 PM Jul 4 2013, 07:44 PM

Return to original view | Post

#73

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

|

|

|

Jul 4 2013, 09:19 PM Jul 4 2013, 09:19 PM

Return to original view | Post

#74

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(felixmask @ Jul 4 2013, 08:14 PM) Now is "cautiously optimistic", 5 year later might be "worrying kaboom". Which journey suits you better? I'd rather ride this anxious bull. 5 years later, put all retire fund into FD and live with yield. |

|

|

Jul 5 2013, 03:49 PM Jul 5 2013, 03:49 PM

Return to original view | Post

#75

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

RHB starts spreading fear on properties sector. Downgrade TP 20% just by a finger touch. Game o Game

This post has been edited by yok70: Jul 5 2013, 03:50 PM Attached File(s)  Property_downgrade_rhb_050713.pdf ( 351.4k )

Number of downloads: 56

Property_downgrade_rhb_050713.pdf ( 351.4k )

Number of downloads: 56 |

|

|

Jul 6 2013, 12:04 AM Jul 6 2013, 12:04 AM

Return to original view | Post

#76

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 6 2013, 01:01 AM Jul 6 2013, 01:01 AM

Return to original view | Post

#77

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 8 2013, 06:10 AM Jul 8 2013, 06:10 AM

Return to original view | Post

#78

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 8 2013, 04:46 PM Jul 8 2013, 04:46 PM

Return to original view | Post

#79

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 8 2013, 04:47 PM Jul 8 2013, 04:47 PM

Return to original view | Post

#80

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

Topic ClosedOptions

|

| Change to: |  0.0221sec 0.0221sec

1.25 1.25

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 07:44 PM |