QUOTE(adrianccseng @ Apr 15 2017, 11:08 PM)

1.

Oct * rm1347

Nov * rm1254

Dec * rm1300

Jan * rm1460

Feb * rm899

March * rm942

there's a restructure from 2017 tho. so the comm gets lesser compare to last yr

no assets no FD just saving account

oh wow, didn't knew that.

haven't contact the remaining 5 panel banks yet.

hopefully affin would approve then

Dear,Oct * rm1347

Nov * rm1254

Dec * rm1300

Jan * rm1460

Feb * rm899

March * rm942

there's a restructure from 2017 tho. so the comm gets lesser compare to last yr

no assets no FD just saving account

oh wow, didn't knew that.

haven't contact the remaining 5 panel banks yet.

hopefully affin would approve then

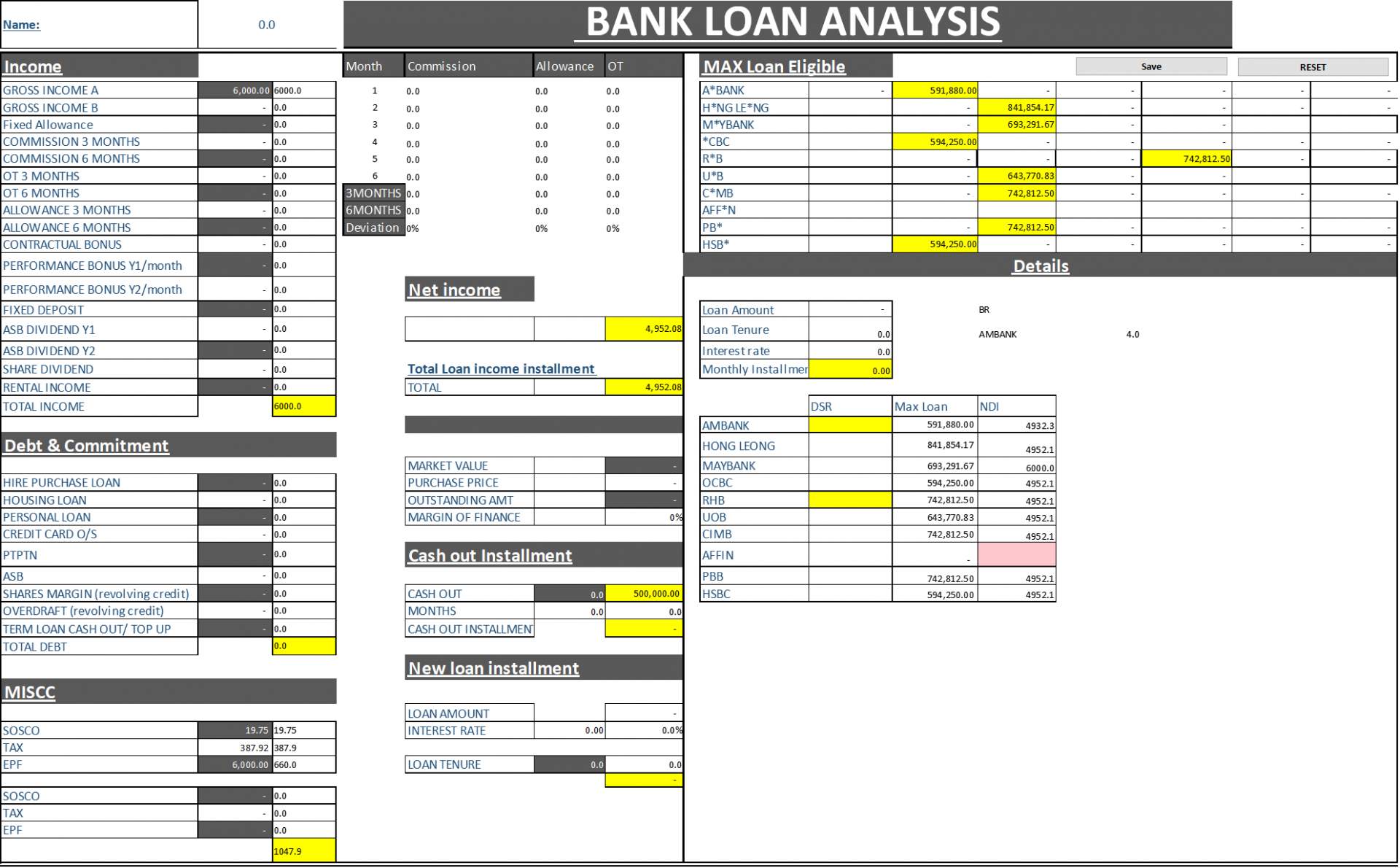

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

Bank Rm

A*BANK 328,078.67

H*NG LE*NG 539,285.33

M*YBANK 294,013.73

*CBC 352,816.48

R*B 309,338.33

U*B 352,816.48

C*MB 511,850.00

AFF*N -

PB* 511,850.00

HSB* 352,816.48

2. However, no ccris, it's subjective. If could show high saving $$$ in her account, there's a chance for 90% approval, else might drop to 80% margin of finance.

QUOTE(jordanseow @ Apr 16 2017, 04:34 PM)

Hi guys ,

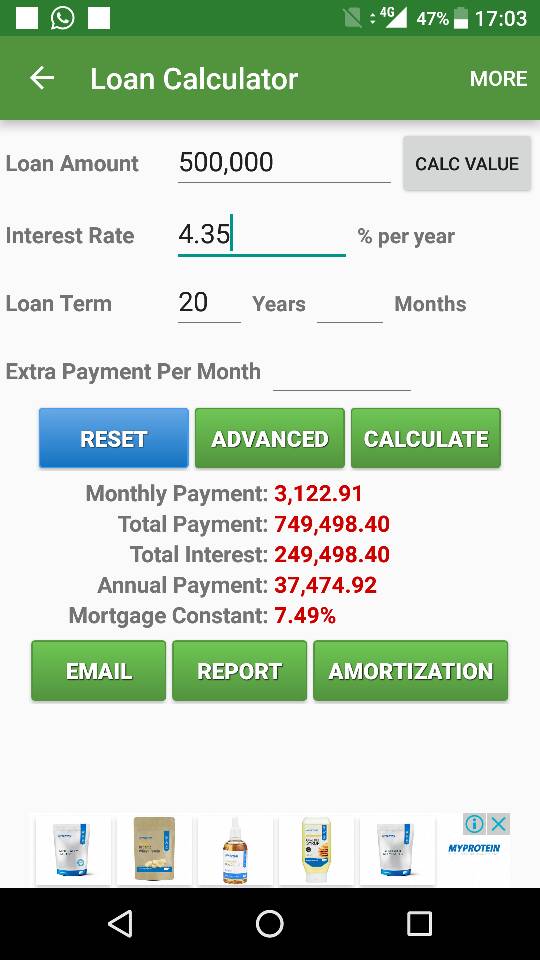

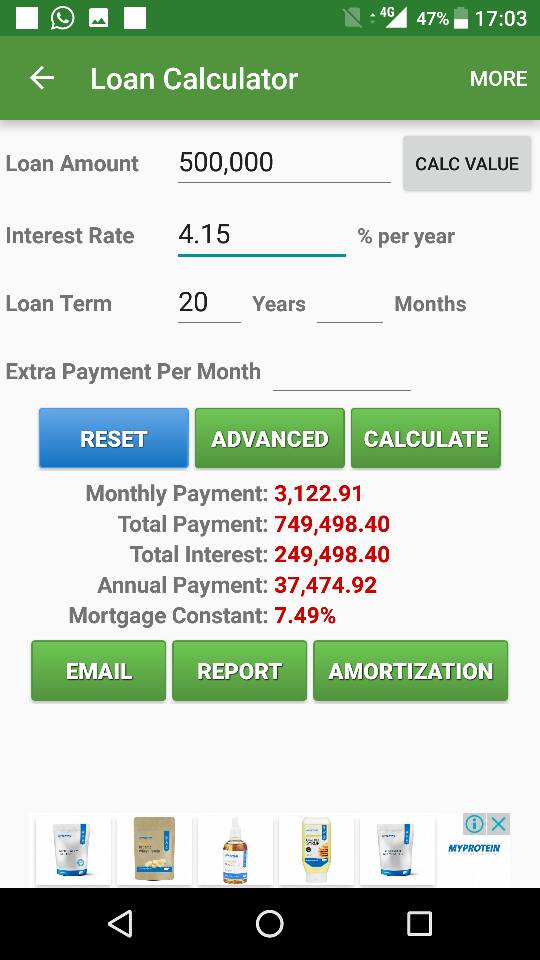

i want to loan a mortgage loan around 590K

1)I am struggling about whether choose OCBC or Maybank to apply the loan

2) normally loan more than 500K , ocbc or maybank provide better offer ?

Net income : RM3900 after epf

No commitment at all.

No car loan , no cc outstanding.

i want to loan a mortgage loan around 590K

1)I am struggling about whether choose OCBC or Maybank to apply the loan

2) normally loan more than 500K , ocbc or maybank provide better offer ?

Net income : RM3900 after epf

No commitment at all.

No car loan , no cc outstanding.

QUOTE(jordanseow @ Apr 16 2017, 04:49 PM)

I just finish my car loan last year 2016 August with pbb car loan.

Yeah I have saving around RM200K , the house value is 760K, so I planning to throw 170-180K as my first downpayment .

29 this year , working sdn bhd. This year bonus is 2 month. Working with this company 4 years already

Dear jordanseow,Yeah I have saving around RM200K , the house value is 760K, so I planning to throw 170-180K as my first downpayment .

29 this year , working sdn bhd. This year bonus is 2 month. Working with this company 4 years already

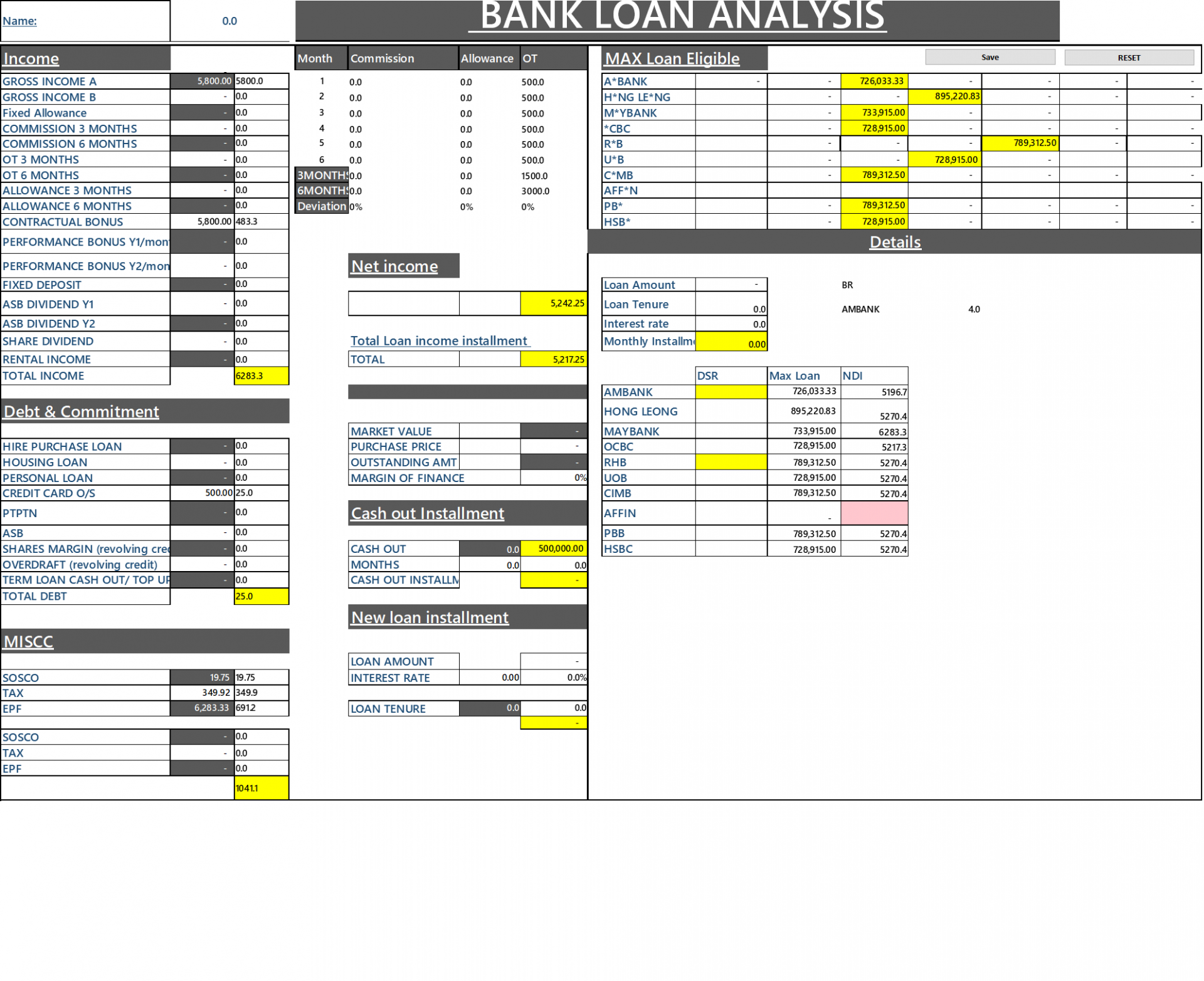

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

Bank Rm

A*BANK 404,543.60

H*NG LE*NG 576,460.93

M*YBANK 339,094.67

*CBC 406,913.60

R*B 508,642.00

U*B 440,823.07

C*MB 508,642.00

AFF*N -

PB* 508,642.00

HSB* 406,913.60

Things to take note of based onmy max loan calculation

" -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

" - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

2. above haven't added your bonus yet.

3. YOu have high saving, that will be a good credit score boost

4. Why don't you try other bank than the 2 banks you mentioned?

Cheers mate

Apr 17 2017, 08:02 AM

Apr 17 2017, 08:02 AM

Quote

Quote

0.1583sec

0.1583sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled