QUOTE(happyice @ Mar 21 2016, 12:41 PM)

Hi.. need help from expert on the following complicated case:

First house S&P under husband and wife, Loan under husband

Second house S&P under husband and wife, Loan under husband and wife

Want to change to :

First house S&P under wife, loan under wife

Second house S&P under husband, loan under husband

1. What is the cheapest & easiest & fastest way to do this? Anyone can help me?

2. There's love & affection transfer which allows exeption on stampduty?

3. Is it possible to do transfer name first or need to do it together with loan application?

4. Who should i approach, directly to bank? Will it be cheaper to use back the same loan from same bank, or change bank?

5. Husband cannot afford to take the full loan of second house, unless the loan of his first house is transferred to wife, so we need to follow sequence, wait until first house settles, only do second house?

Thanks

Dear happyice,First house S&P under husband and wife, Loan under husband

Second house S&P under husband and wife, Loan under husband and wife

Want to change to :

First house S&P under wife, loan under wife

Second house S&P under husband, loan under husband

1. What is the cheapest & easiest & fastest way to do this? Anyone can help me?

2. There's love & affection transfer which allows exeption on stampduty?

3. Is it possible to do transfer name first or need to do it together with loan application?

4. Who should i approach, directly to bank? Will it be cheaper to use back the same loan from same bank, or change bank?

5. Husband cannot afford to take the full loan of second house, unless the loan of his first house is transferred to wife, so we need to follow sequence, wait until first house settles, only do second house?

Thanks

1. There's no easy way to do it. If your property is still under bank loan, you will need to refinance to change to ownership.

If your property is unencumebred, fully paid off, you just need to consult a lawyer to facilitate the changes.

Hence, if your property still owe few thousand outstanding, settle it then you can proceed with 2nd method.

2. Yes, TWL&A, with spouse, stamp duty will be waived..

3. If is method 1, refinance. both will be done together.

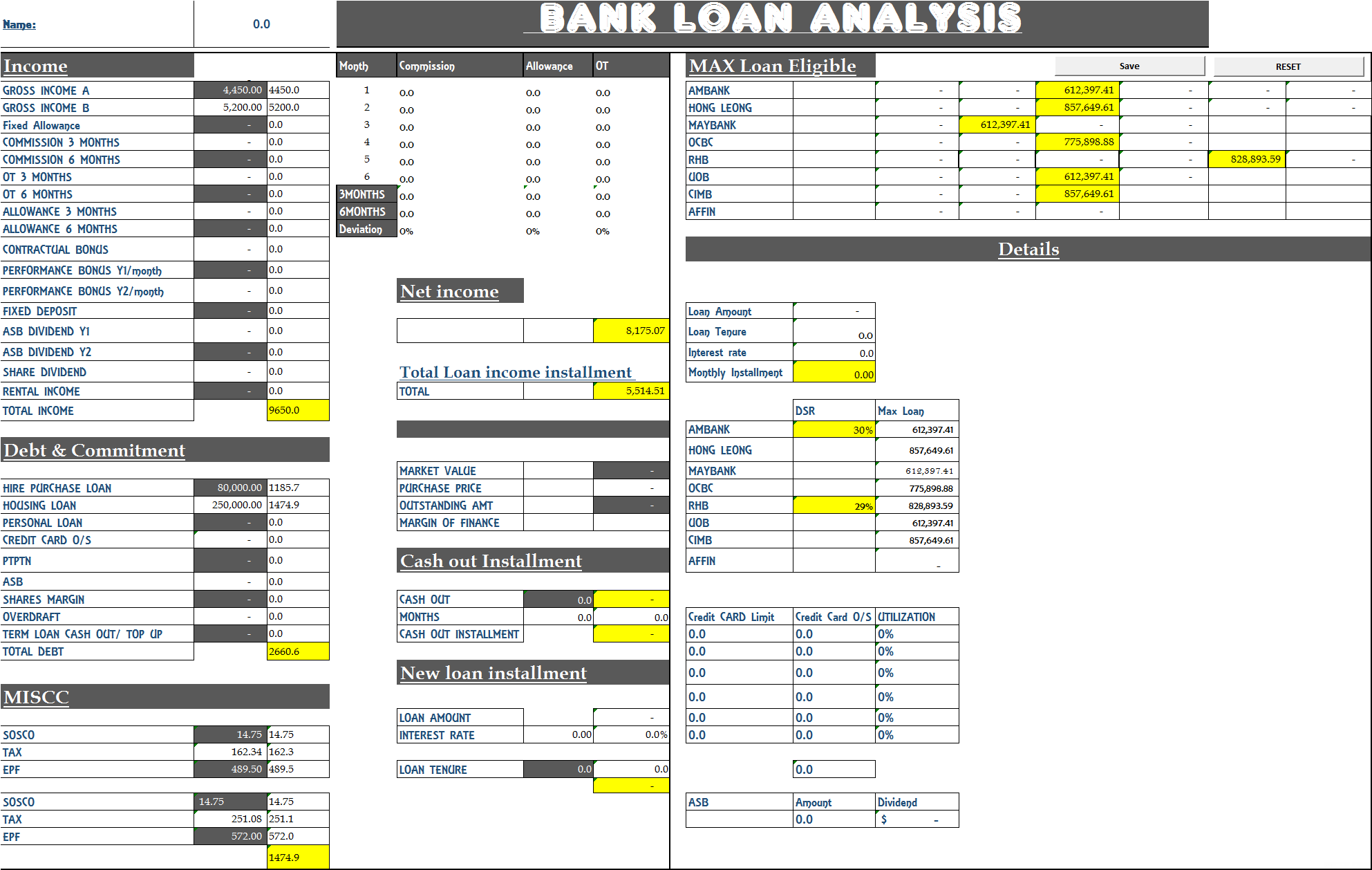

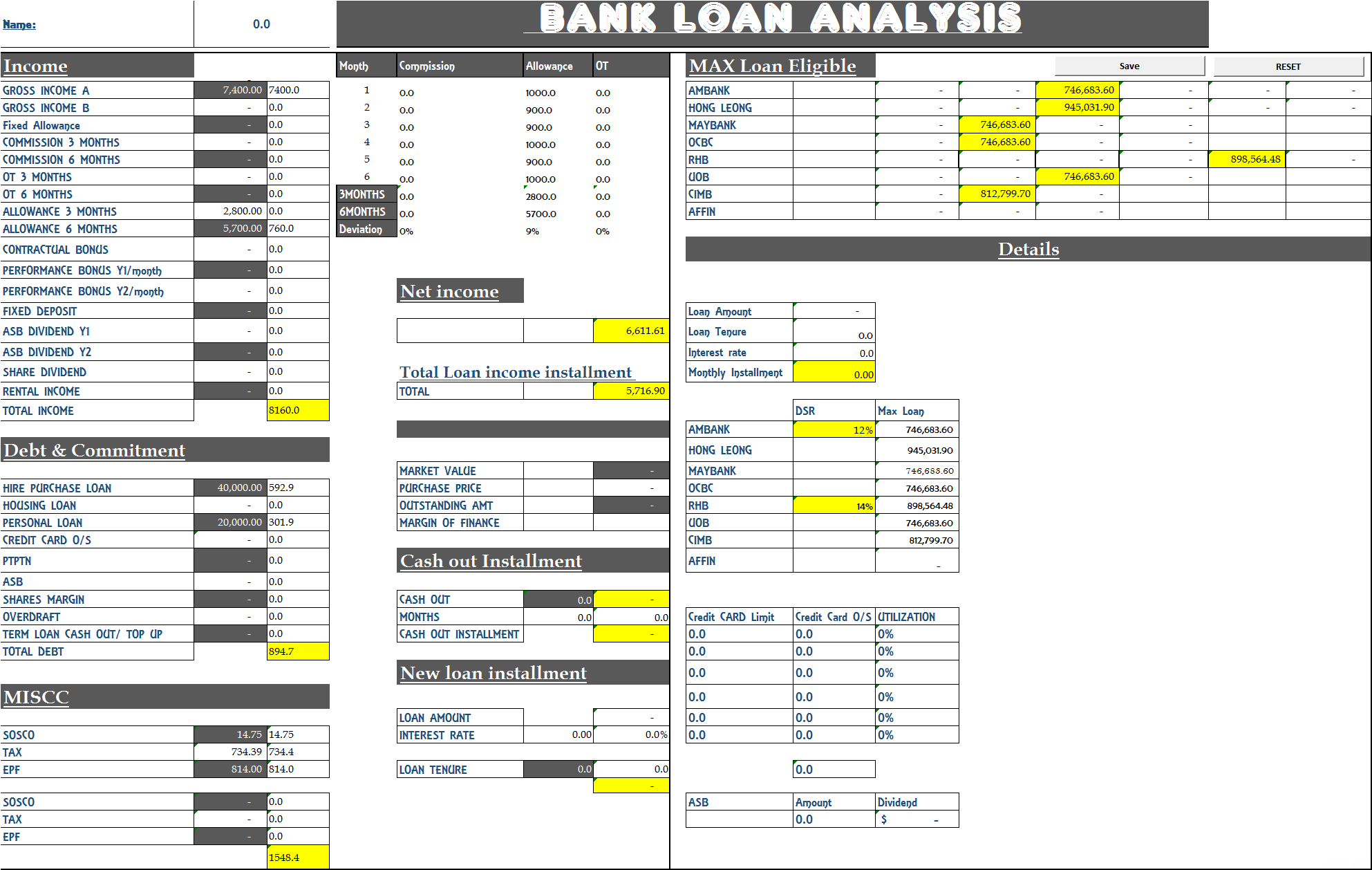

4. It's all the same, it depends on your loan amount on the interest rate you will get. Same bank doesn't mean cheaper rate, banks rate changes all the time. Hence, I would need to assess your details, so that I would able to find the best suitable bank for you to refinance and fulfill your objective. Do provdide below details:

CODE

1.Borrower

a.age

b. No. of borrowers

c. no. of housing loan

2. Income (borrower)

a. Gross salary

A:

B:

b.Variable income for business (6months latest)

"1.

2.

3.

4.

5.

6."

c. OT

d. Fixed allowance

e. Variable Allowance (6months latest)

"1.

2.

3.

4.

5.

6."

f. Bonus contractual (1 year bonus amount)

g. Bonus performance (2 years bonus amount)

h. Comission (6 months, each month amount from the earliest)

"1.

2.

3.

4.

5.

6."

3. Supporting income (borrower)

-Tenancy agreement rental (6months)

"1.

2.

3.

4.

5.

6."

i. ASB ( 2 years total DIV)

j. Shares dividend

k. Fixed deposit

4. Debt / commitment (borrower) "joint or indiv"

a. Hire purchase loan (Borrowed amount)*

b. Housing loan (Borrowed amount) (Joint or indiv)

c. Personal loan (Credit limit)

d. PTPTN (credit limit)

e. Credit card (Outstanding/usage)

f. ASB loan ( credit limit)

g. Overdraft ( Credit limit)

4. Background (borrower)

a. Occupation

b. age

c. currently staying at?

5. Property

a. purchase price

b. subsales or underconstruction

c. freehold or leasehold

d. 1 borrower or joint borrower

e. Strata title or master title

a.age

b. No. of borrowers

c. no. of housing loan

2. Income (borrower)

a. Gross salary

A:

B:

b.Variable income for business (6months latest)

"1.

2.

3.

4.

5.

6."

c. OT

d. Fixed allowance

e. Variable Allowance (6months latest)

"1.

2.

3.

4.

5.

6."

f. Bonus contractual (1 year bonus amount)

g. Bonus performance (2 years bonus amount)

h. Comission (6 months, each month amount from the earliest)

"1.

2.

3.

4.

5.

6."

3. Supporting income (borrower)

-Tenancy agreement rental (6months)

"1.

2.

3.

4.

5.

6."

i. ASB ( 2 years total DIV)

j. Shares dividend

k. Fixed deposit

4. Debt / commitment (borrower) "joint or indiv"

a. Hire purchase loan (Borrowed amount)*

b. Housing loan (Borrowed amount) (Joint or indiv)

c. Personal loan (Credit limit)

d. PTPTN (credit limit)

e. Credit card (Outstanding/usage)

f. ASB loan ( credit limit)

g. Overdraft ( Credit limit)

4. Background (borrower)

a. Occupation

b. age

c. currently staying at?

5. Property

a. purchase price

b. subsales or underconstruction

c. freehold or leasehold

d. 1 borrower or joint borrower

e. Strata title or master title

5. Well, dear, I couldn't give you a specific answer, untill you give me details first. So that I can give you a much more constructive advices.

Mar 21 2016, 02:58 PM

Mar 21 2016, 02:58 PM

Quote

Quote

0.1217sec

0.1217sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled