QUOTE(jacklok @ Aug 8 2016, 02:44 AM)

Hi, I plan to buy a new property which cost around 600k. Wanted to know if I eligible to get the loan or not.

1. Joint name with GF

2. Nett income total 6000

3. Commitment car 240, credit card installment 1600 (6-24 month)

4. Ptptn wait for waive exemption(already six month still waiting), will this affect the approval?

5. Property price 600k

Sifus please give some advice/comment. Thank you.

QUOTE(jacklok @ Aug 8 2016, 02:45 AM)

Hi, I plan to buy a new property which cost around 600k. Wanted to know if I eligible to get the loan or not.

1. Joint name with GF

2. Nett income total 6000

3. Commitment car 240, credit card installment 1600 (6-24 month)

4. Ptptn wait for waive exemption(already six month still waiting), will this affect the approval?

5. Property price 600k

Sifus please give some advice/comment. Thank you.

QUOTE(jacklok @ Aug 8 2016, 10:24 AM)

I just graduated last year, submitted the form for waive payment for first class, until now havent received any letter regarding the application nor payment need to start. How can I know if there is any outstamding?

QUOTE(jacklok @ Aug 8 2016, 10:49 AM)

Alright. Thanks for your information. Because i waiting for the application of "Pengecualian Bayaran Balik", if i pay the monthly payment now, i wonder can i get back the refund after they approve my application. =.=

QUOTE(jacklok @ Aug 8 2016, 11:32 AM)

Just called them and the application was approved since few month ago. I will still need to pay the amount that is overlapped. Is the ptptn will affect the loan application as well as failed the application directly? So worry as i am going to select the unit and send the application on next week.

QUOTE(jacklok @ Aug 8 2016, 12:05 PM)

The worst case is that i not receiving the letter by ptptn..lol..i think will need to go ptptn office and ask for more detail and see if can get any confirmation letter from them..Can i check the CCRIS on myself or someone behave on me?

QUOTE(jacklok @ Aug 8 2016, 12:24 PM)

Thank bro. i need to get the personal report PLUS or BASIC?

QUOTE(jacklok @ Aug 8 2016, 01:08 PM)

Okok. How long will it take to complete verification and get the report?

QUOTE(jacklok @ Aug 8 2016, 01:20 PM)

currently still direct me to the page ask me to update my detail after i login. still verifying my acc i think.

Dear,

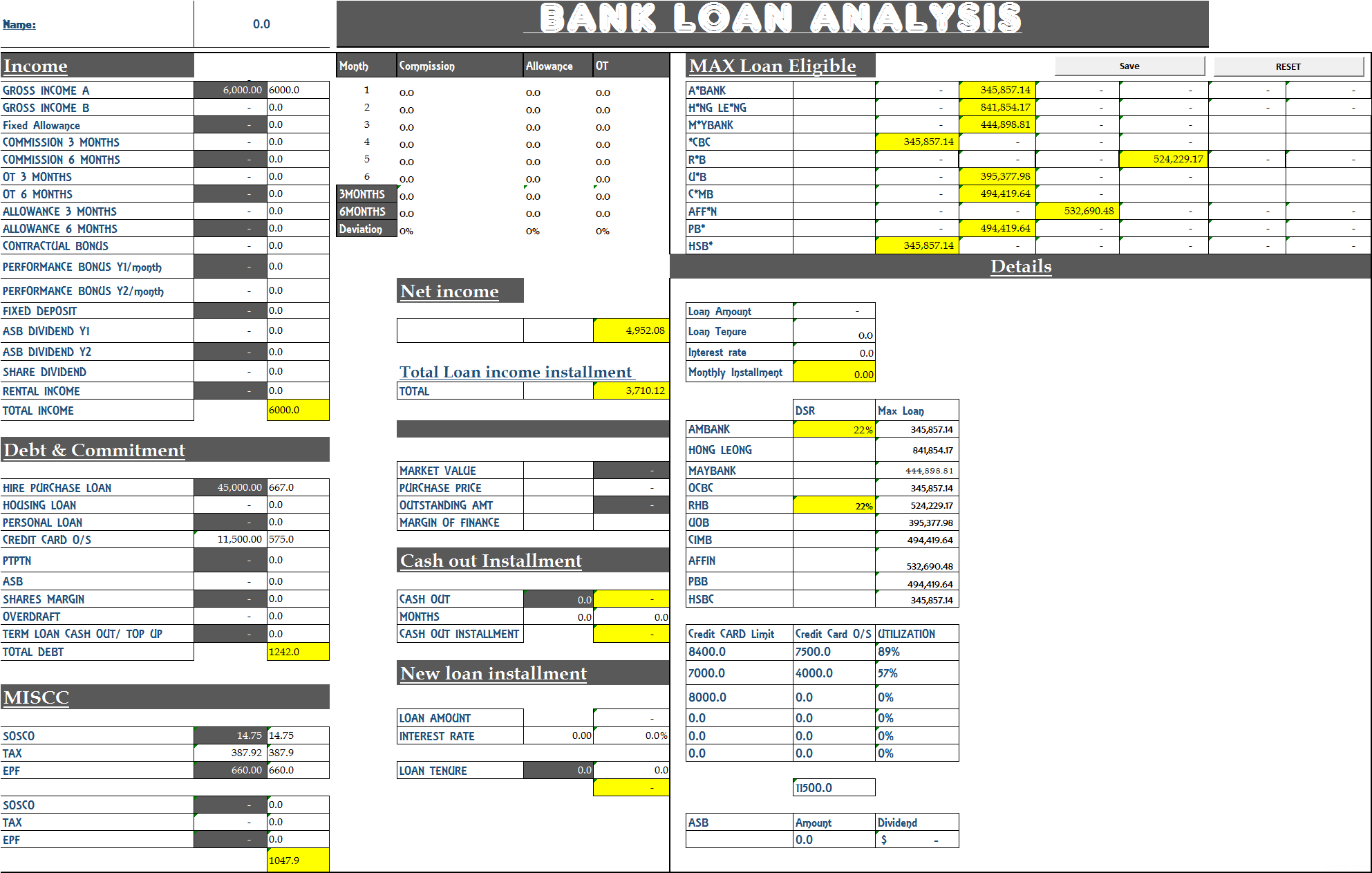

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

Rm

A*BANK 740,246.30

H*NG LE*NG 921,355.20

M*YBANK 740,246.30

*CBC 740,246.30

R*B 880,858.58

U*B 740,246.30

C*MB 800,615.93

AFF*N 853,485.56

2. May I know your credit card breakdown, so that I know the utilization of it

credit card credit limit / credit card outstanding amount

a

b

c

d

3. It depends whether it is inside the ccris record, if it is yes it will affect. But anyhow, there's way to solve it, no problem. For waiver, for high distinction reason, provide the letter of evidence then bank will accept it.

4. For CCRIS and CTOS check, We provide free service on it, just give me your IC info, I can help you check it for free, need your consent first.

5. The best bank to get the highest loan would be HLBB and RHB. However, each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

6. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

Calculation table:

» Click to show Spoiler - click again to hide... «

Cheers!

QUOTE(Andicom @ Aug 8 2016, 02:34 PM)

Hi, guys I need some advise. Was thinking to buy a house to stay after marriage. Already have 1 house in the process of signing SPA.

Used my saving there, but I think it was a good buy. However, it is not really strategic for my own stay for now.

Now, I want to buy a house under both me and my fiance name. Prerabbly, one that can get some rebate/cash back.

I have a few questions :

1. How is our egibility to get a house loan? Max house price?

2. What's the legality of getting a loan more than actual sale price? (the purpose is to get cash - for marriage and other purposes)

3. Is it a good idea to go for new property with zero downpayment (only booking fees). Saw that a lot for new properties.

Me

Age : 29

Job : Software Engineer/Developer

Income

Basic : RM3,800

Fixed Allowance : RM500

After deduct : RM3,800

Commitment

Hire Purchase Car: RM484

Hire Purchase Bike : RM300

Credit card = RM4,000/RM5,000

To add soon (currently waiting for SPA signing)

No of Housing loan : 1

Housing Loan : RM420 (RM80,000 Low Cost Apartment) - Ambank

Rental income : RM600

Fiance'

Age : 26

Job : IT Executive

Income

Basic : RM2,300

Fixed Allowance : RM500

After deduct : RM2,500

Commitment

MARA Study loan RM200-100 (I'll ask her later)

Nothing else (She uses my car for work)

Dear

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

Rm

A*BANK 590,689.02

H*NG LE*NG 780,999.32

M*YBANK 590,689.02

*CBC 590,689.02

R*B 764,922.41

U*B 590,689.02

C*MB 654,125.79

AFF*N 703,812.55

1b. The best bank to get the highest loan would be HLBB and RHB. However, each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

1c. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

2.

A. Renovation loan where OCBC can get, but subject to approval

B. If the property market value received higher than the selling price, you can m*rk up the property SPA price, this need mutual consent from the seller and you with a proper lawyer facilitate this with black and white.

3. SUbjective, it really depends on the property location, demand and supply and vicinity commercial industries effect.

4. Your rental income, do you have 3-6 months banksatement showing crediting of the income monthly? or tenancy agreement stamped?

» Click to show Spoiler - click again to hide... «

Cheers

Jul 15 2016, 08:16 AM

Jul 15 2016, 08:16 AM

Quote

Quote

0.1322sec

0.1322sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled