Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates in Malaysia V4, Please read 1st post.

|

gsc

|

Jul 24 2013, 07:24 PM Jul 24 2013, 07:24 PM

|

|

QUOTE(pinksapphire @ Jul 24 2013, 04:34 PM) It only works for the first RM10k, and it's messy with the CASA. It applies to conventional 3 months FD too. You are right only RM10000 eligible. Not too bad for a person who needs a credit card and high FD rate for small amountbof FD |

|

|

|

|

|

gsc

|

Jul 24 2013, 10:57 PM Jul 24 2013, 10:57 PM

|

|

QUOTE(Keigolee @ Jul 24 2013, 07:44 PM) Lol...means 0.51% per month with 6months contract lol...  How did you get 0.51% per month This post has been edited by gsc: Jul 24 2013, 10:57 PM |

|

|

|

|

|

gsc

|

Jul 25 2013, 11:00 PM Jul 25 2013, 11:00 PM

|

|

QUOTE(jojoe @ Jul 25 2013, 10:56 PM) btw... do they accept banker cheque for opening fd account? or have to hand off cash only? Even personal cheque is also acceptable... |

|

|

|

|

|

gsc

|

Jul 25 2013, 11:50 PM Jul 25 2013, 11:50 PM

|

|

QUOTE(BoomChaCha @ Jul 24 2013, 08:00 PM) What do you think of this foreign currency FD promo from Am Bank?  http://www.ambankgroup.com/en/Promotions/D...CurrencyFD.aspx http://www.ambankgroup.com/en/Promotions/D...CurrencyFD.aspxComparatively Ocbc is better.. |

|

|

|

|

|

gsc

|

Jul 26 2013, 12:12 PM Jul 26 2013, 12:12 PM

|

|

QUOTE(Ancient-XinG- @ Jul 26 2013, 07:51 AM) is that only applicable to BR? My mom put in 100 K with maybank also 3.15 pa @@ BR board rate is around 4% whereas May bank is not...furthermore most bank will strictly adhere to the promotional rate or board rate unless the amount deposited is significantly big.. |

|

|

|

|

|

gsc

|

Jul 26 2013, 03:37 PM Jul 26 2013, 03:37 PM

|

|

QUOTE(LostAndFound @ Jul 26 2013, 09:46 AM) How come all the deals are 12 month =(. Looking for a good 3 month deal which doesn't split to a Savings account (not enough money for that). For Ocbc bonus saver, Instead of all dump all into FD, you just split into smart saver. No additional fund s required. Additional fund RM1000 is required only in month 2 and month 3 only to enjoy 2.9% SS interest rate. But you can also deposit RM50 in month 2 and month3 instead of RM1000. But of course the interest rate s lower than 2.9% |

|

|

|

|

|

gsc

|

Jul 28 2013, 12:44 AM Jul 28 2013, 12:44 AM

|

|

QUOTE(o5is @ Jul 27 2013, 11:55 PM) I see... Thanks... After 3 months need to find others promotions....  There has been lengthy discussion on how to "renew" mature FD into fresh fund. Opening the Bonus Saver now will mature in Oct. Nobody will know will it be at 4.5% or not. Ocbc changes their promo quarterly. Having say that, Jul-Sept month promo on Bonus Saver is the same as that of April -Jun |

|

|

|

|

|

gsc

|

Jul 28 2013, 10:21 AM Jul 28 2013, 10:21 AM

|

|

QUOTE(pinksapphire @ Jul 28 2013, 04:14 AM) Hi, gsc. Are you still in the 4.5% promo? I think you mentioned before they no longer allow you to open extra SS account, but I can't recall if you went ahead with it by join account or went for other banks' promo. Still with Ocbc 4.5% promo. I have closed my single SS. Will use it in Sept. |

|

|

|

|

|

gsc

|

Jul 29 2013, 12:55 PM Jul 29 2013, 12:55 PM

|

|

QUOTE(pinksapphire @ Jul 29 2013, 05:22 AM) You mean they will let you re-open (as in sign up again for the promo) with a new single SS account after you closed it earlier? Yes.. |

|

|

|

|

|

gsc

|

Jul 31 2013, 12:02 AM Jul 31 2013, 12:02 AM

|

|

QUOTE(xbotzz @ Jul 30 2013, 11:37 AM) need some help on calculating here.. say total i have 17k to play with, and - I have 10k to put into FD.. i get 4.5 per annum.. which gives me about 37.5 per month x 3 = 112.5. - I put in the balance 5k in SS(no interest?-its still a deposit right) so i assume 2.9% pa which gives me about 12.08 interest for that month.. - I put 1k each for the balance 2 month in SS at 2.9% which gives me 9.66 for 2 months.. total from SS for 3months = 12.08+9.66=21.74 so total 17k for three months i get 112.5+21.74=134.24 ~ 536.96 p/a which gives me 3.15% .. for those who got lost, im sorry.. those who can see this.. is this right ?... haha.. In your month 1, you get 12.08 interest, but after placing 1k for the balance 2 months, you get 9.66 for 2 months. How could month2 and month3 interests are lower than that of month1? The interest for month2 and month3 couldnt be the same because month3 has an additional1k.....That is the error of your calculation... This post has been edited by gsc: Jul 31 2013, 12:03 AM |

|

|

|

|

|

gsc

|

Aug 2 2013, 12:37 AM Aug 2 2013, 12:37 AM

|

|

QUOTE(pinksapphire @ Aug 1 2013, 08:01 PM) Does anyone know of any long term FD that pays its interest out monthly? I'm trying not to go for monthly FD because the rates are lower. It's not really for me, but for my parents. Thanks. 1st of Aug...hopefully we can see more new promos. You can try Am Bank, they have FD for senior citizen. Need to open saving account so that interest will be credited monthly. It is called Am 50 plus...please check with them.. |

|

|

|

|

|

gsc

|

Aug 2 2013, 11:09 AM Aug 2 2013, 11:09 AM

|

|

QUOTE(BoomChaCha @ Aug 2 2013, 02:08 AM) Bro Jebat, Now we are in the casino, if the average interest rate is below 4.6% in the next 4 years, then we win; and if the average interest rate is higher than 4.6% in the next 4 years, then we lose. If the interest rate is 4.4%, compounded for 5 years, it will be equivalent to 4.8% per year straight simple interest for 5 years. This post has been edited by gsc: Aug 2 2013, 11:11 AM |

|

|

|

|

|

gsc

|

Aug 2 2013, 01:48 PM Aug 2 2013, 01:48 PM

|

|

QUOTE(munkeyflo @ Aug 2 2013, 01:07 PM) Yes, AmBank has this, my aunty has been using it for few years already. If not mistaken, it's for those age 50 and above. Interest is credited into their account monthly. The account type itself is call Am50plus. When you place FD, just give them that account number and they will know how to credit the interest in every month. http://www.ambankgroup.com/en/Personal/Dep...s/Am50Plus.aspxThe extra it provides is the insurance equivalent to the FD deposited, coverage up to maximum 25k (may be 15k, cant remember exactly), till age 65 (again cant remember exactly). If your aunt is above age limit, then can open joint account with the child, the child will then be covered under the insurance scheme. |

|

|

|

|

|

gsc

|

Aug 2 2013, 08:08 PM Aug 2 2013, 08:08 PM

|

|

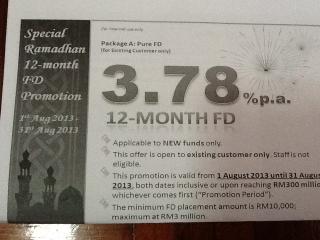

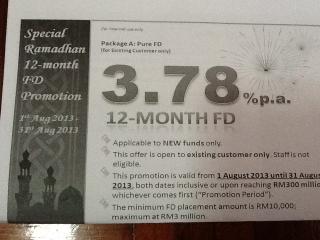

QUOTE(Ancient-XinG- @ Aug 2 2013, 01:15 PM) any new promo ??? For all banks RHB till 30 Aug or target reach New customer 3.88% for 12 months, 10% of FD in CASA for four months Existing customer 3.78% for 12 month pure FD This post has been edited by gsc: Aug 2 2013, 08:09 PM |

|

|

|

|

|

gsc

|

Aug 3 2013, 09:22 AM Aug 3 2013, 09:22 AM

|

|

QUOTE(pinksapphire @ Aug 3 2013, 04:05 AM) Yeah, I was thinking if opening a savings account is considered as existing customer, then can use that shortcut to place that 12-months FD, hehe...but I doubt they're that easy with this condition la. I was in RHB yesterday, SA is considered as existing customer. Pure FD rate is better as RHB want to reward their exsting customers...there s a target limit, once reach, this offer is closed. Existing customers means having account prior to 1 Aug. thus if you open account in Aug you are still considered as "new" customer. this is what I was told yesterday This post has been edited by gsc: Aug 3 2013, 09:38 AM |

|

|

|

|

|

gsc

|

Aug 3 2013, 09:35 AM Aug 3 2013, 09:35 AM

|

|

QUOTE(BoomChaCha @ Aug 3 2013, 02:38 AM) Good morning...  Not really.... New customer3.88% for 12 months, 10% of FD in CASA for four months if put 10% in CASA (assuming if CASA is zero interest), 3.88% x .9 = 3.49 effective rate -------------------------------------------- Existing customer3.78% for 12 month pure FD This is okay... It is not appropriate to calculte the effective rate in this way because the CASA amount is kept for 4 months and then it can be withdrawn and turn inti FD and put into whichever bank....thus it is definitely more than 3.49%. It is better take up the pure FD 3.78% for 12 months for existing customers This post has been edited by gsc: Aug 3 2013, 09:36 AM |

|

|

|

|

|

gsc

|

Aug 5 2013, 12:11 PM Aug 5 2013, 12:11 PM

|

|

QUOTE(aeiou228 @ Aug 5 2013, 11:02 AM) Last Tuesday, Fitch downgraded Malaysia credit rating outlook from stable to negative sending stock market and ringgit tumbling down. Ringgit was history low against S$ and renminbi. I wouldn't want to go long on FD at this very moment unless G implement measures to control the country debt and spending. Just my personal opinion. Can the current G does it? With all the malpractices and focus on own pockets? Since beginning of the year I have withdrawn my FD and put into property. Only keeping Ocbc for 3 months turn around and HL bank for 2 years long terms. |

|

|

|

|

|

gsc

|

Aug 5 2013, 03:22 PM Aug 5 2013, 03:22 PM

|

|

QUOTE(aeiou228 @ Aug 5 2013, 02:21 PM) Well, G have to but at the expense of Rakyat for their mismanagement of the country's finance. Good excuse to introduce Goods and Services Tax (GST). Ringgit is now 3 years low against the greenback and you had made a wise decision to diversify into foreign currency FD earlier. Government bond yields is at its high since mid 2011 and I don't see a point to lock-in current FD rate for longer tenure. No wonder EPF throwing Malaysia's REITs like no body business weeks before prior to the Fitch announcement. (haha just guessing) EPF head already mentioned do not next year dividend to be as good as this year. EPF is proposing new member can only withdraw full amount at the age of 60 |

|

|

|

|

|

gsc

|

Aug 5 2013, 10:52 PM Aug 5 2013, 10:52 PM

|

|

QUOTE(Maneki-neko @ Aug 5 2013, 05:17 PM) Amonth all the GLCs, KWSP is the most cash rich organization  It is the 6th largest pension fund in the World.. |

|

|

|

|

|

gsc

|

Aug 6 2013, 10:56 AM Aug 6 2013, 10:56 AM

|

|

QUOTE(pinksapphire @ Aug 3 2013, 02:29 AM) Seems like a decent deal for 12 months...hmm...anyone considering this? I gotta look up more info on this in the meantime.

|

|

|

|

|

Jul 24 2013, 07:24 PM

Jul 24 2013, 07:24 PM

Quote

Quote

0.0433sec

0.0433sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled