Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

contestchris

|

Apr 25 2024, 12:39 PM Apr 25 2024, 12:39 PM

|

|

QUOTE(CommodoreAmiga @ Apr 25 2024, 12:27 PM) Given current situation, with no mention by EPF. Very likely. All our dividends pulled down by these withdrawal idiots. Hopefully, they withdraw every month so then the situation will be less impactful. Others will also transfer to Acc 3 if there is no difference. But later maybe do a rug pull after you transfer, then say dividend will be minimal for Acc 3....  Do you people have zero understanding of how things work in an investment fund? As long as they have sufficient cash/bank balances and MMF, no issue. The problem becomes, if the withdrawal exceeds their short term liquidity. Then they will need to start selling assets in the market - the more they sell, the more the haircut they will need to take to generate the liquidity. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:44 PM Apr 25 2024, 12:44 PM

|

|

QUOTE(Barricade @ Apr 25 2024, 12:36 PM) Does bank give same interest for savings account and FD? There’s a reason why they can give higher interest by locking your money. Account 3 can be withdrawed anytime, why on earth they give you same interest? You really have zero critical thinking. For RM100k FD, you need to pump in RM100k. For RM100k Account 3 withdrawal, you need to pump in RM1mil in the future. Even at present, only 1/3rd of Account 2 can be transferred to Account 3. This is at max, 10%. EPF has nearly RM100mil liquid assets. I'm more worried what will happen Shariah fund and how they might strong-arm Conventional fund to absorb the liquidity shortfall. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:50 PM Apr 25 2024, 12:50 PM

|

|

QUOTE(thecurious @ Apr 25 2024, 12:45 PM) While that analysis is quite sound, can't fault people for thinking it will drag/impact overall dividend as the original allocation of money market/cash was likely for cash flow and risk purpose to facilitate other assets. Now that there is a specific fund allocated for liquidity purpose (withdrawal instead of facilitating cashflow of investments), some people would expect that the carved portion likely to be stored in cash or money market hence the likelihood of less income generation (if placed in money market fund maybe) or no income generation at all if in cash... The locked portion (account 1) may have increased from 70% to 75% and the Withdrawable portion may have decreased from 30% (Account 2) to 25% (15% Account 2 + 10% Account 3), but don't forget that the current withdrawal of account 2 is based on limited conditions. While EPF probably have retain some liquidity in the past for potential withdrawal, it is not likely to be the full 30% (depends on their risk assessment), now there is a minimum 10% that they are required to hold in reserve + 15% potentially withdrawal amounts. Unlikely to be changed much. If anything, the "reserve" for potential withdrawal might be lower given that Acc 2 + Acc 3 = 25%, which is lower than Acc 3 previously. All in all, I just see this as a more optimised way to deploy capital and over the longer run, it should result in higher dividends (but we're talking about a few bps at most) ' |

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:51 PM Apr 25 2024, 12:51 PM

|

|

QUOTE(Le Don @ Apr 25 2024, 12:48 PM) KUALA LUMPUR: Economists believe it is highly likely that a lower dividend rate will be assigned to the Employees Provident Fund's (EPF) planned flexible account or Account 3 when it comes into effect next year. Less than 10 per cent of the total sum of contribution also should be allocated to the flexible account which allows for withdrawals. Bank Muamalat Malaysia Bhd chief economist and social finance head Dr Mohd Afzanizam Abdul Rashid told Business Times, given the expected short tenure of the money kept in Account 3, it would seem likely that the it would command lower returns than the other other accounts which are not as easily withdrawn from. https://www.nst.com.my/business/corporate/2...s-epf-account-3EPF does not manage funds by Account 1, Account 2 and Account 3. Funds are managed as a whole. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:53 PM Apr 25 2024, 12:53 PM

|

|

QUOTE(Barricade @ Apr 25 2024, 12:49 PM) You’re not answering my question and try to kelentong. Simple logic, the lesser EPF can lock your money/more withdrawals, the lower the dividend will be. No need to talk so much bullshit. I think you better stick to kopitiam la with your peanut ego brain - most of your post are there anyway. I've given you the reason why your logic is flawed. More withdrawals can absolutely mean higher dividends given the lower base. Also, long-term locked savings has increased from 70% to 75%. EPF manages Acc 1/2/3 together, not in separate funds. There is no need for Acc 3 funds to be exclusively invested in short-term liquid assets. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:55 PM Apr 25 2024, 12:55 PM

|

|

QUOTE(Barricade @ Apr 25 2024, 12:52 PM) Don’t. Our keyboard warrior contestchris is smarter than Bank’s chief economist apparently. His ego confirm triggered by this. Dude, I agree with the economist if Acc 1/2/3 were separately managed in different funds. But the fact is, they're not. They're being managed as a whole. Our dividend is for Acc 1 + Acc 2 + Acc 3. The lower returns attributed to Acc 3 will be cancelled off by the higher returns and lower liquidity requirements of Acc 1 and 2. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 04:51 PM Apr 25 2024, 04:51 PM

|

|

Given the lack of penalty for Account 3 withdrawals and the exact same dividend rate across the board:

1. Members should opt-in to maximize their Account 3 starting balance

2. Members should maintain the 10% contribution into Account 3 moving forward (rather than transfer to Account 1/2 or submit the form to change the allocation %)

Ultimately, you lose nothing and you get some flexibility to draw down into liquidity should a calamity befall you. The only issue will be, for those who do not have financial discipline, I believe they will tap into Account 3 for frivolous spending.

|

|

|

|

|

|

contestchris

|

Apr 25 2024, 05:15 PM Apr 25 2024, 05:15 PM

|

|

QUOTE(CommodoreAmiga @ Apr 25 2024, 04:38 PM) Finally some revelation: https://www.malaymail.com/news/malaysia/202...rst-year/130739So what i said earlier is correct....EPF could pull the rug under you. Earliar got one forumner here very langsi scold everybody say no impact to EPF dividend...say we all bodoh....looks who bodoh now....  If you're referring to my, I'm merely saying that the introduction of Account 3 is on its own unlikely to cause a reduction in the OVERALL dividend. If anything, I reckon there might be a slight positive improvement in dividend yield. Now, of course if they're going to segmentise the dividend by Acc 1/2 /3 (meaning which, create separate funds for Acc 1/2/3), then logically Acc 3's dividend will be significantly lower, and Acc 1/2 would see a higher dividend. This is basic common sense and driven by the fact that shorter term investments have lower returns than longer term investments. Likewise, longer term investments can command some liquidity premium that can enhance long term returns. As the bulk of the liquidity needs for Acc 1/2 are transferred to Acc 3, meaning which Acc 1/2 can be invested for the longer term, and command better returns, as Acc 1/2 would not need to require excess cash lying around as much as they do now. This post has been edited by contestchris: Apr 25 2024, 05:20 PM |

|

|

|

|

|

contestchris

|

Apr 25 2024, 05:19 PM Apr 25 2024, 05:19 PM

|

|

QUOTE(victorian @ Apr 25 2024, 05:14 PM) Not going to opt in because I dun want to put more into acc 1. If originally I can withdraw 100% of acc 2, now I can only withdraw 83% of it. Fair enough. But you now get easier access to 33% of it. For that easier access to 33%, you have to forgo 17%. |

|

|

|

|

|

contestchris

|

Apr 25 2024, 06:09 PM Apr 25 2024, 06:09 PM

|

|

QUOTE(CommodoreAmiga @ Apr 25 2024, 06:00 PM) Talk so much. End of the day. Dividend in Acc3 MIGHT be affected depending on EPF. As what most people said earlier. So now you changed story...  .earliar was scolding everyone bodoh, when it's logical that high liquidity account will only be able to get low yield, else if it's a flat rate, definitely the overall dividend will be pulled down. Money don't grow from thin air. No need rocket science. Now still need to save face saying what everyone else already said. Next time, without facts and info, don't go so gung ho and langsi. Make yourself looks stupid only. It is quite pointless arguing with fools. |

|

|

|

|

|

contestchris

|

May 1 2024, 09:27 AM May 1 2024, 09:27 AM

|

|

QUOTE(annoymous1234 @ May 1 2024, 09:11 AM) Finally a black and white answer about self contribution, for those who want to treat EPF like saving account, too bad. https://soyacincau.com/2024/04/30/epf-accou...ribution-ratio/Does this even need to be explained?? |

|

|

|

|

|

contestchris

|

May 3 2024, 11:08 AM May 3 2024, 11:08 AM

|

|

QUOTE(gashout @ May 3 2024, 10:42 AM) cause they will change their % soon, my speculation. acc 3 doesn't make sense to have same % interest as acc 1 and acc 2 It only doesn't make sense if Acc3 inflow and outflow was unrestricted or if you could directly pump 100% allocation to Acc3. However, that's not the case. I simply don't understand why people don't get this. Yes, as individual funds, Acc3 should earn far less than Acc1 and Acc2. But its easier to continue managing all three Acc as a single fund, as is currently the case |

|

|

|

|

|

contestchris

|

May 15 2024, 05:56 PM May 15 2024, 05:56 PM

|

|

Can Acc3 opt-in be done via website?

|

|

|

|

|

|

contestchris

|

May 18 2024, 01:09 PM May 18 2024, 01:09 PM

|

|

My April 2024 salary contribution is in, apportioned to Acc1/2/3 per the new method. Btw, any idea what this means? https://soyacincau.com/2024/05/17/epf-accou...-transfer-soon/I feel the entire implementation of Acc3 is just short-sighted and politically-driven. We made fun of Muhyiddin politicising EPF, now Anwar does it and crickets. At least during Mahathir and Najib's time, they didn't touch EPF. The most Najib did was reduce contributionr rate to 8% one of the years when things were tough. |

|

|

|

|

|

contestchris

|

Oct 7 2024, 12:55 PM Oct 7 2024, 12:55 PM

|

|

QUOTE(Wedchar2912 @ Oct 7 2024, 12:49 PM) this stat is stupid rite? there are around 80K persons with epf balance above 1 million, and EPF recorded that there are 16.1 million members. so what does this mean? the people with 1 million and above is the top 0.5%.... not even T01, these are T0.5 and yet many claim 1 million is not enough to retire, but according to stats, these are already top 0.5% in Malaysia. may as well ask the rest of 99.5% to give up completely.... so, which is right? the stats is wrong or we are fools to believe the stats?   Obviously, not everyone keeps their retirement assets in EPF solely. In fact, the large portion of retirement funding will come from elsewhere - property sales, jewelry sales, stocks, unit trust, insurance surrender, ASB/ASNB, cash savings, FD etc |

|

|

|

|

|

contestchris

|

Dec 12 2024, 09:29 PM Dec 12 2024, 09:29 PM

|

|

QUOTE(nexona88 @ Dec 12 2024, 06:09 PM) There's some who said EPF doing all this because they lack of $$$ to pay??? Seriously?? Monthly $$$ from contributors not enough to cover all the withdrawal??! 55yo, 60yo, account 3, housing etc.????? . don't think so There is some truth to this, which is why they must make structural changes NOW before it is too late. While it is true that EPF is asset rich, they are by far the largest player in Bursa Malaysia. If they pare down their holdings too much to raise cash to pay off those liquidating their holdings, the local market would be impacted. And this impact is circular, as heavy selling will lead to lower prices, which will lower down the asset value base and hit EPF 2x as hard. Couple this with the demographic crisis - too many people hitting retirement age and too few coming through the ranks to join the workforce. The liquidity taps are being tightened, and the EPF has to make some moves now to reform the structure so things remain orderly. |

|

|

|

|

|

contestchris

|

Feb 19 2025, 02:49 PM Feb 19 2025, 02:49 PM

|

|

We're looking at 6.15%

|

|

|

|

|

|

contestchris

|

Feb 27 2025, 04:30 PM Feb 27 2025, 04:30 PM

|

|

Don't forget, some % of the returns are used back as public service. EPF and PNB are being pressured to inject some funding into local businesses etc and carry out public service.

|

|

|

|

|

|

contestchris

|

Mar 1 2025, 02:29 PM Mar 1 2025, 02:29 PM

|

|

QUOTE(N9484640 @ Mar 1 2025, 12:43 PM) Not logical to have the same dividends for both. How can you get the same rate when you got less market to invest in? That only means the conventional investment failed No it doesn't mean the conventional investments failed. There is reason to believe there is some amount of "cross-subsidization" where certain costs are parked under conventional but enjoyed by both, and certain income are shared more with the Shariah as opposed to conventional funds. If these were 100% transparent and auditable, Shariah will never beat conventional over the long run, it's simply not possible given the shallower range of opportunities. Although, from year to year, it will not be impossible to see Shariah outperforming Conventional occasionally, especially in "down" years. |

|

|

|

|

|

contestchris

|

Mar 3 2025, 09:15 AM Mar 3 2025, 09:15 AM

|

|

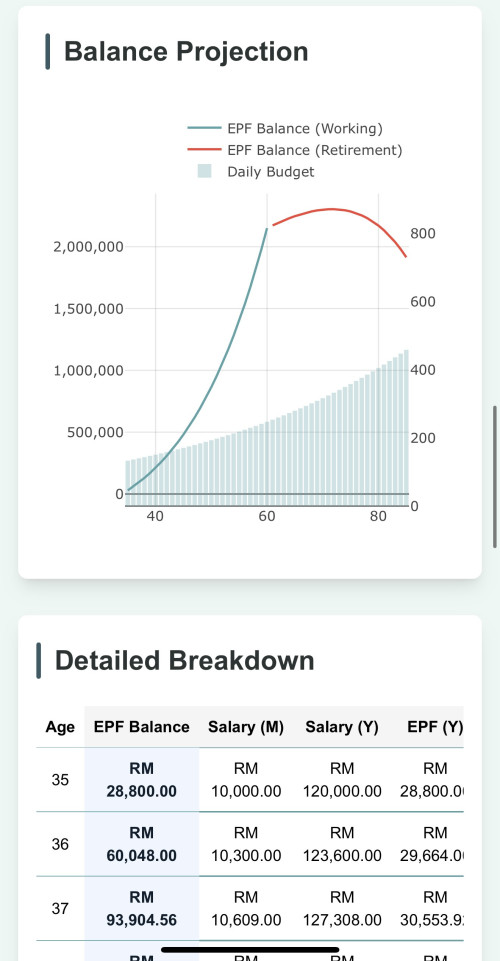

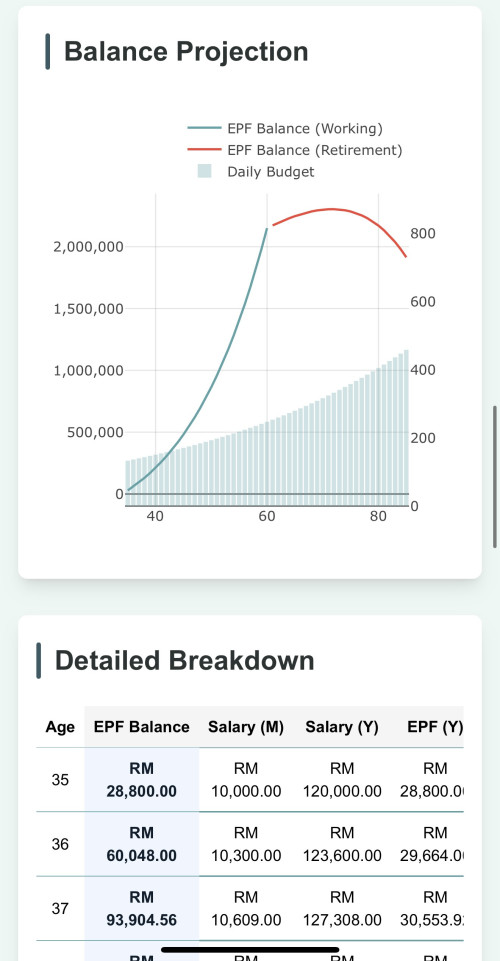

QUOTE(chongyang @ Mar 3 2025, 08:34 AM) hi all, just wanna shamelessly share a weekend project I made for EPF and retirement calculations. Initially built for my own use, but figured it might be useful for others with the projection of yearly contribution, dividend and spending break down after the dividend news https://duithero.my/epf-retirementDo let me know if there’s any good to have details I can add too, cheers  One small improvement to the calculator. If salary is above RM5k, the employer contribution % should automatically be adjusted to 12%. |

|

|

|

|

Apr 25 2024, 12:39 PM

Apr 25 2024, 12:39 PM

Quote

Quote

0.0527sec

0.0527sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled