QUOTE(prophetjul @ Dec 26 2022, 06:24 AM)

Why are you in a hurry?

I have just changed my interest and started a new project in my company.

It's like a hobby. Enjoying it!

Question to those intending to retire at around 45:

Are you guys single?

10 to 15k in future ain't much!

Since i was using 10-12k as an example before, i will elaborate on this.

I am not single, but i decided not to have kids (i had decided on this since i was 16-17 years old, when i was still in secondary school). IMHO, 10-15k monthly without working is still considering a lot even "in the future", at least for me.

Currently my life is, i can spend 200-400rm in one dinner, and can buy anything as long as i want. But i realised one thing, i won't always eat a breakfast/lunch/dinner a few hundred rm daily or frequently, because i can't eat so much (and those foods are mostly seafoods, like crabs, prawns), and my favourite foods are always chicken rice (i can eat chicken rice 3 times a day no joke), so i guess i won't be spending too much on foods.

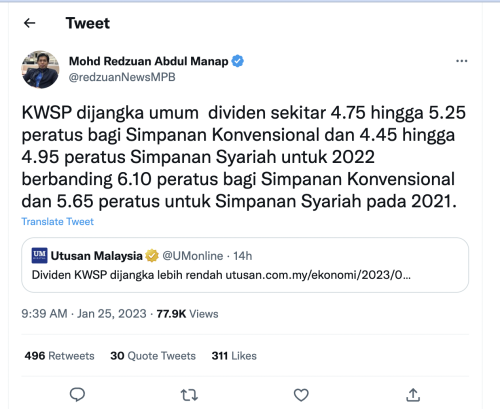

As mentioned i am a safe person, if i aim rm 10-15k, then it is just a safe point. In fact, if i stopped working, i still have dividens coming in which could range from a few hundred K to a mil per year, but i just don't count it in since i treat this as a "bonus" due to i won't know when will the company out the dividen altho it is quite consistently for the past few years. And if EPF always giving 5-6% yearly, my calculation is always using 4% as the benchmark, i aim the worst, if it is more than 4%, it is a bonus.

As for life after retirement, i have ways too many things to do due to i have many hobbies :

1. Coding. I used to code 12 hours as day and i loved coding a lot, may be i will learn back something after i am retired

2. Gaming. i am in between 70s-80s, i started gaming when i was 4-5 years old on atari, and then famicom, super famicom, mega drive, gam gear, arcade (went in arcade when i was 16), ps1, until now ps5 and i am still gaming daily. Pre-orderd a PSVR2 for virtual reality and will get it on February next year.

3. Collecting collectibles / statues.

4. Cycling. I used to cycling a few hours a day during my secondary school era, already planned to get a basikal once i am retired (i went to some shops to check them out, holyshit, those basikals are crazily expensive, my mind still stuck at the time i spent rm 100+ for a BMX)

5. Lucid dream, hypnosis, meditation , etc are the topics i am always interested, i will spend more time on these.

Dec 26 2022, 12:30 AM

Dec 26 2022, 12:30 AM

Quote

Quote

0.0474sec

0.0474sec

1.02

1.02

7 queries

7 queries

GZIP Disabled

GZIP Disabled